Key takeaways

- Union Pacific's third-quarter profit beat estimates as the railroad raised prices.

- Revenue fell as the company got less from fuel surcharges and is reducing volumes.

- CEO Jim Vena said Union Pacific faces continued inflationary pressures and a decline in carloads.

Shares of Union Pacific (UNP) rose Thursday after the freight rail operator posted better-than-expected profits on price hikes, although the company warned that the company's profits were higher than expected. it was struggling with the impacts of inflation and demand.

Union Pacific reported third-quarter earnings per share of $2.51, down 18% from a year earlier but 8 cents higher than the consensus view of analysts surveyed by Visible Alpha. Revenue fell 10% to $5.94 billion, just below analysts' figure. forecasts.

The company said the price increase partly offset a decline. fuel surcharge revenues, decline in volumes and business mix. Freight car speed, locomotive productivity and average maximum train length have been improved.

CEO Jim Vena said the railroad “faced numerous challenges this quarter, including continued inflationary pressures and a decline in carloads.” In a letter to employees, Vena said he wasn't going to “sweeten the finances,” adding: “Things cost more to make and move, and people buy less of them.” »

Vena , who took over the company in August, explained that the results show “a railroad that needs to use its resources more efficiently, an economy characterized by rising prices, weaker demand for some of that that our customers carry and higher inflation.” He noted that to improve its performance, Union Pacific focuses on safety, speed of delivery, efficiency, productivity and value.

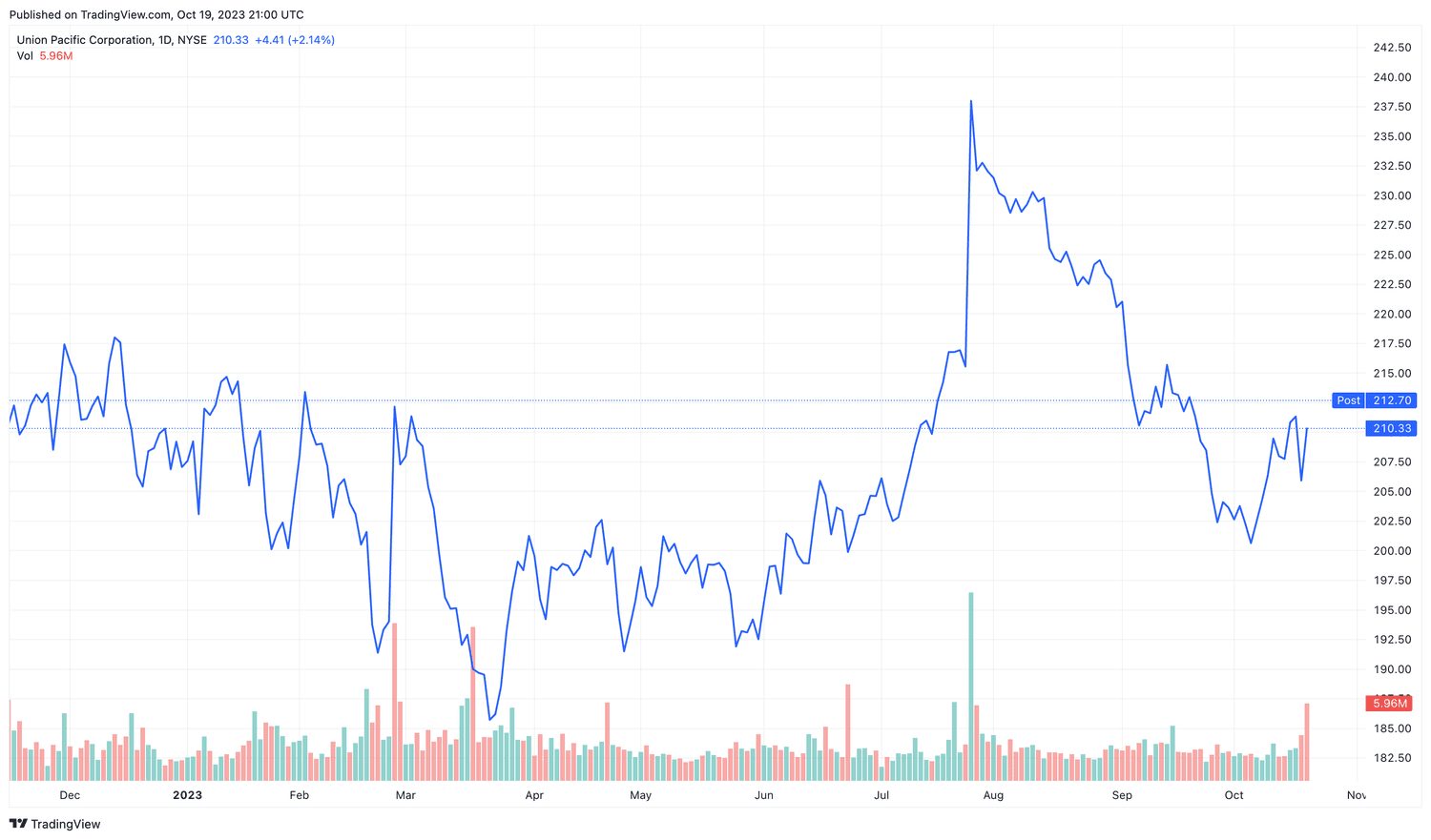

Union Pacific shares gained 2.1% on Thursday, moving into positive territory for the year.

TradingView

Source: investopedia.com