Key takeaways

- Shell on Friday raised its third-quarter profit forecast as the company benefited from higher oil and gas prices in the third quarter.

- The company's LNG division has emerged as a key driver in profits during a blockbuster 2022, but struggled in the first half of this year.

- The energy giant also revised its estimates upward oil and gas production.

British energy giant Shell PLC (SHEL) raised its third-quarter earnings forecast on better-than-expected natural gas and chemicals trading volumes, likely due to higher prices. oil and gas prices. Weak energy prices weighed on the company's financial results in the first half.

Turnaround after mediocre first half

The company's LNG division has become a powerhouse of key profits after a successful 2022. Adjusted profit at Shell's integrated gas unit hit a record of nearly $6 billion in the fourth quarter of last year, boosted by Europe. #39;abandonment of Russian natural gas following the latter's invasion of Ukraine.

A decline in oil and natural gas prices from the last year's highs impacted profit margins in the first half. Second-quarter net income was $5.1 billion, down more than half from $11.5 billion in the same quarter last year, when prices for Crude oil had peaked above $120 per barrel. The company also referenced a decrease in LNG trading opportunities that impacted earnings in the second quarter.

Production at pace

Shell also adjusted its production estimates on Friday for the three months ended September.

LNG production is expected in a range of 880,000 to 920,000 barrels per day, a more precise range than the 870,000 to 930,000 forecast in July. Liquefaction volumes, which refer to the amount of natural gas cooled to ultra-low temperatures to be stored and shipped, are projected between 6.6 million and 7 million tonnes, revised upwards from 6.3 million to 6.9 million tonnes.

Upstream oil production is expected to be in the range of 1.7 to 1.8 million barrels per day (bpd), revised upwards from forecasts of 1.6 to 1.8 million barrels per day (bpd). d in July, when the company released its second-quarter results. Upstream production refers to the drilling and extraction of crude oil, unlike downstream activities, which involve refining the oil and selling it to consumers at gas stations.

Better than expected these prospects come less than two days after rival energy giant ExxonMobil (XOM) said rising oil prices likely boosted the company's profits for the quarter ended September.

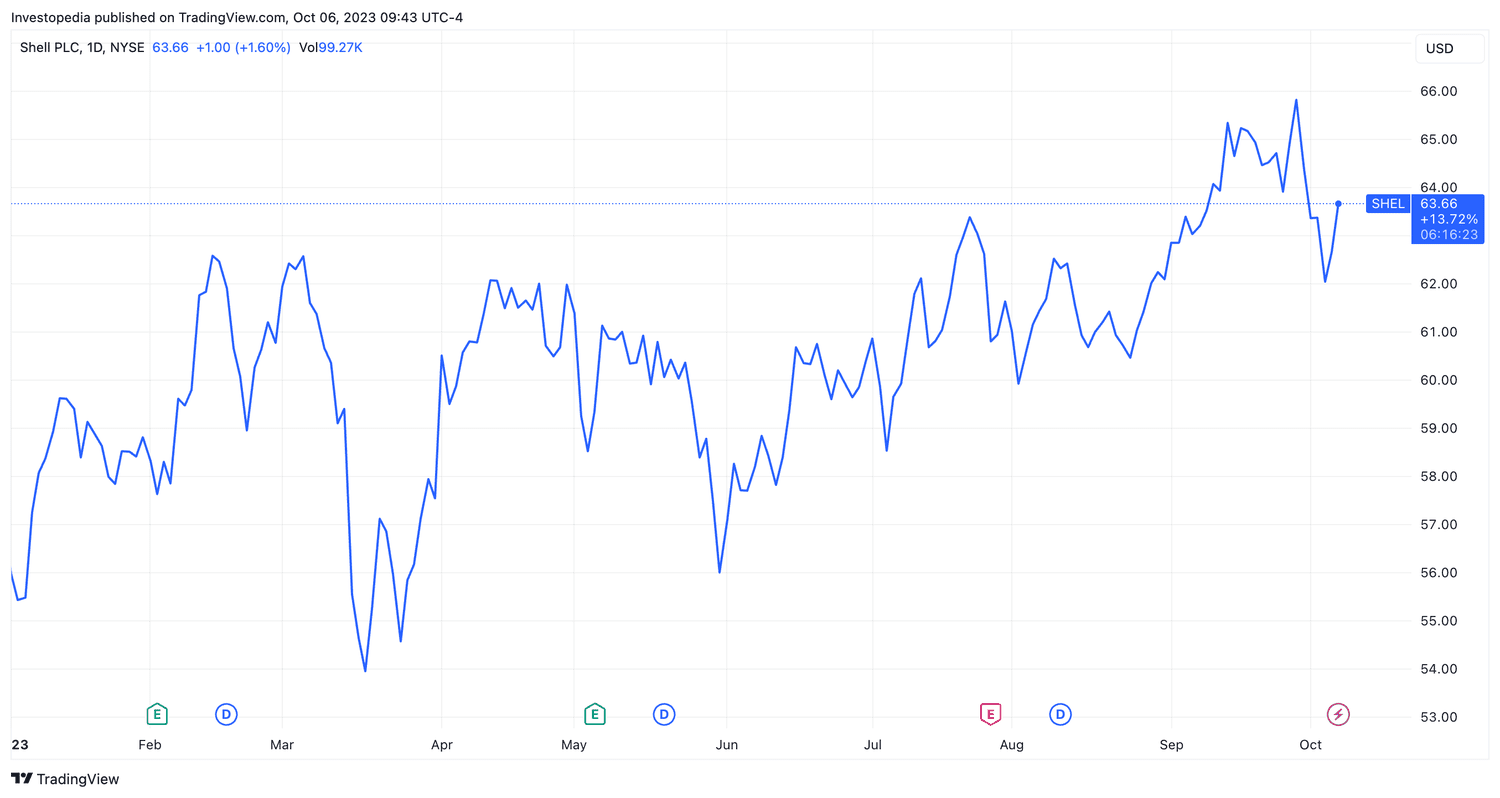

The company's shares have jumped 3% Friday. They are up more than 13% year to date.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com