Potbelly Corporation (PBPB) stock has increased more than 15% during Thursday’s session after the company announced a reduction of 75% of its cash consumption rate at the peak of the COVID-19 impact of mid-May. The company has also announced an improvement in same-store sales in eight of the past nine weeks as return customers.

During the first quarter, the Chinese reported a 10.7% decrease in revenues of $87.59 million, missing consensus estimates by $ 2.05 million, and non-GAAP net losses, which have reached 32 cents per share, missing consensus estimates by nine cents per share. The company has $ 40 million of capacity available under a revolving credit facility in March and has enacted significant capital and expense reductions. In mid-May, Potbelly announced that it was considering the closure of 100 stores, while having conversations with their owners.

Before the announcement of the results, Potbelly has added David, up Close and Todd Smith to its board of directors in the framework of an agreement with a shareholder activist group. The group has held discussions with the company about “management and corporate governance” in the past, according to an SEC filing.

TrendSpider

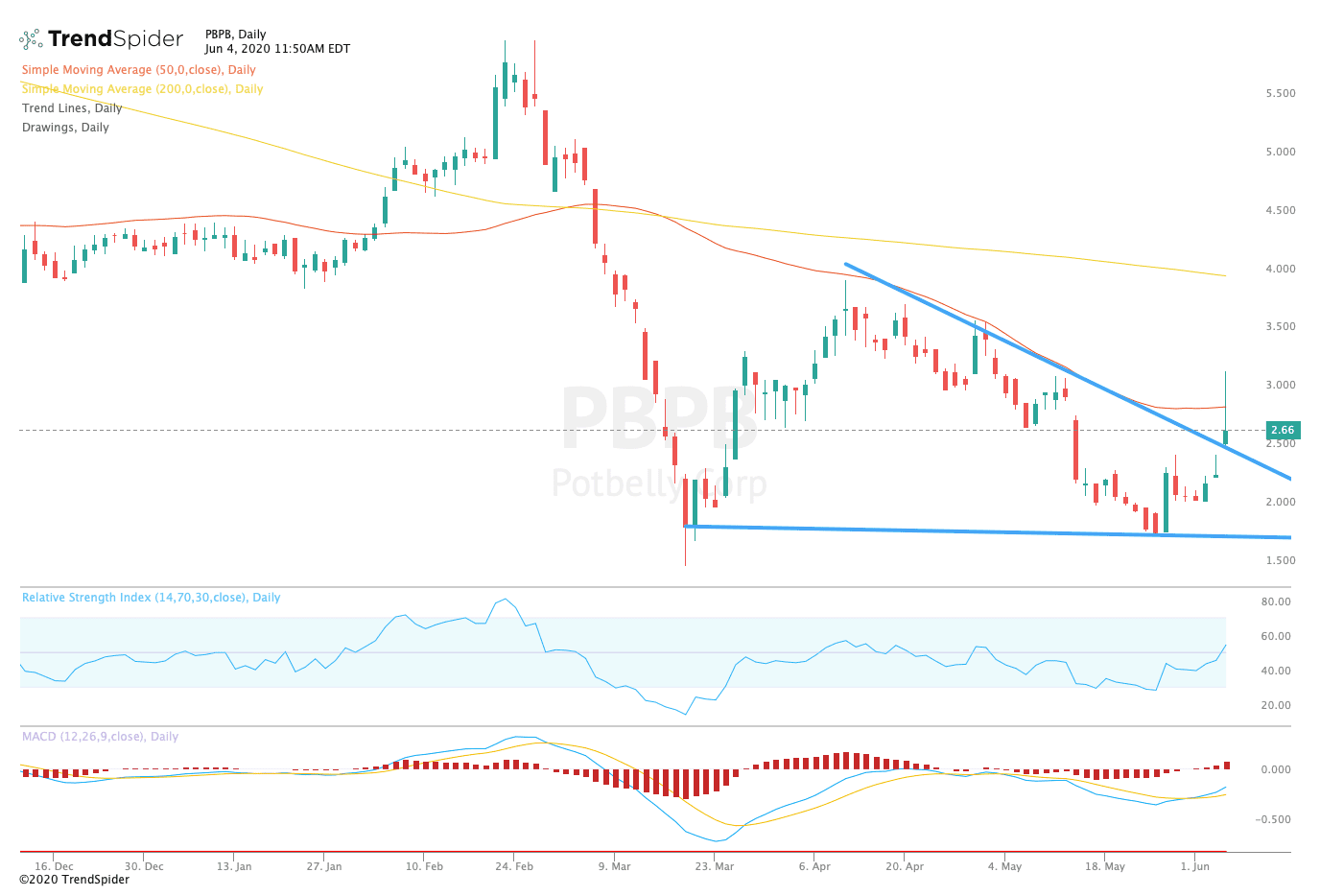

From a technical point of view, the stock has briefly reached the 50-day moving average at $ 2.86 during the session of Thursday, before giving a little ground. The relative strength index (RSI) has been moved into a neutral territory with a reading of 54.32, but the moving average convergence divergence (MACD) in histogram MACD experienced a bullish cross. These indicators suggest that the stock has room to run in the coming sessions.

Traders should expect to see a break of the 50-day moving average and trend line resistance near $ 2.86 to the 200-day moving average of $3.98 in the coming sessions. If the stock moves lower, traders could see a resumption of the trend line support levels near$ 1.75, although the scenario seems less likely to occur given the rise in same-store sales.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com