Key takeaways

- RTX beat earnings and sales estimates, announced a stock buyback and gave an optimistic update on inspections of a jet engine taken out of service due to a problem potential.

- CEO Greg Hayes said significant progress had been made on inspection. problem, and the financial impact will likely be as expected.

- RTX increased its share repurchase program by $10 billion.

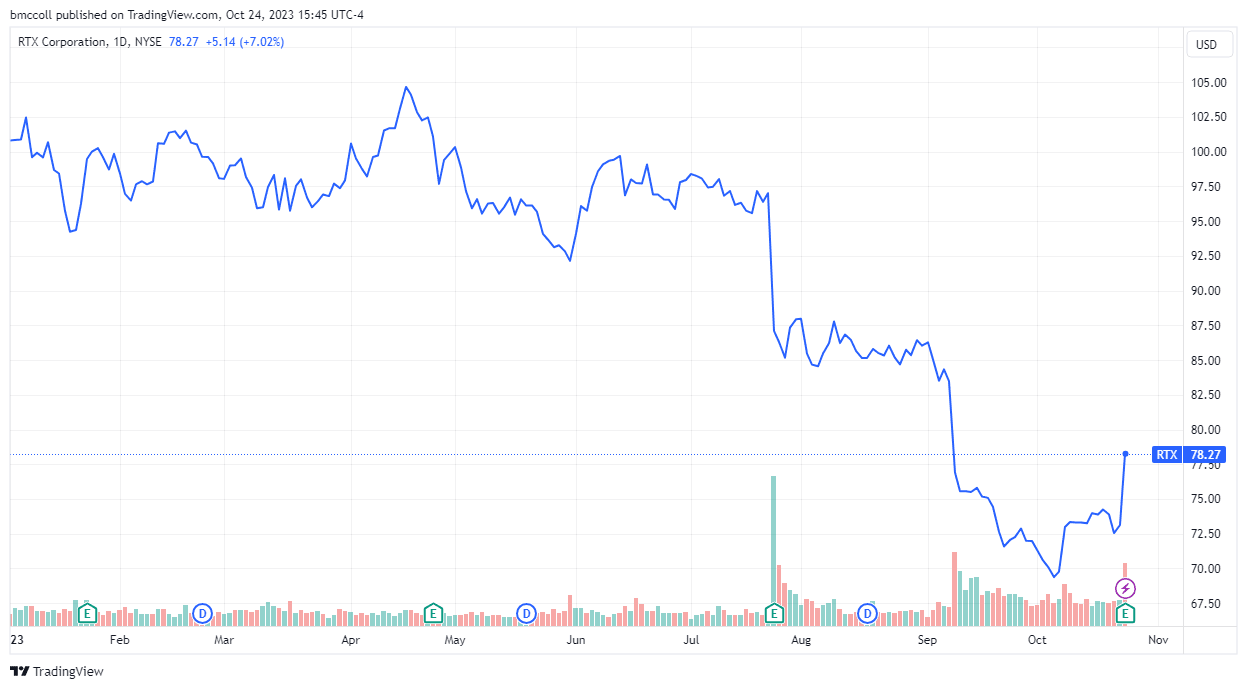

Shares of RTX (RTX) jumped more than 7% on Tuesday after the defense company reported better-than-expected results, announced a stock buyback and gave an upbeat assessment of progress in inspections for a possible jet engine defect.

The company formerly known as Raytheon reported earnings per share (EPS) of $1.25 for the third quarter of fiscal 2023, with revenue down 20.6%. year-over-year to reach $13.46 billion. Both exceeded estimates.

Sales rose 16% at its Collins Aerospace division, and 3% at its Raytheon unit. However, sales fell 83% at Pratt & The Whitney Group had to take a popular engine out of service to inspect them for a “rare condition of metal powder.”

CEO Greg Hayes explained that the company has made “significant progress” on inspections and expects the financial impact to be “consistent with previously disclosed charges.”

RTX shares have fallen since the Pratt & Whitney's problem was revealed and the company indicated that with this it could offer “an attractive investment opportunity”. RTX announced it would repurchase an additional $10 billion in shares, bringing its current repurchase plan from $36 billion to $37 billion through 2025.

RTX said it expects annual revenue of $74. billion, at the top of its previous forecast, and narrowed its EPS outlook range to $4.98 to $5.02, from $4.95 to $5.05.

The company also announced that& #39;an anonymous buyer agreed to pay $1.3 billion for cybersecurity, intelligence and services businesses within Raytheon.

Despite Tuesday's gains, RTX shares have still lost more than 20% of their value this year.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com