Takeaways

- Rivian Automotive Inc. shares fell 20% in early trading Thursday after the maker of electric pickup trucks and SUVs announced a $1.5 billion bond offering.

- The company said funds from the convertible notes would be used to finance "green" energy projects.

- Rivian also raised the upper end of its preliminary quarterly revenue estimate, to a range of $1.29 billion to $1.33 billion.

Shares of Rivian Automotive Inc. (RIVN) fell Thursday after the automaker (EV) announced a $1.5 billion “green” bond offering.

The maker of the R1T pickup and R1S SUV announced Wednesday that it will offer the senior convertible bonds due 2030 to qualified institutional buyers.

Rivian added that it expects initial investors to have the option to purchase up to an additional $225 million of notes. The company said the interest rate, initial conversion rate and other terms of the notes will be determined based on the offering price.

The company said that it planned to use this money to finance, refinance or make direct investments in one or more new or recently completed “green” energy projects.

Rivian also indicated that it Analysts expect revenue for the quarter ended September 30 to be between $1.29 billion and $1.33 billion, up from $540 million in the same quarter in 2022. expected $1.31 billion. The company highlighted that the gain was mainly attributable to an increase in deliveries.

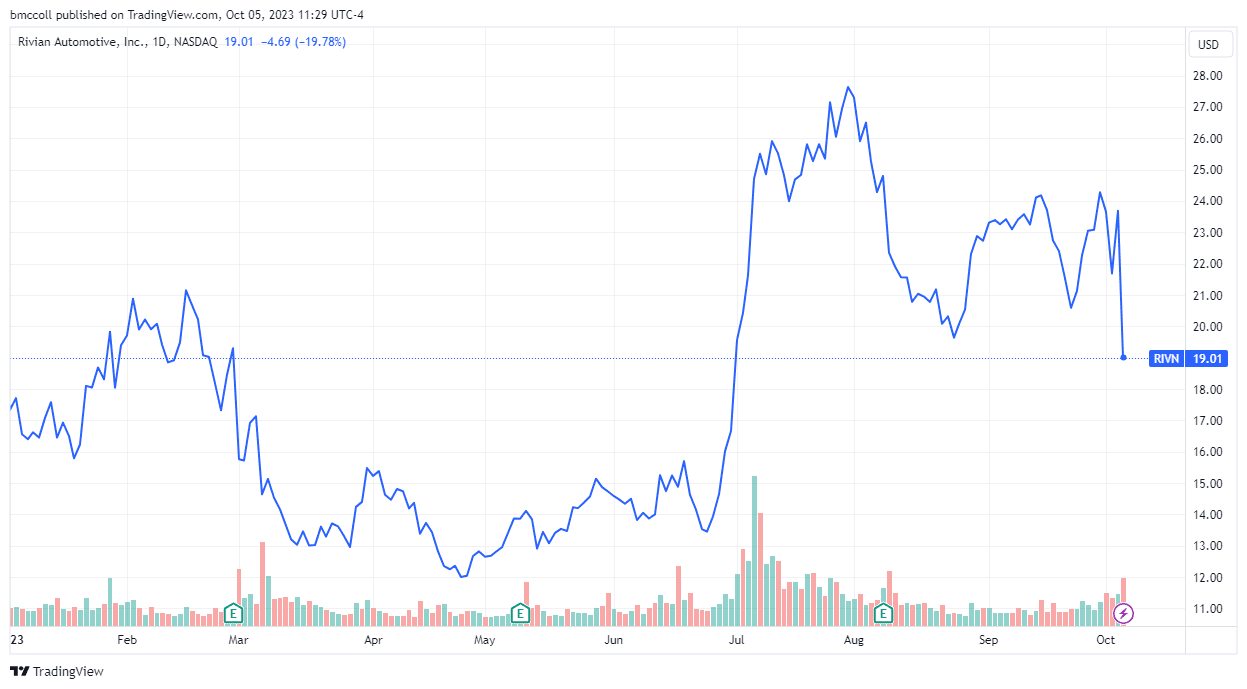

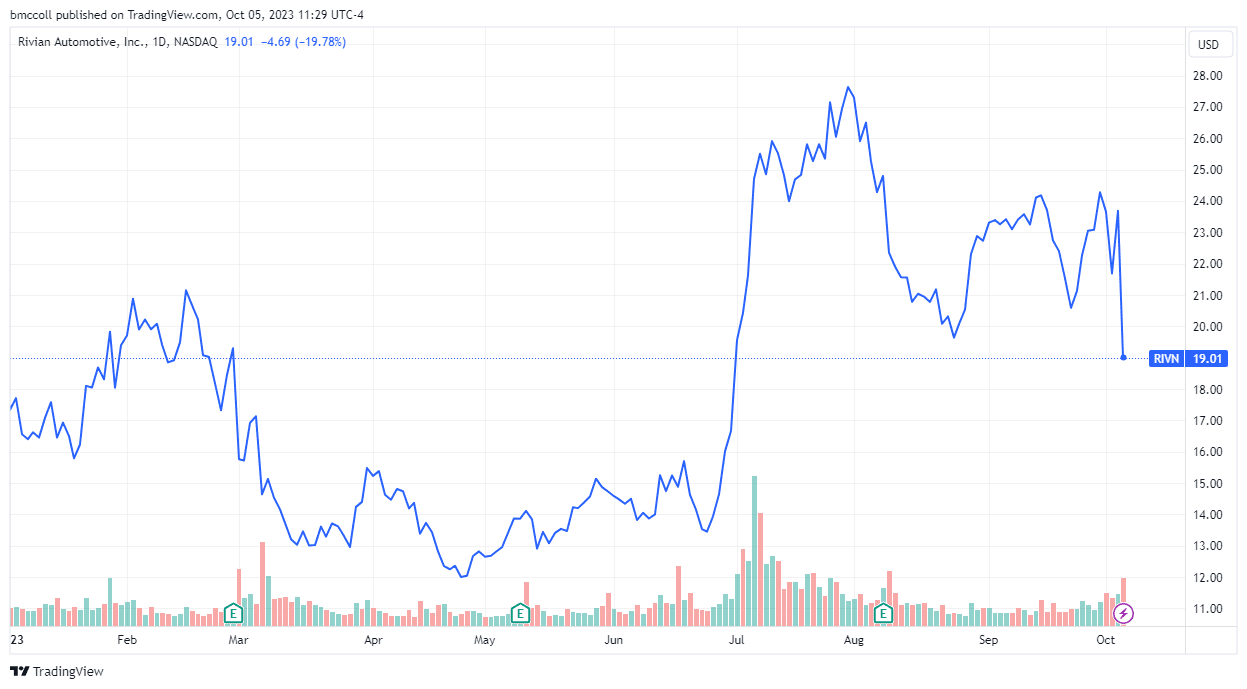

Thursday noon, the shares of Rivian Automotive had lost about 20% of its value, but even with that drop it remained higher for 2023.

TradingView

Do you have a tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com