Key takeaways

- Lordstown Motors has announced a 1-for-15 stock split, effective Wednesday.

- The move is designed to lift its stock price above $1 in order to avoid Nasdaq delisting and save Foxconn investment. #39;were not met.

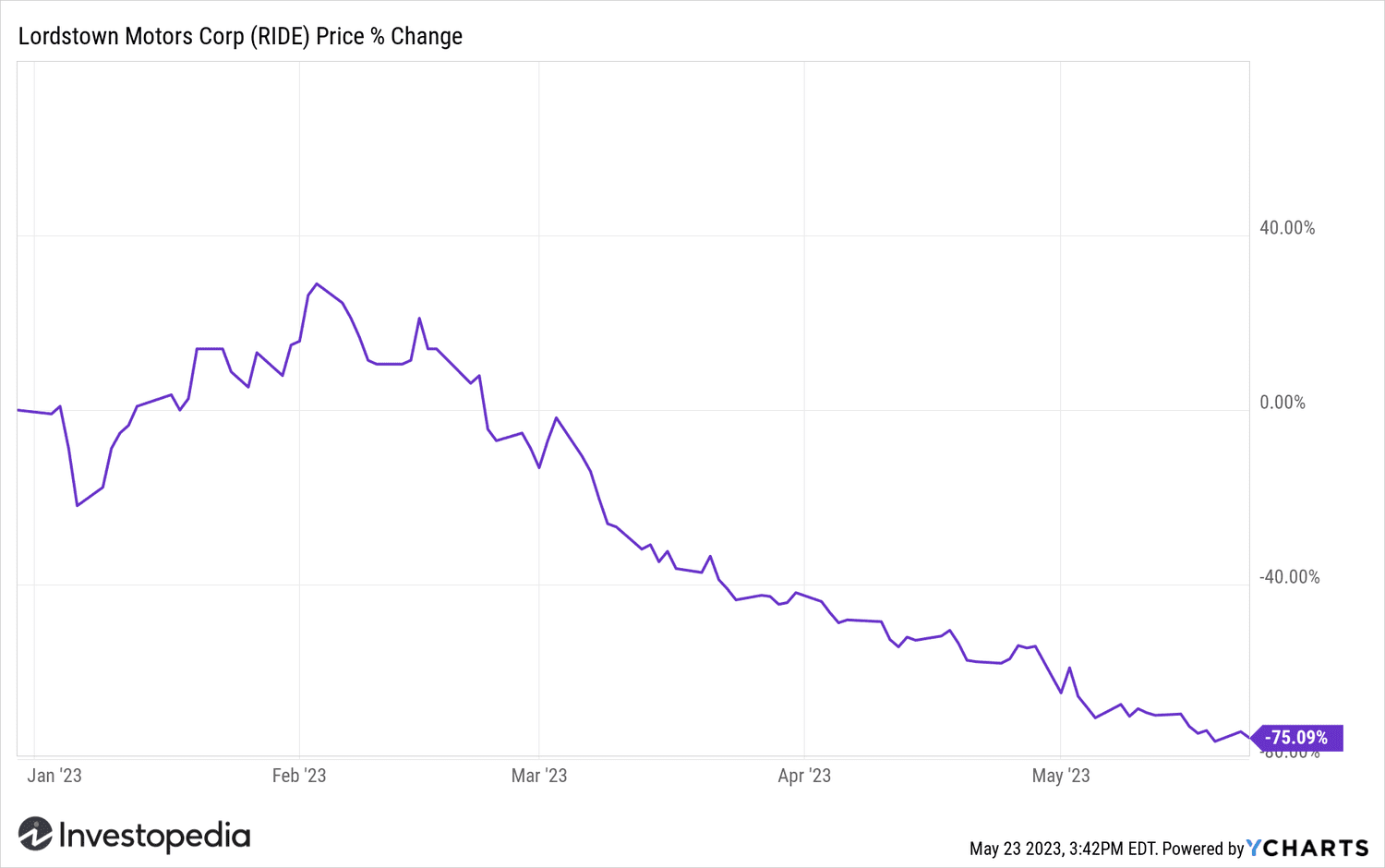

Struggling electric truck maker Lordstown Motors (RIDE) has announced it will perform a 1-for-15 stock split as it tries to avoid being delisted Nasdaq and losing a key investor.

Lordstown said shareholders approved the move at the company's annual meeting on Monday, and the shares will begin trading on the split-adjusted basis from 12:01 a.m. ET. ;East, Wednesday.

The company explained that the The decision was “intended to improve the marketability and liquidity” of the stock and will allow the shares to exceed the $1 threshold needed to meet Nasdaq listing requirements.

Additionally, Lordstown noted the move is expected to see investor Foxconn move forward with the electronics company's deal to buy around 10% of Lordstown's shares for $47. .3 million. In April, Foxconn argued that due to the potential delisting, the purchase conditions were no longer met. Lordstown disputed Foxconn's position, but added that if the split increased the stock's value above $1 and the stock remained listed on Nasdaq, the deal could go through.

The new n' did not help Lordstown shares, which fell more than 5% on Tuesday and are trading near all-time lows.

Y-Graphs

Source: investopedia.com