Six Flags Entertainment Corporation (SIX) shares rose 5% during pre-market trading on Thursday, before giving up ground later in the session. Janney Montgomery Scott upgraded Six Flags stock to Hold from Buy with a $30 fair value estimate, citing its attractive valuation and the diversity and exposure of its end markets. Analyst Tyler Batory think that investors are less focused on quarterly financial that the normal to the mid-COVID-19, which gives the new management team of the hedge to make changes to the business.

The move follows an upgrade from B. Riley in mid-June to Buy with a $target price of 31. Analyst Eric Wold said that a possible restart of the China park development plans over the next 12 months could be to benefit current adjusted EBTIDA estimates. He also believes that in the short term, the attendance of the limitations of miss the long-term performance standard of attendance for the next year.

Janney Montgomery Scott simultaneously downgraded Cedar Fair, L. P. (FUN), because of its use of two theme parks, and SeaWorld Entertainment, Inc. (SEAS), due to its heavy mix of revenue from California and Florida, to Neutral, making Six Flags the firm the first choice in the theme park space.

TrendSpider

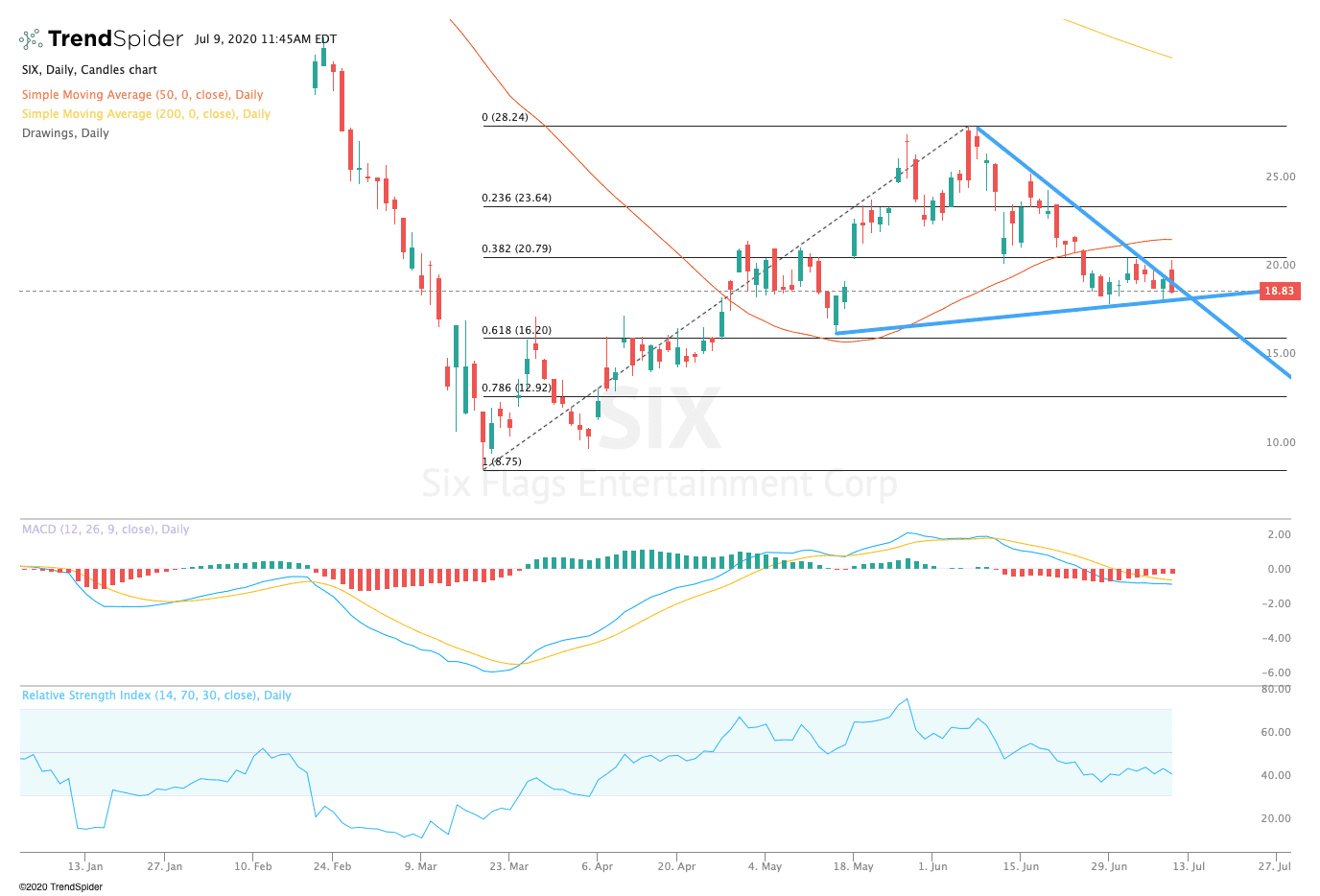

From a technical point of view, Six Flags stock briefly broke out of trend line resistance before giving up the ground later in the session. The relative strength index (RSI) remains slightly oversold with a reading of 39.98, but the moving average convergence divergence (MACD) remains in a modest downward trend to the downside. These indicators suggest that a great deal of uncertainty in terms of the direction of the future.

Traders should expect to see a break of trend line resistance around the 50-day moving average of $21.78, or the Fibonacci levels of $23.64 in the coming sessions. If the stock moves lower, traders should watch for a break of trend to reaction low and Fibonacci levels of $16.20, or a transition to the Fibonacci levels of $12.92 in the coming sessions.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com