Key Takeaways

- Analysts estimate adjusted EPS of$0.10 vs -0,06$in Q2 2019.

- Daily active users is expected to rise 17.8% year-on-year.

- Snap revenue growth will slow sharply in the middle of COVID-19 crisis.

Social networking company Snap Inc. (SNAP) has seen its stock plunge by over 55% by 2020 high after having missed the revenue estimates in February and that the COVID-19 pandemic pulled down the stock market. But the stock since then has almost tripled since its lows in March that the company’s revenues and daily active users have soared as millions of consumers safe at home, in the middle of the pandemic.

Investors will be watching to see if the Snap can continue this growth when it publishes its results for the 2nd quarter of the FISCAL year 2020 on 21 July, after the close of the market. The news is likely to be mixed. Analysts estimate that the Snap Q2 losses widen on an adjusted per share basis as the company has the lowest sales growth of at least 14 quarters.

A key metric that investors will focus on is the Snap-in daily active users (DAU), a measure of growth that allows you to determine how much the company is able to charge for advertising. Snap is dependent on advertising for almost the entirety of his income and turnover. Analysts believe Snap-in registered a strong growth of DAU in Q2 , the second highest growth rate for more than two years.

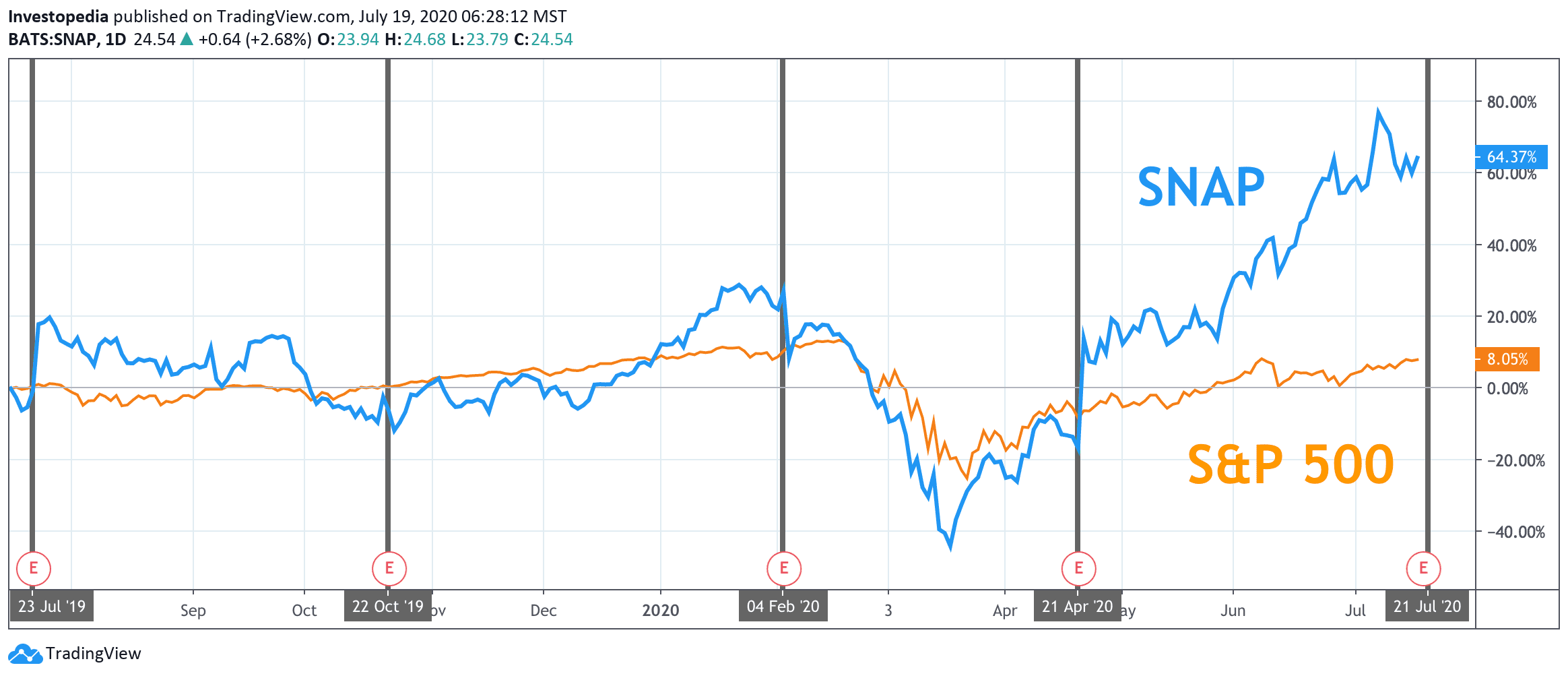

Reflecting the optimism of investors, the Snap’s stock has significantly outperformed the broader market, posting a total return of 64.4% in the last 12 months, nearly eight times greater than the S&P 500 total return of 8.1%.

Source: TradingView.

Since its ipo in 2017, the Snap has struggled to make a profit, even as its daily active users, and revenues have increased. It has posted losses in each quarter, except for Q4 of FISCAL 2019. In the 2nd quarter of the FISCAL year 2020, the analysts expect a Snap of the quarterly loss to widen on an adjusted EPS basis of$0.10, 66% larger than the loss of$0.06 posted in the Q2 of FISCAL year 2019. Snap’s worst quarter was Q1 of FISCAL 2017, when it reported an adjusted loss per share of$0.20 per share.

While Snap has struggled to report a quarterly profit, revenue was a different story. The company has achieved constant and impressive revenue growth in every quarter since it went public. The Consensus estimates of $438.9 million for the 2nd quarter of the FISCAL year 2020, an increase of over 140% from the 2nd quarter of FISCAL year 2017. However, this estimate, the year-on-year revenue growth at 13.1%. Although strong, the year-on-year improvement is much lower quarterly year-over-year gains for each quarter during the past three years. In the YEAR 2019, for example, the Snap-in is lower year-on-year quarterly revenue growth was 38.9%, and in the 1st quarter of FISCAL year 2020, it was 44.3%.

Snap To Key Indicators

Estimate of the Q2 2020

Actual Q2 2019

Actual Q2 2018

The Adjusted Earnings Per Share

-$0.10

-$0.06

– 0.14$

Turnover (in millions of dollars)

$438.9

$388.0

$262.3

Daily Active Users (in millions of dollars)

239.2

203.0

188.0

Source: Visible Alpha

Like other social media, the companies, one of the main engines of the Snap stock and financial growth is its number of daily active users, or DAU. DAU measures the number of people that use a Snap-in application or visit the web site of the company each day. Another important index is the average revenue per user (ARPU), which reflects the average revenue generated by each user of the site or the app. As a whole, DAU and ARPU to present an image of the size of Snap-in of the user base and the success of the company to monetize this base mainly through advertising. Snap needs to produce strong growth in daily active users to attract advertisers.

The Snap daily active users have increased steadily since the 1st quarter of FISCAL year 2019, following a plateau in 2018 approximately 186 million users. The company has climbed above 200 million DAU for the first time in Q2 2019 and has seen the growth of this metric on a sequential basis throughout 2019 and Q1 2020. Last quarter, Snap reported 229 million DAU, a record for the company. Analysts expect that this number will rise even higher in Q2 2020, with the consensus estimates of 239.2 million DAU for the quarter, a 17.8% year-on-year increase.

While DAU is expected to reach new heights, Snap-in difficulty with the average revenue per user in Q2 2020. In before T2 periods, this figure has climbed steadily: from $1.05 in 2017 to $1.40 in 2018 and $1.91 in 2019. For the 2nd quarter of FISCAL 2020, however, analysts expect a decline in year-on-year by 3.8% to $1.84. This will mark the first year-over-year quarterly ARPU decline since the Snap-in has been made public.

Source: investopedia.com