Key takeaways

- Planète Fitness beat earnings and sales estimates and raised its outlook by adding members and locations.

- Interim CEO Craig Benson announced new efforts to make ownership and Benson also said he was helping the board find a replacement for former CEO Chris Rondeau.

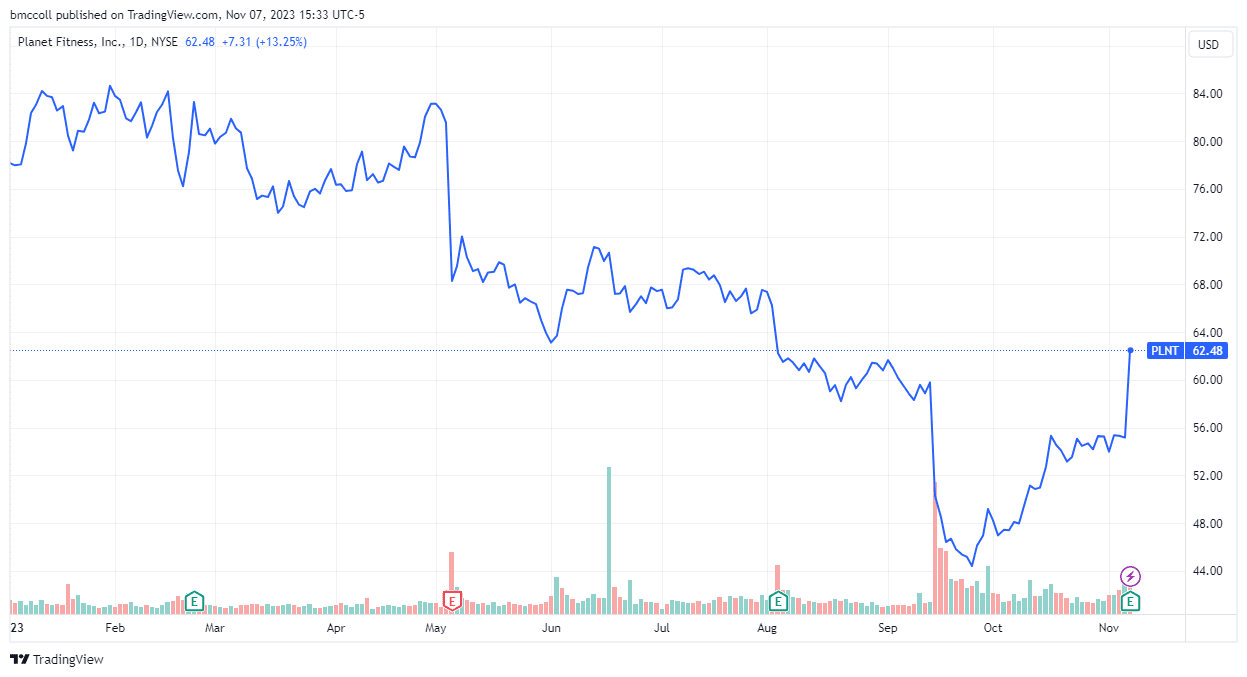

Shares of Planet Fitness (PLNT) soared after the fitness center operator reported better-than-expected results and raised its forecast by adding members and stores.

The company reported fiscal earnings per share for Q3 (EPS) of $0.59, with revenues up 13.6% year-over-year to $277.6 million. Both exceeded expectations. Same-store sales rose 8.4%, in line with estimates.

Planet Fitness has indicated that it more than 18.5 million members at the end of September, compared to 18.4 million in the previous quarter and 18.1 million in the first quarter. The company increased its store count by 26 during the third quarter, giving it a global total of 2,498.

Interim CEO Craig Benson announced a shake-up of the company's operations, explaining that Planet Fitness would “adjust our store-level return model to further enhance the attractiveness of opening and of operating Planet Fitness stores in a new macro environment." He added that the changes will include reducing investment costs by “extending the time for replacing equipment and completing renovations.”

Benson also said he was helping the board find a Permanent CEO. Former CEO Chris Rondeau was unexpectedly ousted in mid-September, without explanation. He remains on the board and is helping with the transition.

The company now expects full-year revenue to increase 14%, up from its previous forecast of 12%. It forecast earnings before interest, taxes, depreciation and amortization (EBITDA) of 18%, compared to an earlier forecast of 17%.

Planet Fitness shares have plunged to their lowest level since the outbreak of the COVID-19 pandemic following Rondeau's firing, and although they have recovered since then, shares remain down about 20% for the year. #39;year.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com