Catalent (CTLT) shares jumped more than Early 5% trading took place on Tuesday after the struggling drugmaker reached a deal with activist investor Elliott Investment Management.

Points to remember

- Struggled pharmaceutical company Catalent has reached a deal with activist investor Elliott Investment Management.

- The company is the leading contract manufacturer of the fast-growing weight loss drug Novo Nordisk, Wegovy, for which demand has exceeded supply in recent months.

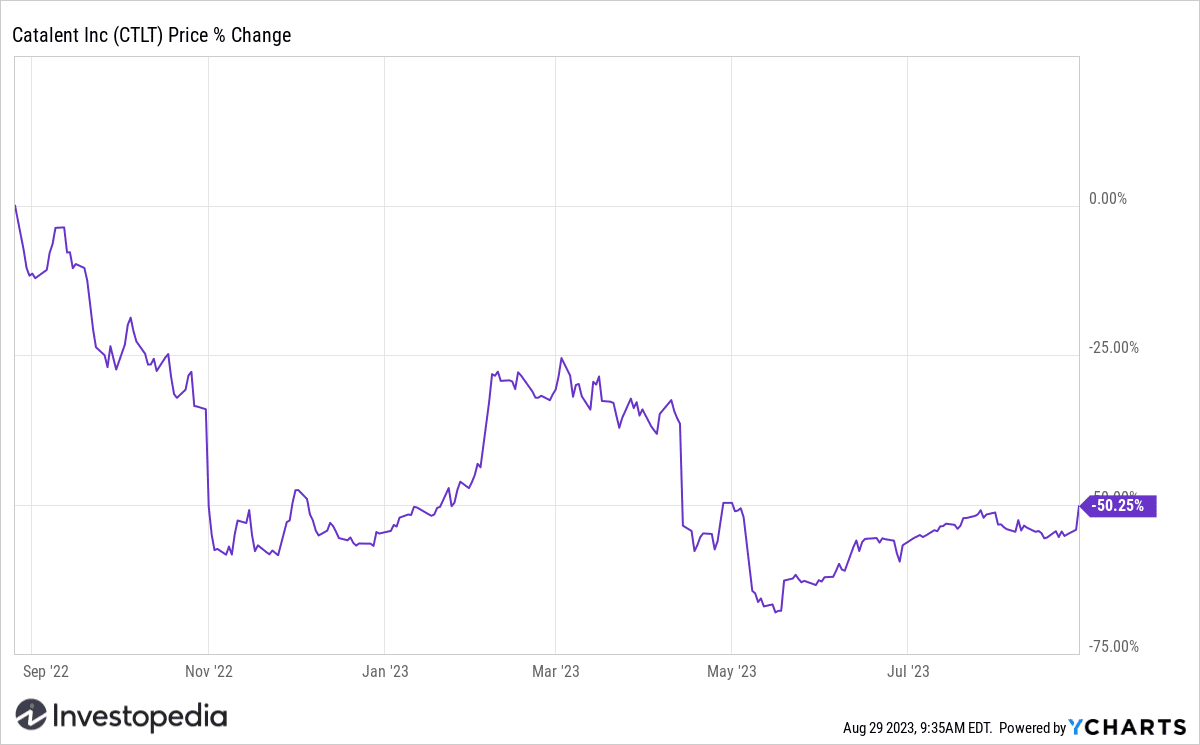

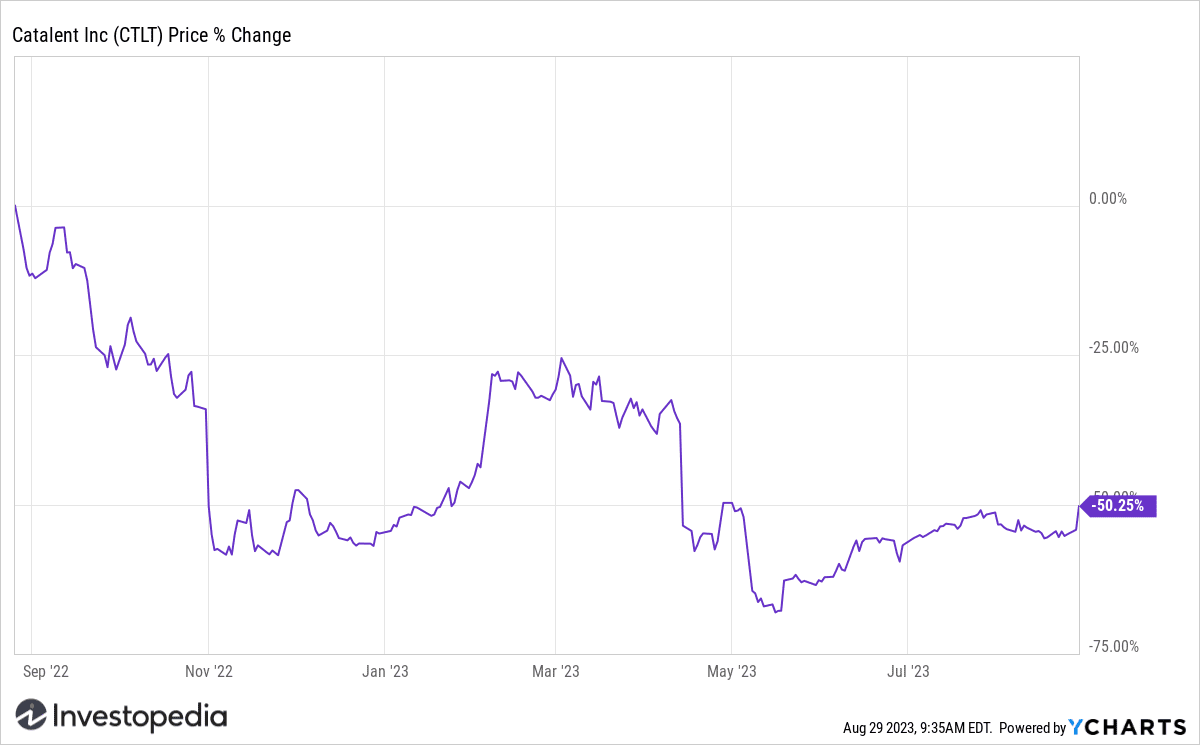

- Catalent shares have lost more than half their value in recent months. last year, and are down two-thirds from their peak in September 2021.

As part of a turnaround effort, Catalent named four new members to its board, formed a strategic review committee and reached a deal with activist investor Elliott Investment Management . Catalent is the main contract manufacturer of Danish healthcare company Novo Nordisk (NVO)'s fast-growing weight loss drug, Wegovy, and a deal could give Elliott some degree of influence over its production. .

The use of Wegovy in the United States has increased in recent months, with hundreds of thousands of patients using it as a weight loss medication. Growing demand for the drug, along with Catalent's recent financial difficulties, have contributed to a production shortage and prompted Novo Nordisk to limit shipments of the drug to wholesalers.

Catalent has struggled financially in recent quarters, posting a loss of $86 million in the quarter ended June, down from a loss of $232 million last year. The company lost its chief financial officer (CFO) in April after warning of “productivity issues and higher than expected costs” at its manufacturing facilities, and delayed the release of third-quarter results.

“We are not satisfied with our recent results and are taking the necessary steps to address the issues that have negatively impacted our performance, which was well below our prior guidance,” he said. Alessandro Maselli, Chairman and CEO of Catalent, said so at the time.

It's a change of fortune from the early years of the pandemic, when Catalent played a vital role in the pandemic response by filling vials with COVID-19 vaccine and supplying vaccine manufacturers such as #39;AstraZeneca (AZN), Johnson & Johnson (JNJ) and Moderna (MRNA). By the end of 2021, the company had produced more than a billion vaccines and treatments for COVID-19.

Amid its struggles, activist investors and private equity (PE) have taken interest in Catalent in an attempt to force a turnaround. Activist investors, or activist shareholders, are companies that buy a minority stake in a company with the goal of changing the way it is run. Their goals can be as modest as advising company management or as ambitious as forcing a sale and replacing the board.

Catalent stocks lost half their value over the past year, and are down two-thirds from their September 2021 peak.

YCharts

Do you have any news tip for news reporters? #39;Investopedia? Please email us at tips@investopedia.com

Source: investopedia.com