Airlines could see their profitability affected in the months to come as fuel costs – one of their biggest expenses – rise, while demand for domestic travel peaks.

Points to remember

- Spiking fuel costs and spike in domestic travel demand could hurt airline performance. profitability in the coming months.

- Until recently, air travel has been relatively unaffected by the slowdown in discretionary spending that has hit other sectors, such as retail.

- Shareholders of major airlines, including American, United, Delta and Southwest Airlines, could be affected.

Airlines have two major expenses that impact profitability. One is the fixed cost of labor, or employing and maintaining a flight crew. The second is fuel costs, which are tied to oil prices and fluctuate wildly from year to year. Rising oil prices have led to higher fuel prices in recent months, worrying some airlines.

Jet fuel prices tracked by the Energy Information Administration (EIA) averaged $3.07 per gallon at the end of August, up 50% from the recent low of 2.05 dollars in early May. This was accompanied by a surge in crude oil prices, which reached their highest level in almost 10 months.

At the same time, there are many signs that demand for domestic air travel, which has surged in the wake of the pandemic, may have peaked as cash-strapped consumers book fewer trips. Southwest Airlines (LUV) has revised its fuel cost expectations up, but expects revenue per available seat mile (RASM) – a key indicator of profitability for airlines – to fall between 5% and 7%, down from a previous range of 3% to 7%, the company said in an SEC filing Wednesday.

The updated outlook came just over a month after Southwest Airlines reported higher-than-expected costs for the quarter ended June and said those higher costs were likely to continue in the quarter. course.

On a broader scale, domestic bookings over Labor Day weekend, including those for flights, hotels, rental cars and cruises, were up just 4% per year. year over year, according to AAA data, despite a 44% increase in international bookings.

Meanwhile, Alaska Airlines (ALK), which operates almost exclusively in North America and derives most of its revenue from domestic travelers, has downgraded its outlook for revenue growth and cost per seat-mile. available (CASM) – a key indicator of profitability for airlines – for the last quarter, prompted by a spike in fuel prices. The company now expects fuel costs per gallon to be between $3.15 and $3.25, down from $2.70 to $2.80.

United Airlines United (UAL) also increased its fuel costs per gallon, to between $2.95 and $3.05, from $2.50 to $2.80, as it shared in its commentary on the results in July. The company does not yet expect an impact on its revenue.

Until recently, air travel has been relatively unstructured by the slowdown in discretionary spending that has hit other sectors, such as retail. However, the picture could change as continued high inflation and rising interest rates weigh even more heavily on households, who may consider cutting back on travel spending.

To be sure, earnings at major airlines like United and American Airlines (AAL) have been robust so far this year thanks to windfall profits from record travel demand, with the former's net profit having more than tripled over last year in the second quarter. However, rising fuel prices, coupled with lower domestic revenues, could hurt airline profitability, thus affecting the shareholders of these companies.

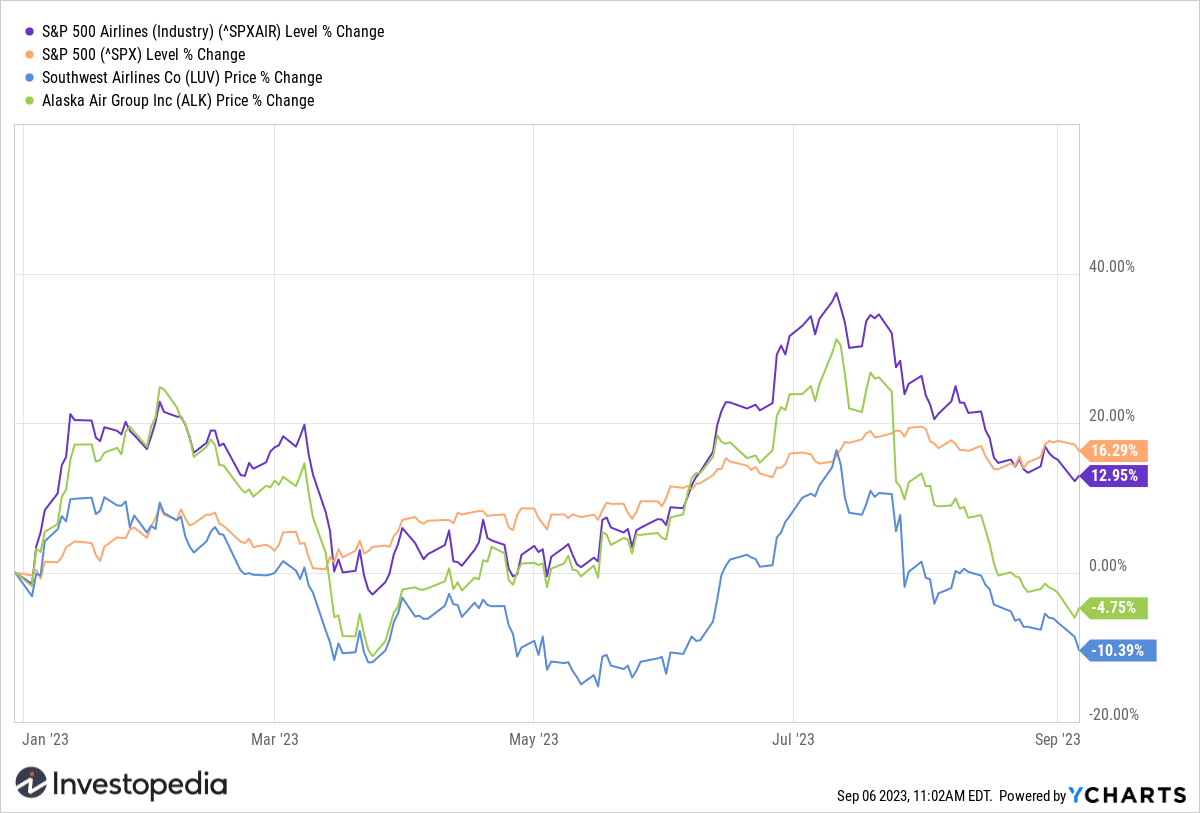

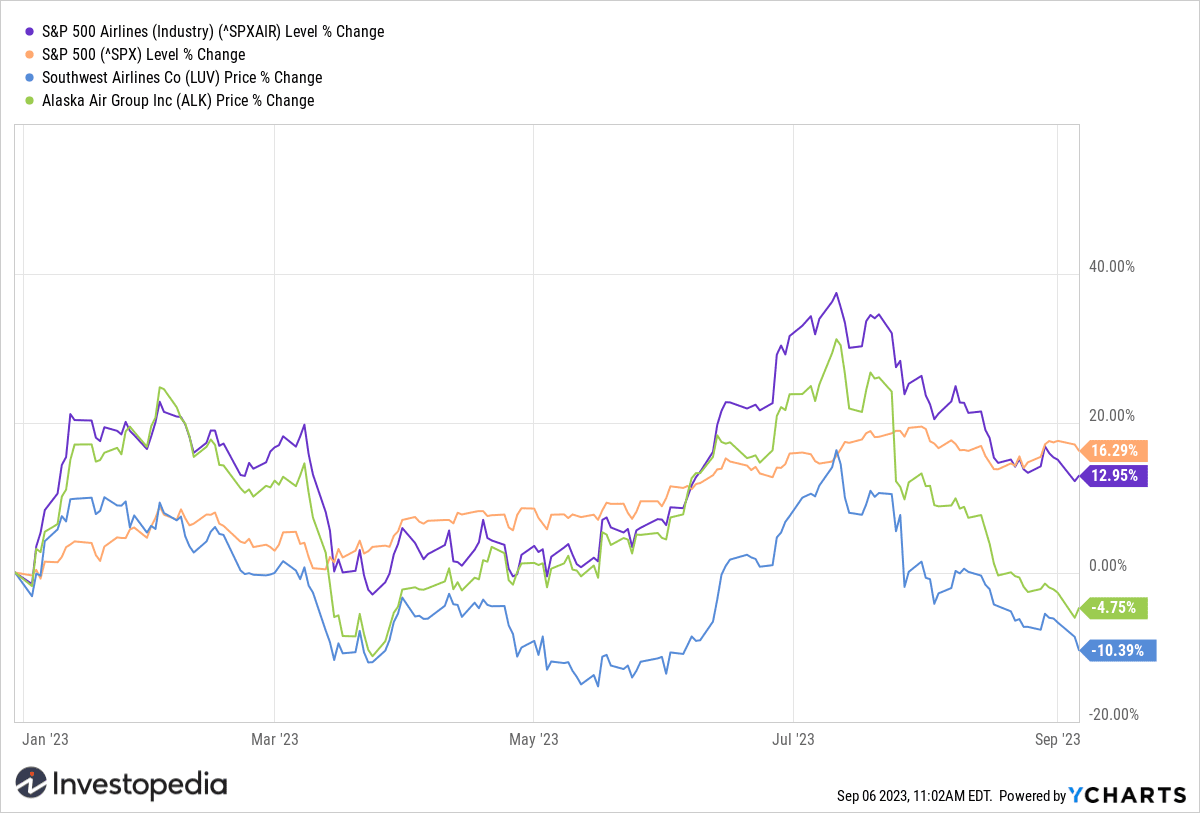

The Average Action airlines has underperformed the S&P 500 so far this year, up 13%, versus a 16% gain for the broader index. Shares of Alaska and Southwest Airlines are among the worst performers in the sector so far this year, with shares down 5% and 10%, respectively.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com