Takeaways

- Pioneer Natural Resources shares rose following reports that the shale oil drilling company was in advanced talks to be acquired by Exxon Mobil.

- Exxon Mobil would offer $60 billion for Pioneer, which would be the biggest acquisition for the oil giant since it bought Mobil in 1999.

- If a deal is finalized, it would give Exxon Mobil a greater presence in the highly sought-after Permian Basin oil field.

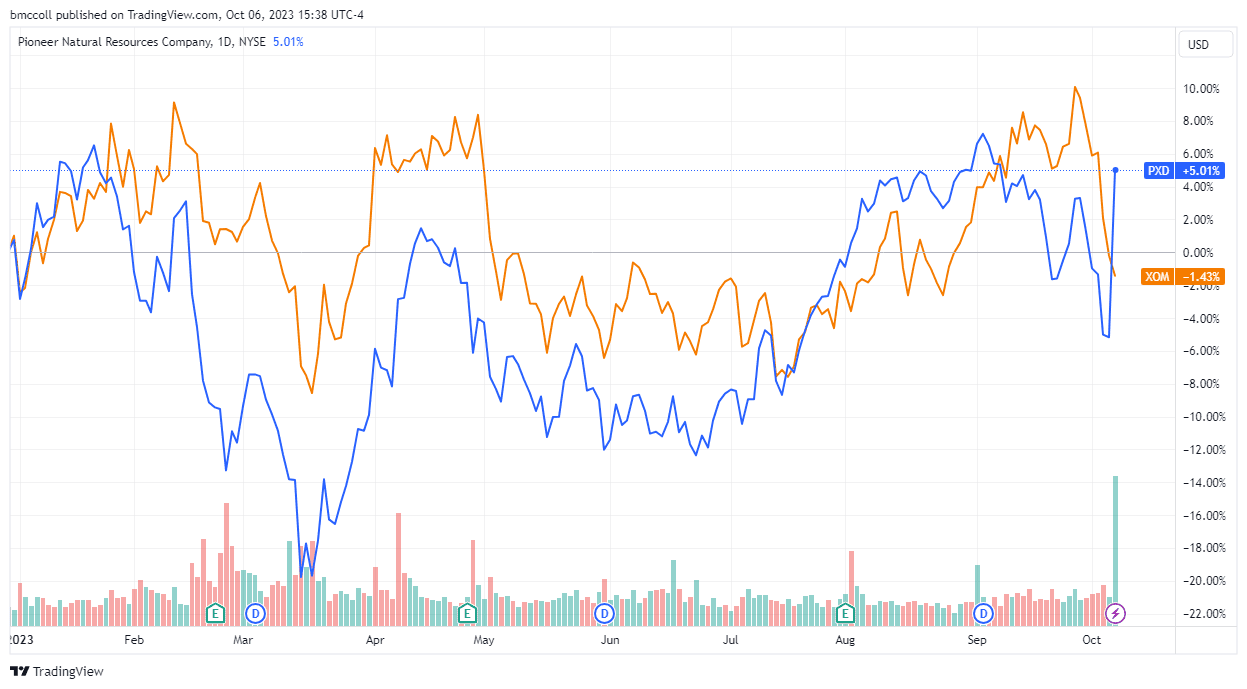

Stocks Pioneer Natural Resources (PXD) jumped 10.5% on Friday, making it the best-performing stock in the S&P 500, following reports that Exxon Mobil (XOM) was in talks advanced to buy the shale driller for $60 billion.

At that price, it would be the biggest acquisition of Exxon Mobil since it was simply called Exxon and purchased Mobil Oil for $81 billion in 1999.

Reports indicate a deal could be finalized in the coming days, although there is no guarantee that the two parties will reach an agreement.

Adding Pioneer would help Exxon Mobil to expand its presence in the Permian Basin of West Texas and Southeast New Mexico, the most prolific oil region. producing region of the Western Hemisphere. Pioneer is the third largest producer, behind Chevron (CVX) and ConocoPhillips (COP).

The news sent prices soaring Pioneer shares Natural resources are in positive territory for the year. Exxon Mobil shares fell 1.7% on Friday.

TradingView

Do you have a tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com