Key Points

- Salesforce shares have fallen as capital spending increases and customer behavior changes.

- Salesforce's quarterly earnings, revenue and current-quarter outlook beat expectations.

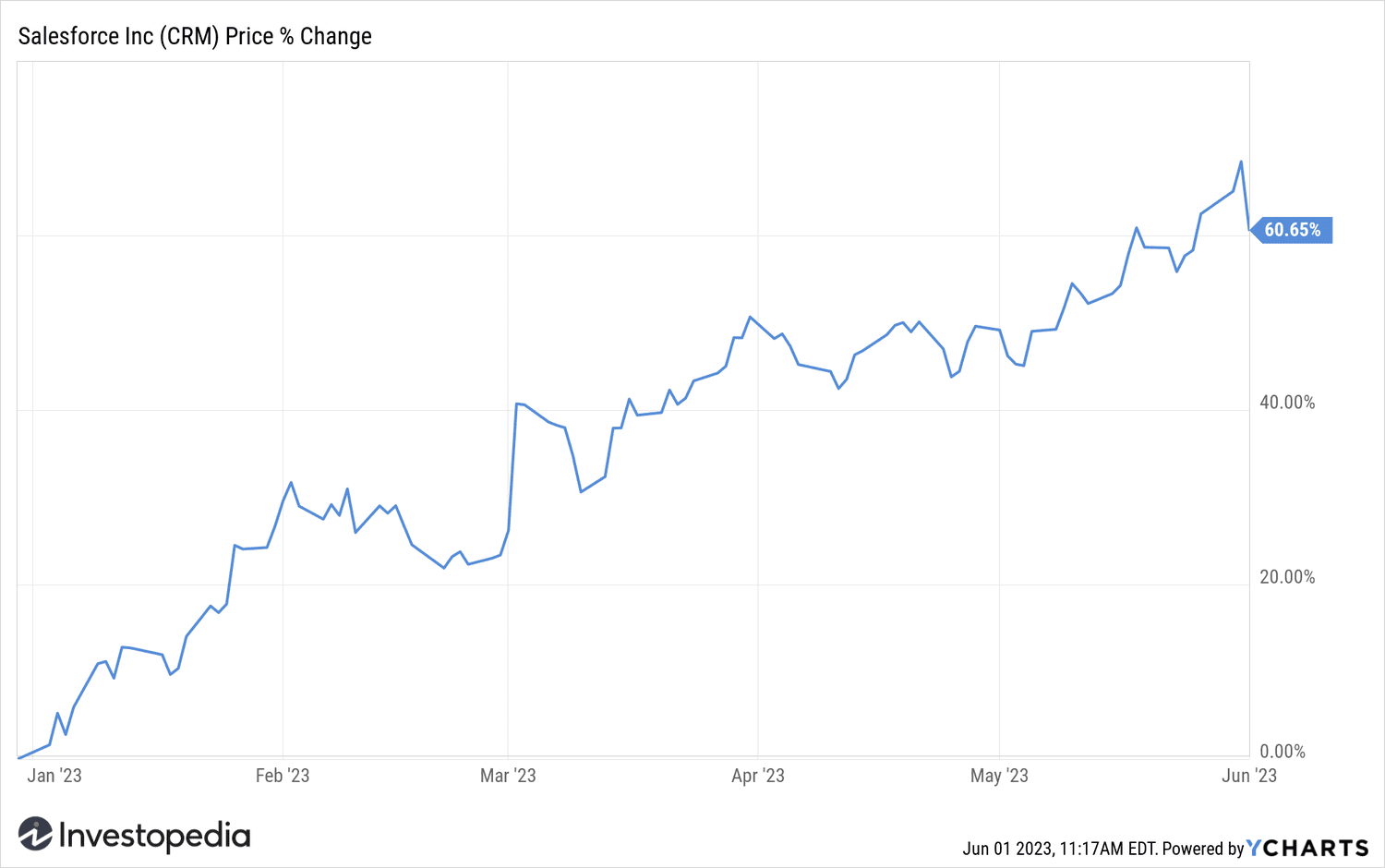

- Despite the stock price falling on Thursday, shares are up about 60% for 2023.

Salesforce (CRM) was the worst-performing Dow Jones stock in early trading Thursday after the cloud-based enterprise software provider reported higher-than-expected spending and warned of policy changes. Customer Buying Behavior.

Shares fell even as Salesforce reported strong first-quarter fiscal 2024 results, with earnings per share (EPS) of $1.69 and revenue up 11.3% to 8.25 billions of dollars. Both were better than expected. The company also raised its full-year earnings outlook and gave guidance for the current quarter that beat analysts' estimates.

However, Salesforce said capital expenditure (CapEx) jumped 35.8% to $243 million, nearly $40 million more than expected. Additionally, COO Brian Millham noted that clients continue to scrutinize deals and take longer to close than in the past. He noted that the company's professional services businesses have started to see less demand for multi-year transformations and, in some cases, they have delayed projects.

CFO Amy Weaver has added that with the pressure on professional services, more and more customers are choosing to contract on a time and material basis.

Salesforce shares fell by 4.5% as of 11:16 a.m. ET Thursday, though they were still up about 60% year-to-date.

Y-Graphs

Source: investopedia.com