Costco (COST) likely to see solid earnings growth in high single digits when it reported earnings on Thursday, as rising memberships and continued customer loyalty could help the wholesaler offset weakness in discretionary spending and e-commerce.

Key Takeaways

- Net income is expected to be $1.46 billion, or $3.28 per share, up 7.6% from the same quarter last year.

- Same-store sales likely grew only 2.3% at the slowest annual rate since the first quarter of 2017.

- Rising membership numbers could help the wholesaler offset slower sales growth amid declining consumer spending.

Net income (NI) is projected at $1.46 billion, up 7.6% from the same quarter last year, according to estimates compiled by Visible Alpha, with earnings per share expected at $3.30. Revenue likely increased 4.2% from the prior year quarter to $54.81 billion, driven by slowing same-store sales growth in the United States, which did not 39; rose only 2.3%, the slowest annual pace in more than six years. Costco releases its fiscal third quarter results on Thursday, May 25 after markets close.

Key Indicators

Costco's growth in recent years has been driven by effective price management, increased memberships and greater penetration of the company's e-commerce platform, which has exploded during the pandemic. Total membership, combining Executive, Corporate and Gold Star cardholders, likely reached nearly 68.4 million, up 6.2 % compared to the same period last year.

However, growth has slowed in recent quarters as high inflation and rising interest rates weigh on household budgets, sales of discretionary business items such as with televisions and refrigerators being the most affected.

Costco, Key Metrics Q3 FY 2023 (projection) Q3 FY 2022 Q3 FY 2021 Net profit (B$) 1.456 1.353 1.220 Same store sales growth (%) 2.32% 16.60% 18.20% Memberships (M) 68.37 64.40 60.60

The effect of slowing sales was even greater on the company's e-commerce business, where revenue likely fell 6.4% from a year ago, versus growth. annual growth of 7.4% in the same quarter last year. That's a sharp reversal since the start of the pandemic, when e-commerce sales more than doubled on a yearly basis in the fourth quarter of 2020.

Despite the slowdown, the wholesaler retains a loyal customer base, which could allow it to weather economic headwinds better than competitors. At the same time, sales of certain product categories likely held up as consumers changed their spending habits. Sales of food and beverages and fuel at company gas stations were likely robust as consumers spent more of their income on basic necessities.

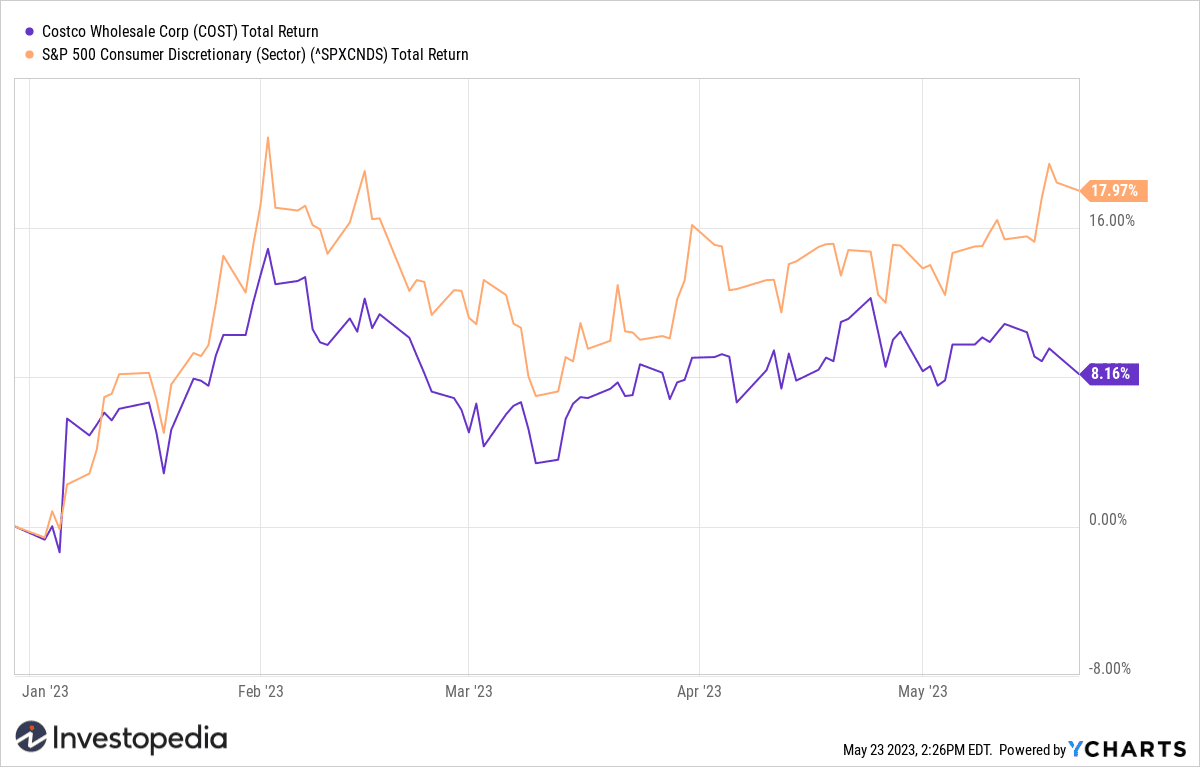

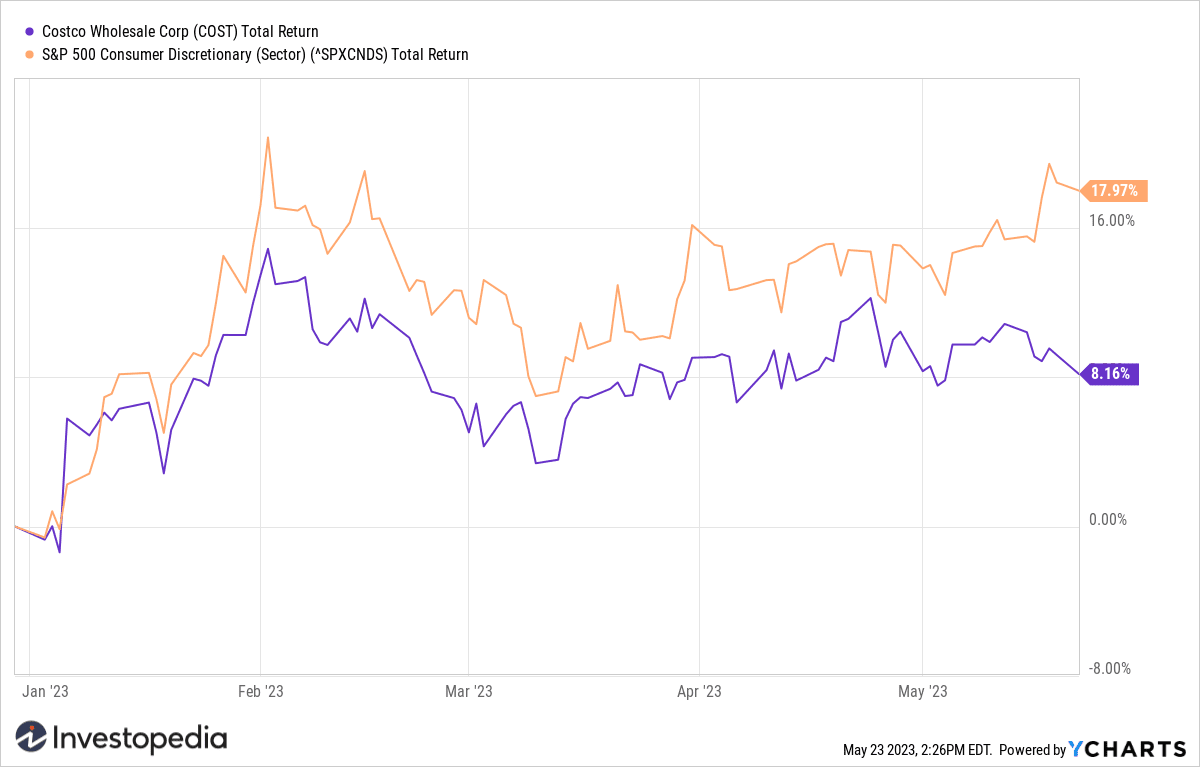

Costco stocks are up just over 8% so far this year, underperforming the broader consumer discretionary sector, which is up 18% over the same period.

YCharts

Source: investopedia.com