SeaWorld Entertainment, Inc. (SEAS) shares rose over 1% during Friday’s session after better-than-expected financial results for the first quarter to offset a 30% decline in traffic. Revenue fell 30.4% to $153.56 million, but beat the consensus estimates of$ 650,000. During this time, the company has recorded a net loss of 72 cents per share was better than the loss of 75 cents per share estimated by analysts. The poor results were driven by a 30% drop in customers to 2.3 million in the first quarter.

Attendance initially rose by nearly 10% during the first two months of the quarter due to the improvement of marketing, pricing strategies, and compelling attractions. While the parks are closed because of COVID-19, the company strives to extend the expiry dates on its season passes, and provide other offers.

In April, Wedbush’s James Hardiman believes that SeaWorld had at least 16 months of liquidity, which enables him to withstand the storm without suffering any serious financial consequences. Although the company has sought the support of the government, in its passage to the seniority of most of its staff and its private equity history make it an unpopular candidate for help.

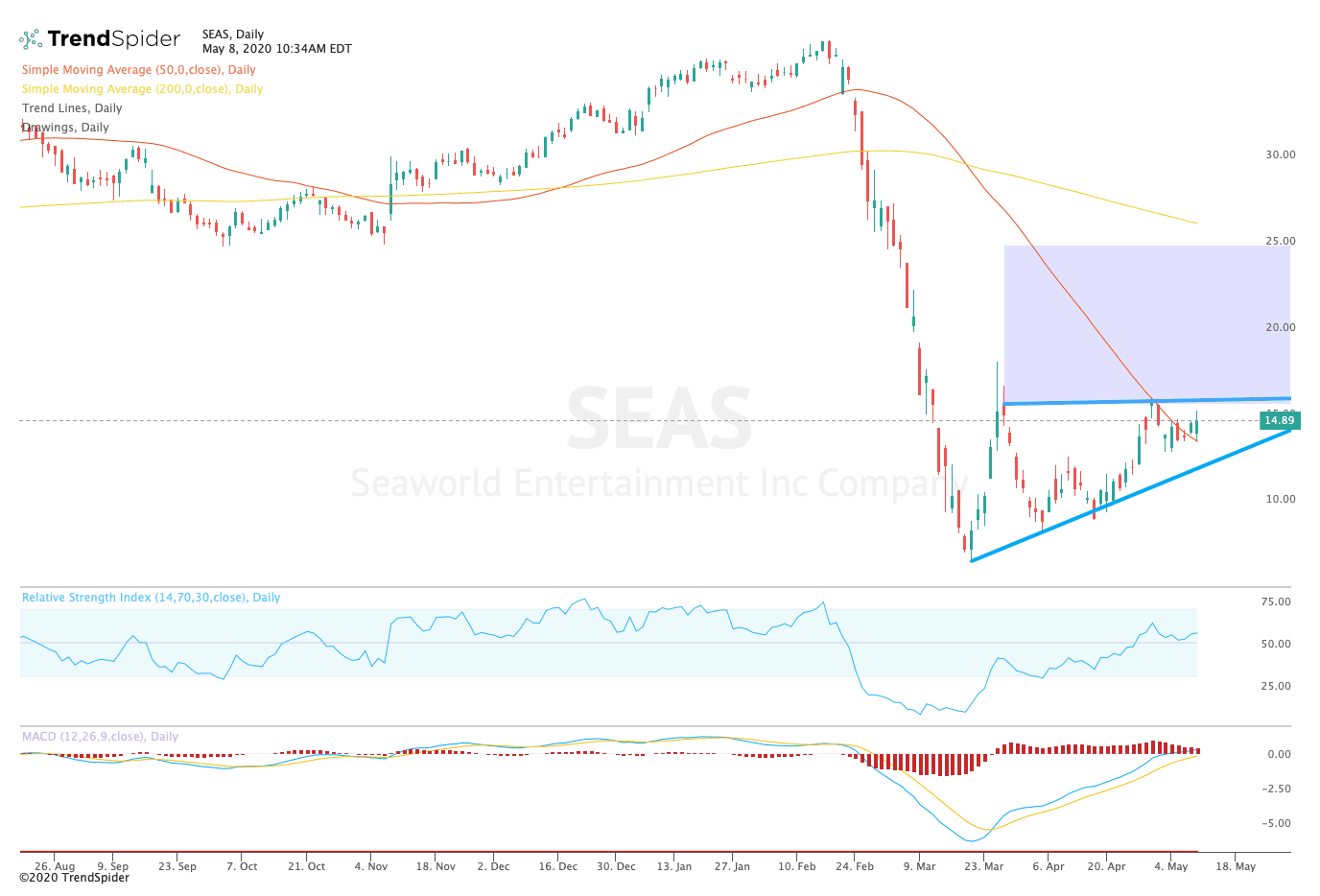

TrendSpider

From a technical point of view, SeaWorld stock trading on the rise, ascending triangle pattern, which could indicate upside ahead. The relative strength index (RSI) remains neutral with a reading of 56.29, while the moving average convergence divergence (MACD) has followed an upward trend towards the zero line. These indicators suggest that the stock has more room to run before the consolidation at levels of overbought.

Traders should expect to see a break of the bullish ascending triangle pattern at about $16.00. If this happens, traders could see a move towards the 200-day moving average of $26.32. If the stock fails to break out, traders could see a breakdown of support at about $13.00 and a tendency to the reaction of the low of close to $9.25 over the next sessions.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com