Roku Inc. (ROKU), among the top nine applications entertainment downloaded in the US, will likely see its first-ever year-over-year revenue decline in the first quarter as a tepid advertising market outweighs the growing popularity of its Roku channel .

Key Points to Remember

- Roku is expected to post -$1.45 EPS for the first quarter, compared to -$0.19 in the prior year quarter.

- Revenue could fall for the first time in company history, at $709.5 million.

- Roku faces lower ad spend due to inflation and rising interest rates.

The streaming platform provider will likely report net losses attributable to shareholders of $204.8 million, or $1.45 per share, compared to losses of $26.3 million, $0.19 per share, in the quarter of the previous year, according to estimates compiled by Visible Alpha. Revenue could fall 3.3% to $709.5 million, the first such drop in company history. Roku announces earnings after markets close Wednesday.

Roku's advertising business, its main source of revenue, faces macroeconomic headwinds, including inflation and rising interest rates, which have reduced advertising budgets in recent quarters. The company said in February that it was seeing some improvement in certain segments, including restaurants, travel and wellness.

Citing the difficult economic environment, Roku promised investors last year it would cut costs, and investors will be looking at first-quarter spending to see evidence of that plan.

The company laid off 200 employees in November last year and another 200 in March, for which it expects to incur between $30 million and $35 million in one-time charges in the first quarter. The savings will not be fully realized until later in the year.

Total operating expenses for the first quarter are expected to be $537 million, 38% higher than a year ago. That would be the slowest rate of increase in two years. Analysts expect operating expenses to rise only 1% by the end of the year.

Meanwhile, Roku is expanding its product line and in-house programming. During the first quarter, the company launched its first Roku-branded televisions. It has also partnered with content producers Pocket.watch and Jellysmack, among others, to boost deals on The Roku Channel.

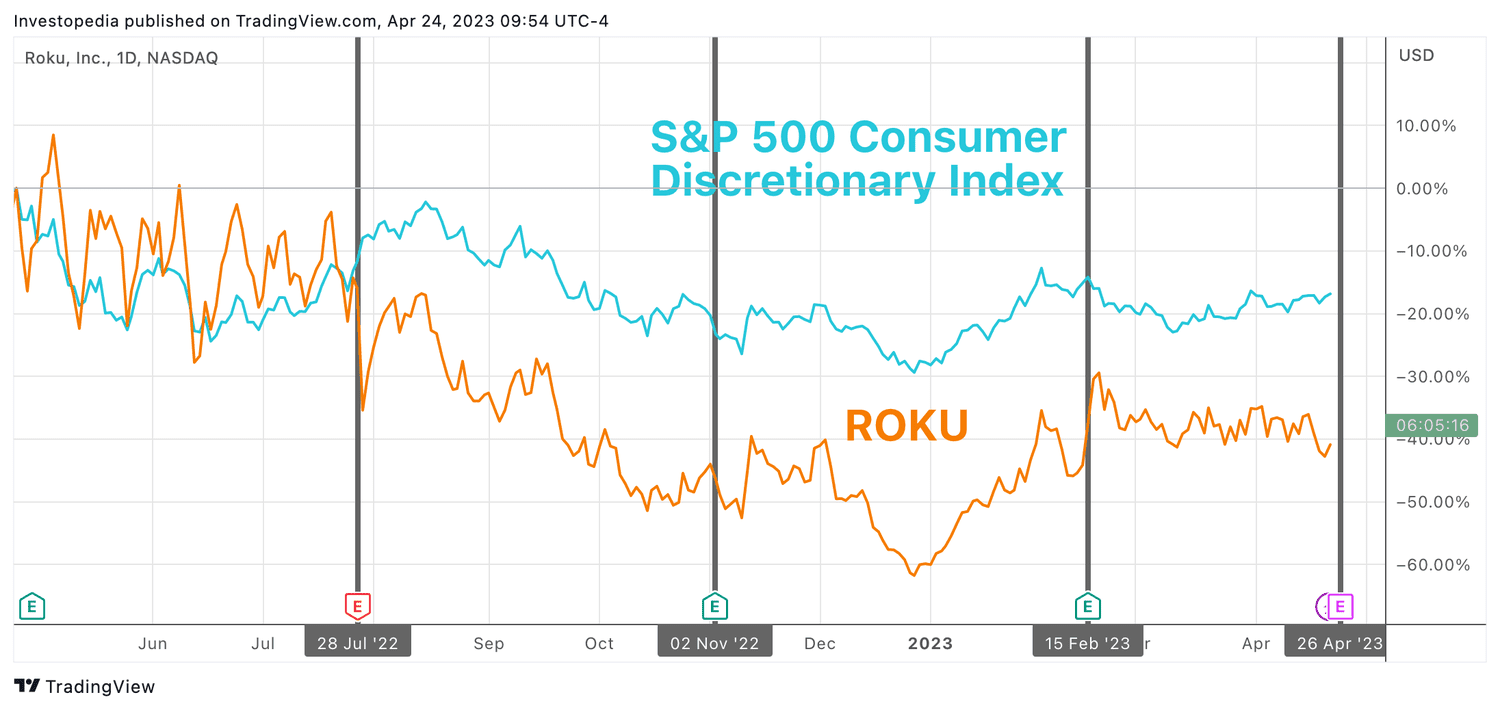

Roku shares have fallen about 41% in the past year, compared to a 17% decline for the benchmark S&P 500 Consumer Discretionary sector. Source: Commerce See. Roku Key Metrics Estimate for Q1 2023 Actual for Q1 2022 Actual for Q1 2021 Earnings per share ($) -1.45 -0.19 0.54 Revenue ($m) 709.5 733.7 574.3 Accounts Assets (M) 71.0 61.3 53.6 mntl-sc-block_1-0-21″ class=”comp mntl-sc-block finance-sc-block-html mntl-sc-block-html”> Source: Visible Alpha

Source: Commerce See. Roku Key Metrics Estimate for Q1 2023 Actual for Q1 2022 Actual for Q1 2021 Earnings per share ($) -1.45 -0.19 0.54 Revenue ($m) 709.5 733.7 574.3 Accounts Assets (M) 71.0 61.3 53.6 mntl-sc-block_1-0-21″ class=”comp mntl-sc-block finance-sc-block-html mntl-sc-block-html”> Source: Visible Alpha

Key Metric: Accounts assets

The key to the advertising activity of Roku is the number of active accounts on its platform, a measure of the size of its user base. Roku defines active accounts as the number of distinct user accounts that have streamed content on its platform in the past 30 days. The company does not distinguish between unique individuals streaming content on the same account, although the number of active accounts is closely correlated to the number of viewers, and therefore potential advertiser reach.

Basic Roku user is in growth. The company said in early January that it had passed 70 million active accounts, and analysts expect it to hit 71 million by the end of the first quarter.

Source: investopedia.com