Takeaways

- Raymond James said client assets under management fell 1% in August compared to July.

- The firm said the decline was caused by falling stock prices.

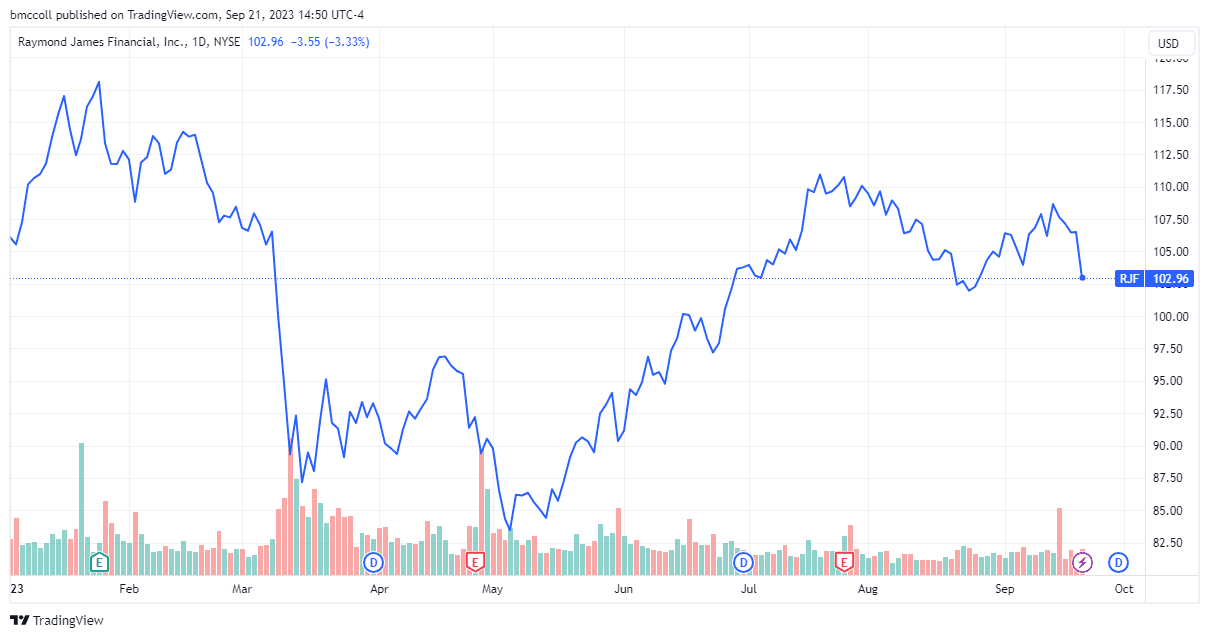

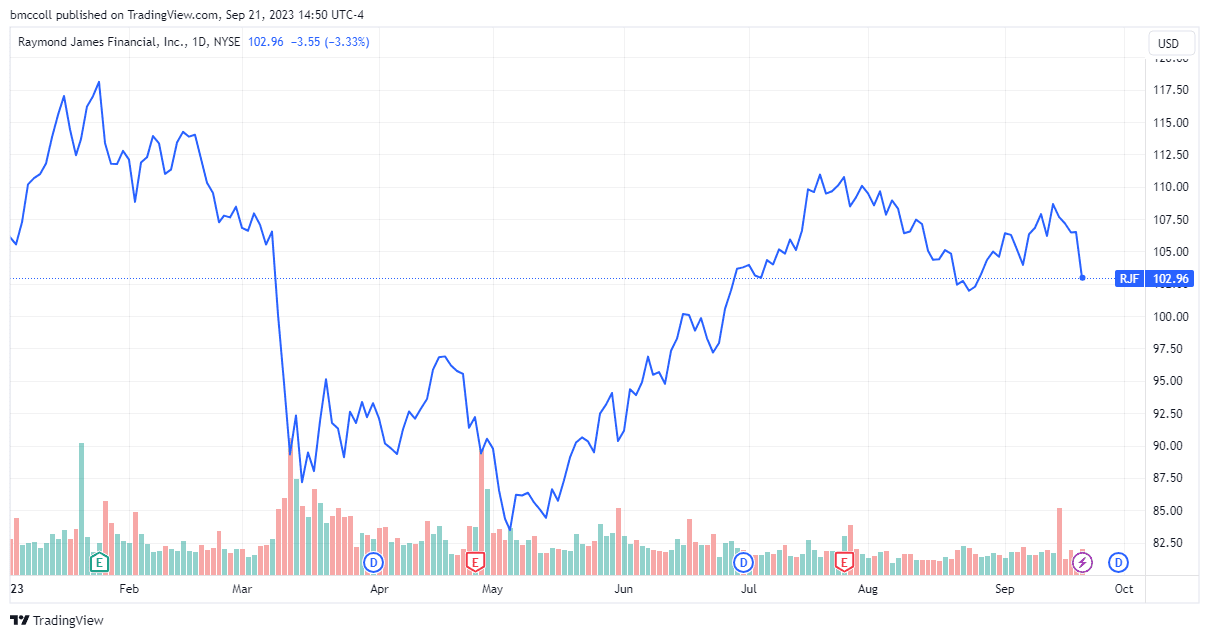

- Raymond James shares fell on this news and were in the red for 2023.

Shares of Raymond James Financial (RJF) fell after the financial firm reported a decline in client assets under management (AUM) last month, which it blamed on falling stock prices.

The company reported total client assets under management in August of $1,296. trillion, a decrease of 1% compared to July. Private Client Group assets under administration, Private Client Group assets in fee-based accounts and financial assets under management also decreased by 1%.

CEO Paul Reilly said that “stock market declines during the month contributed to a slight decrease in client assets compared to July 2023.” The S&P 500 slipped 1.8% in August.

Reilly noted that in the end As of last month, Private Client Group's assets under administration were up 12% from last year, which it attributes to “strong retention and recruitment of advisors across our multiple investment options.” #39;affiliation”. Over this period, the S&P 500 gained 14%.

Shares of Raymond James Financial were down 3.3% as of 3 p.m. ET Thursday after the announcement and were down 2.9% year to date.

TradingView

Do you have any news advice for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com