BYD's American Certificates of Deposit (ADR) surged by more than 4% in early trading on Tuesday after reporting that its profits rose as deliveries hit a record high, helping the automaker retain its status as China's top-selling auto brand.

KEY THINGS TO REMEMBER

- BYD announced that its profit reached 10.95 billion yuan ($1.50 billion) for the first half of the fiscal year, up 204.7% from the same period last year.

- The rise was largely driven by its automotive segment, which grew more than 91% year-on-year to 208.8 billion yuan (28.64 billions of dollars).

- The company attributed the increase in sales of its electric vehicles to favorable government policies and the growing popularity of smart vehicles.

BYD said its profit soared to 10.95 billion yuan ($1.50 billion) for the first half ended June 30, a jump of 204.7% from the same half. a year ago, despite the price war in the electric vehicle (EV) market.

Growth was largely driven by BYD's automotive segments and related products, which jumped more than 91% year on year to generate 208.8 billion yuan ($28.64 billion). BYD's automotive business accounted for more than 80% of company revenue in the first half.

BYD also cited rapid growth in its new energy vehicle business, supported by the introduction of favorable government policies. BYD said it sold a record 700,244 electric passenger vehicles worldwide in the second quarter, a 98% increase over the previous year. By comparison, Tesla delivered 466,140 vehicles worldwide during the same period.

BYD is also increasing its capabilities by outside car space. Yesterday the company announced the acquisition of Jabil's mobile electronics manufacturing business in China, in a move that could help BYD expand its customer base and portfolio of products in its smartphone components business.

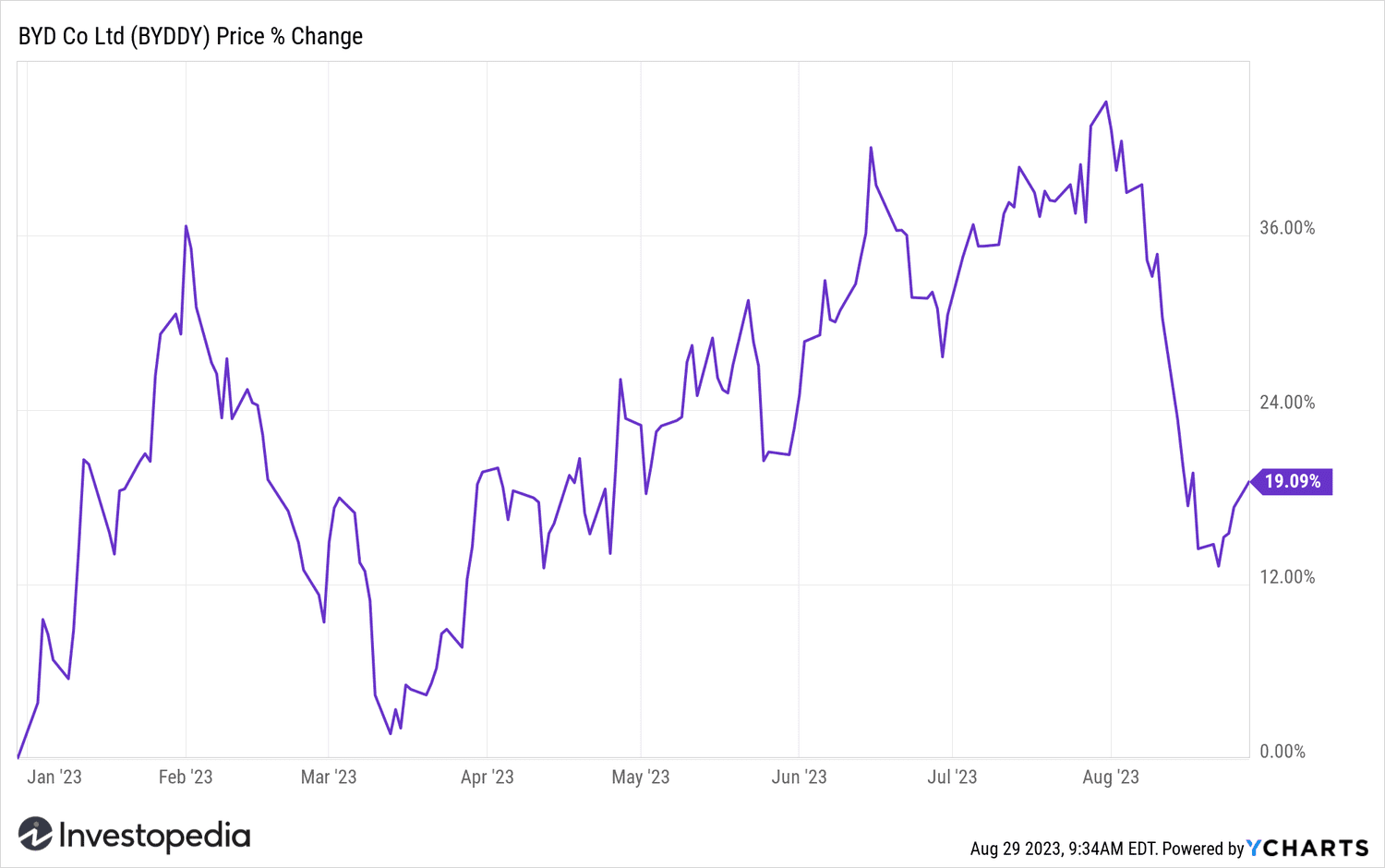

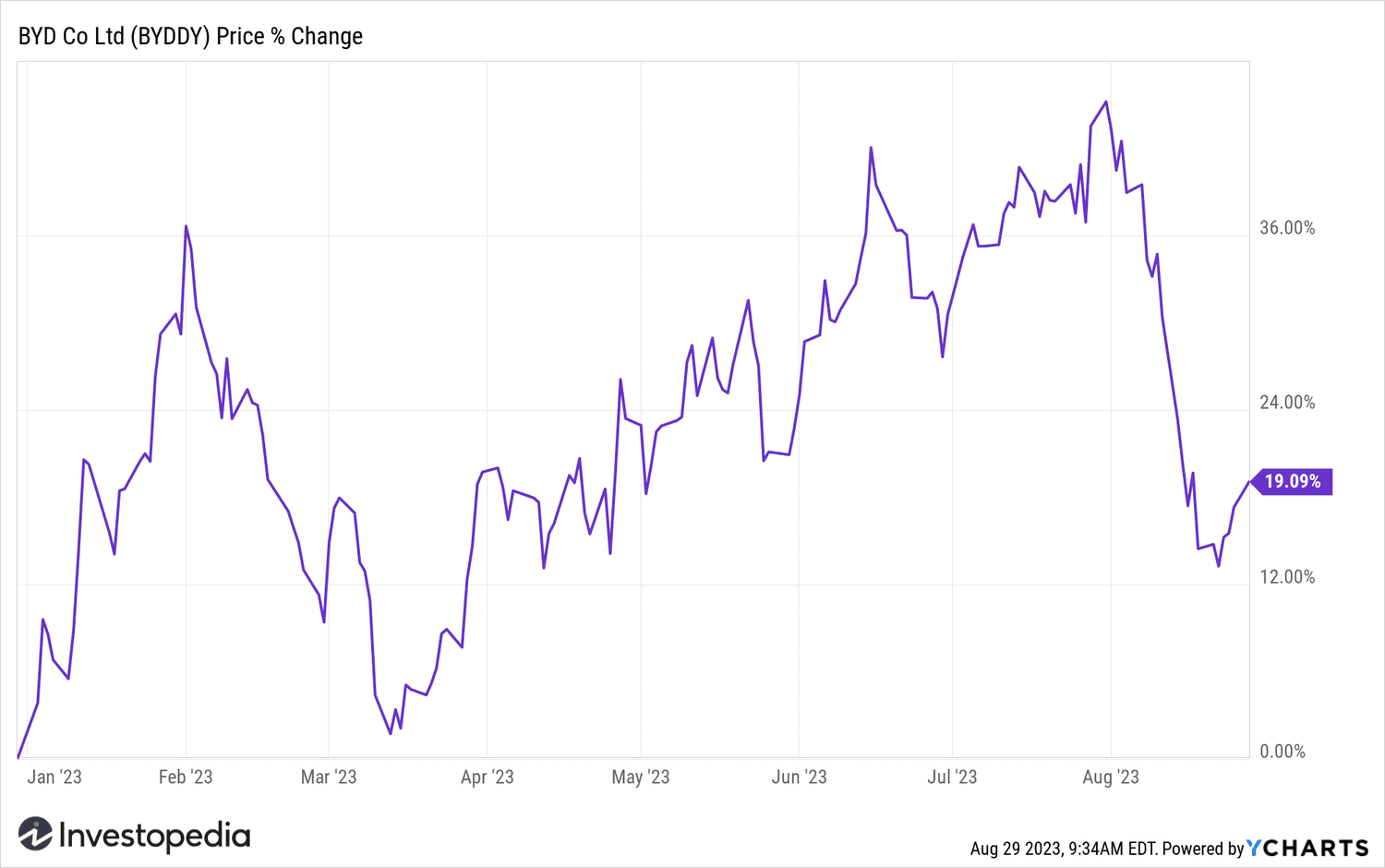

With Tuesday's gains, BYD's ADRs were up 19% year-to-date.

YCharts

Do you have any topical advice for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com