KEY TO REMEMBER

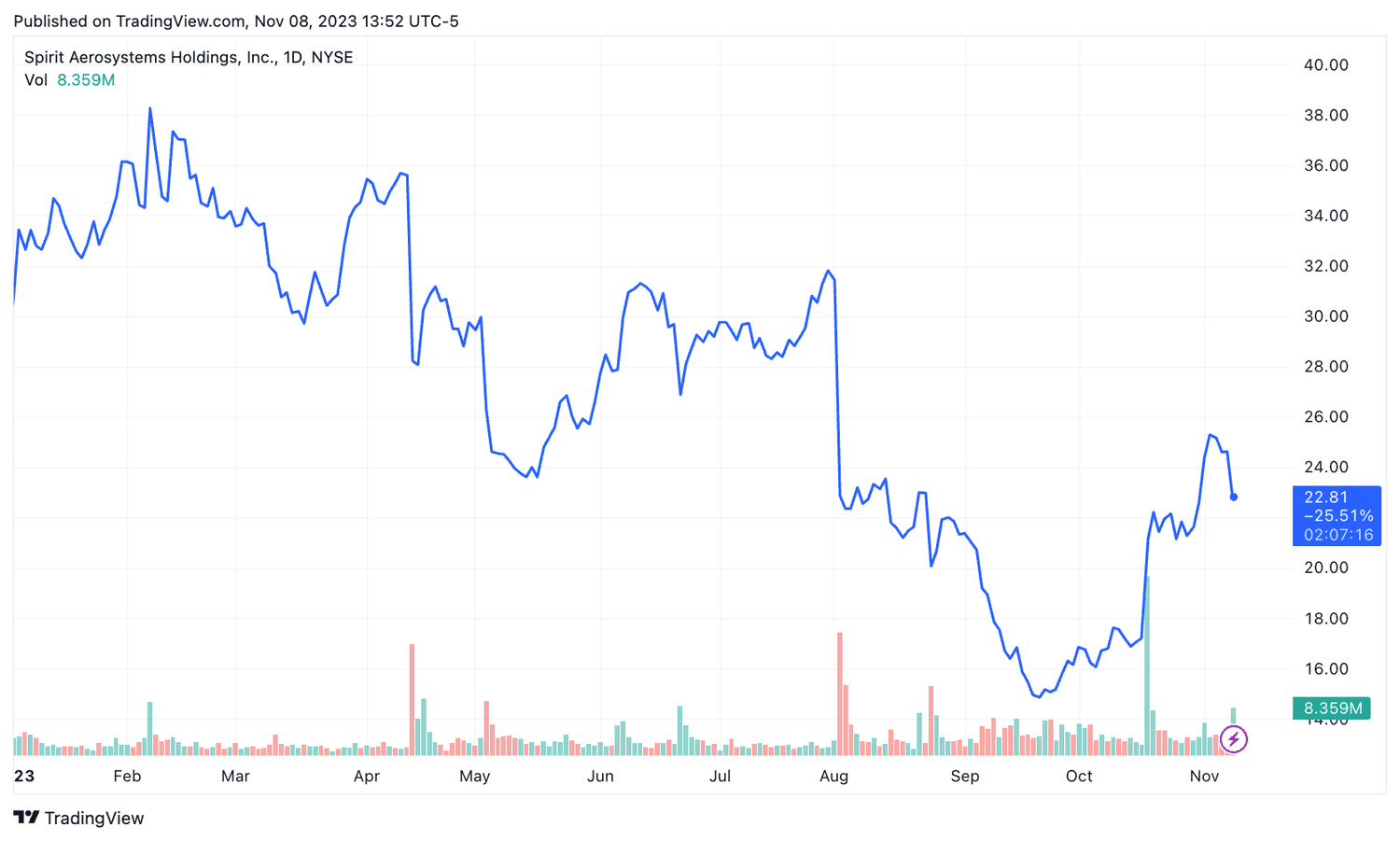

- Esprit AeroSystems shares fell Wednesday after announcing plans to raise capital.

- Aircraft parts supplier to sell $200 million of its common stock class A, as well as issuing $200 million in convertible debt.

- The move comes after a series of quality issues that disrupted and delayed aircraft deliveries.

The aircraft parts supplier said it plans to raise $200 million through the sale of its common stock and an additional $200 million through convertible debt that matures on November 1, 2028.

A key manufacturer of large aircraft structures such as wings and fuselages for Boeing and Airbus, Spirit has been implicated in defects that have negatively impacted Boeing deliveries, with a string of ;higher supply and labor costs that led Spirit to report a net loss of $692 million for the first nine months of 2023.

Last month, Spirit announced that it had signed an agreement with Boeing to strengthen its production system and shorten its supply chain. However, Spirit further lowered its forecast for 737 narrow-body deliveries to Boeing to between 345 and 360 units, from 370 to 390 units.

Interim CEO Patrick Shanahan, suggested in an earnings call that it was “of the utmost urgency” to reach a similar agreement with other customers like Airbus.

With Wednesday losses, the Spirit AeroSystems shares have lost a quarter of their value this year.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com