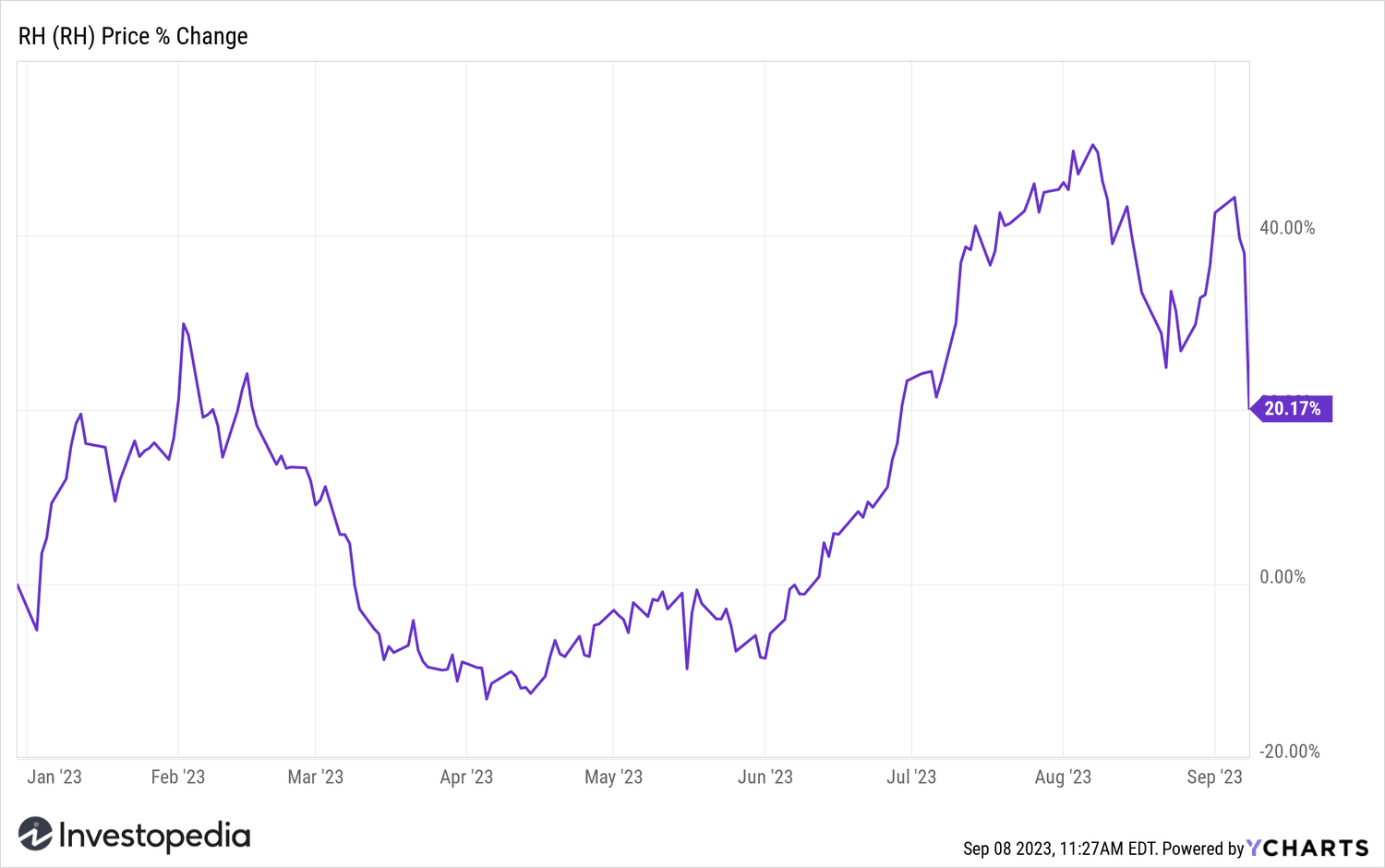

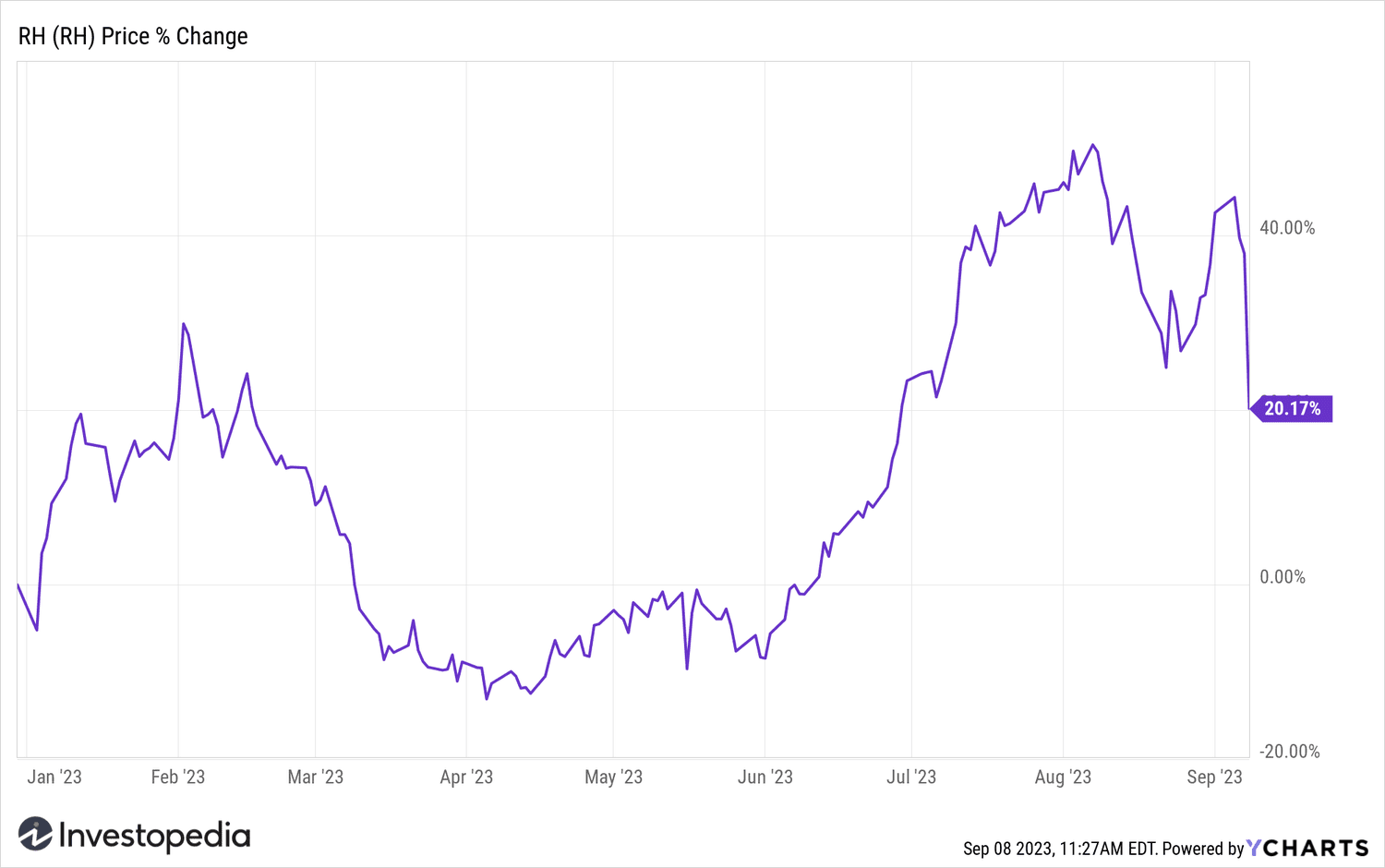

Shares of RH (RH) fell by more than 14% at midday after the high-end home furnishings retailer issued lower-than-expected guidance as rising mortgage rates hit luxury home sales.

Takeaways

- Furniture retailer RH said high mortgage rates will continue to impact the luxury real estate sector and reduce the company's sales.

- The high-end furnishings company's revenue for the current quarter missed estimates.

- RH CEO Gary Friedman said the market luxury real estate and the economy in general “will remain difficult”. until this year and next.

RH on Thursday forecast current quarter sales of between $740 million and $760 million, down 14% from last year and below analyst estimates. It forecast fourth-quarter revenue of $760 million to $800 million, with the midpoint above forecast, and it raised the low end of its forecast for the full ;year to $3.04 billion, up from $3.0 billion previously.

During its second quarter of fiscal 2023, RH reported a profit of $3.93. per share. Revenue fell 19% to $800.5 million. However, both were more than expected.

CEO Gary Friedman said the company continues to expect the luxury real estate market and the economy as a whole “to remain challenging throughout the fiscal year.” 2023 and next year, as mortgage rates continue to hit 20-year highs.” He added that RH expects rates to remain unchanged until the second quarter of 2024.

Friedman also told employees that they now had to return to the workplace, saying it was time to ” break bad COVID habits” and “get off screens, leave our home office, and reconnect with our team office. block-html”> RH shares fell to their lowest level in two months on Friday, but remained in positive territory for the year.

Yes Charts. Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Yes Charts. Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com