Robinhood Markets (HOOD) shares rise as the online retail brokerage reported better-than-expected financial results and said it was expanding its services, including enabling 24-hour trading.

The online brokerage posted a first quarter loss of $0.57 per share, with revenue up 47% to $441 million. Both were above analysts' forecasts.

The company benefited from the Reserve interest rates rise, with net interest income jumping 278% from a year ago. However, transaction-based revenue decreased by 5%.

Robinhood added 400,000 monthly active users (MAUs) from the prior quarter for a total of 11.8 million, and average revenue per user increased 17% to $77.

24 hour trading

The company also stated that ;she would launch & #34;Marché 24/24" next week, giving clients the ability to trade stocks 24 hours a day, five days a week.

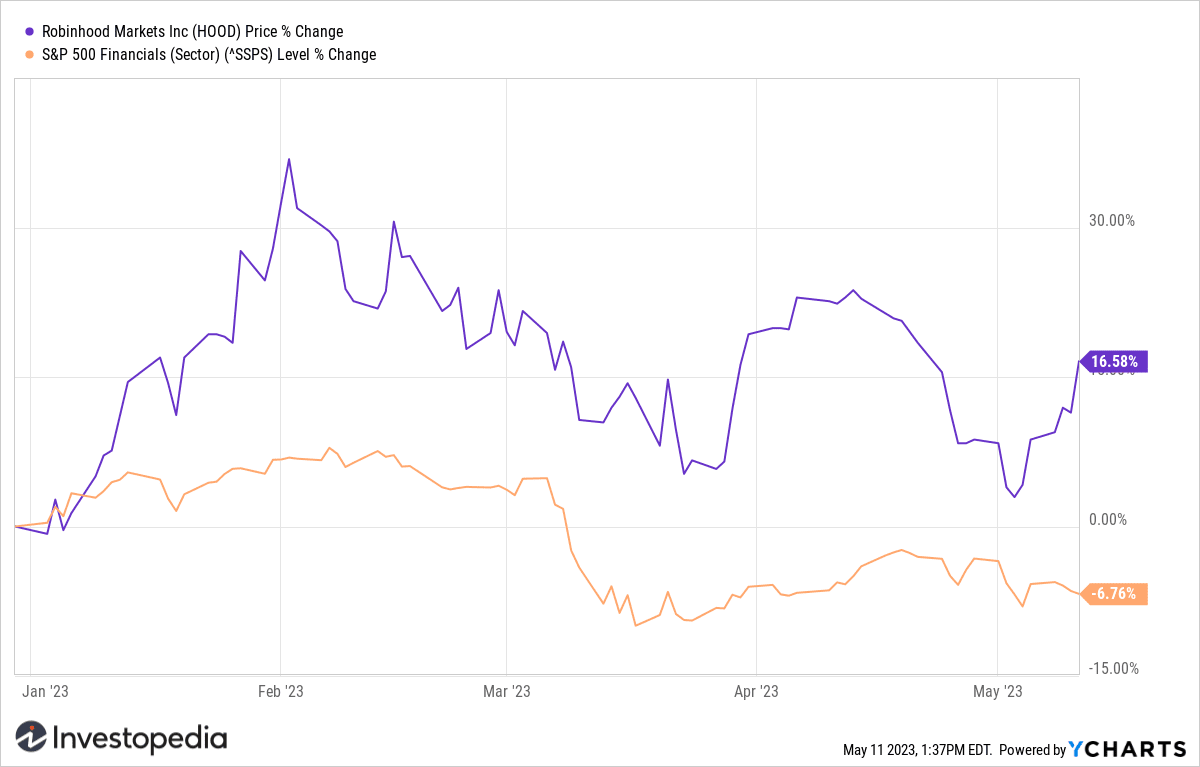

Robinhood Markets shares are up 4% as of 2:00 p.m. New York time and 16% year-to-date. They largely outperformed the broader financial sector of the S&P 500, which fell 7% over the same period.

Y-Graphs

Source: investopedia.com