Trending Videos

Takeaways

- Pfizer gave lower-than-estimate 2024 profit and revenue forecasts as demand for its COVID-19 products wanes.

- The drugmaker expects COVID-19 vaccines and treatments COVID-19 will generate sales of $8 billion in 2024, up from $12.5 billion this year. year.

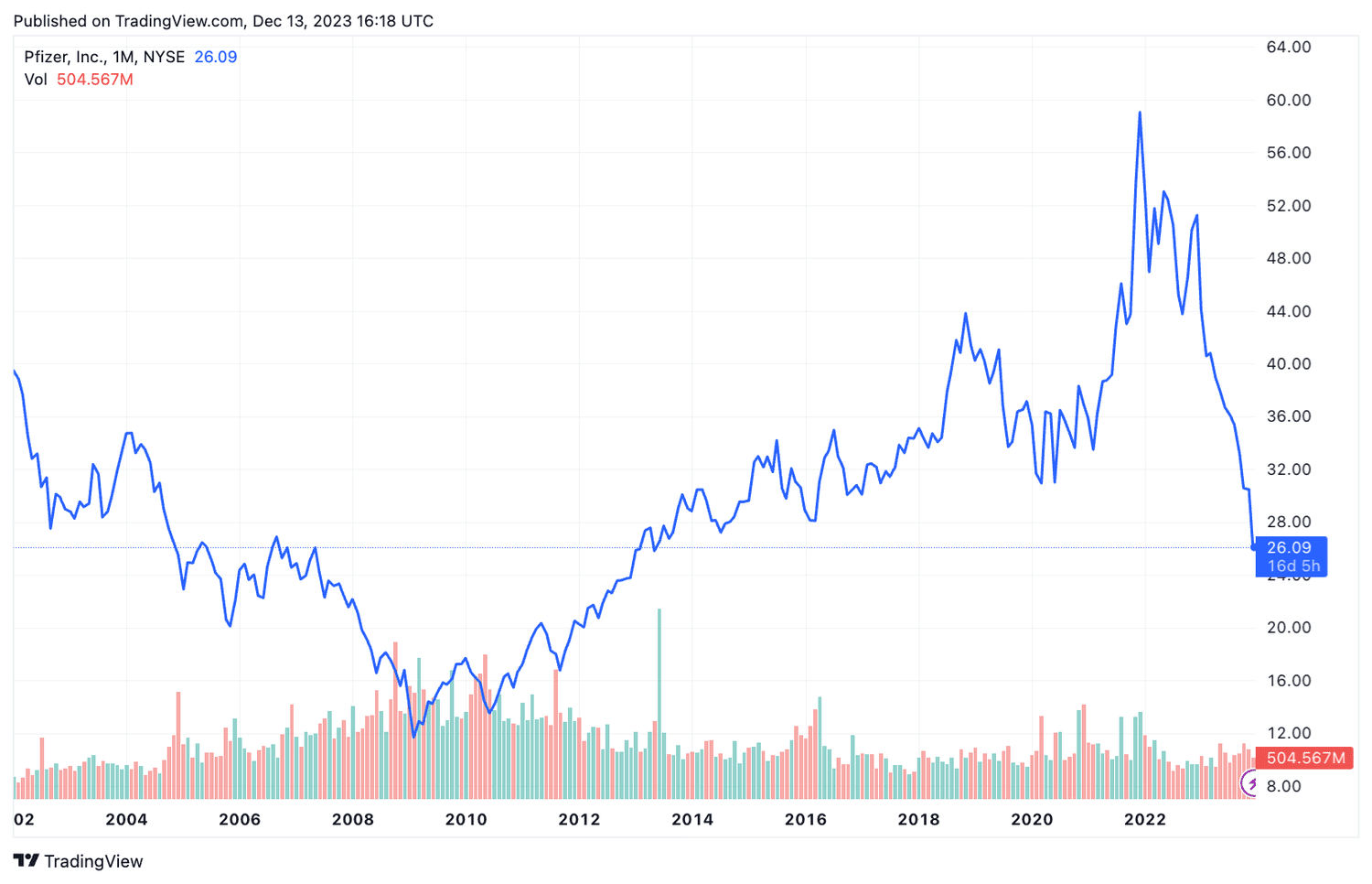

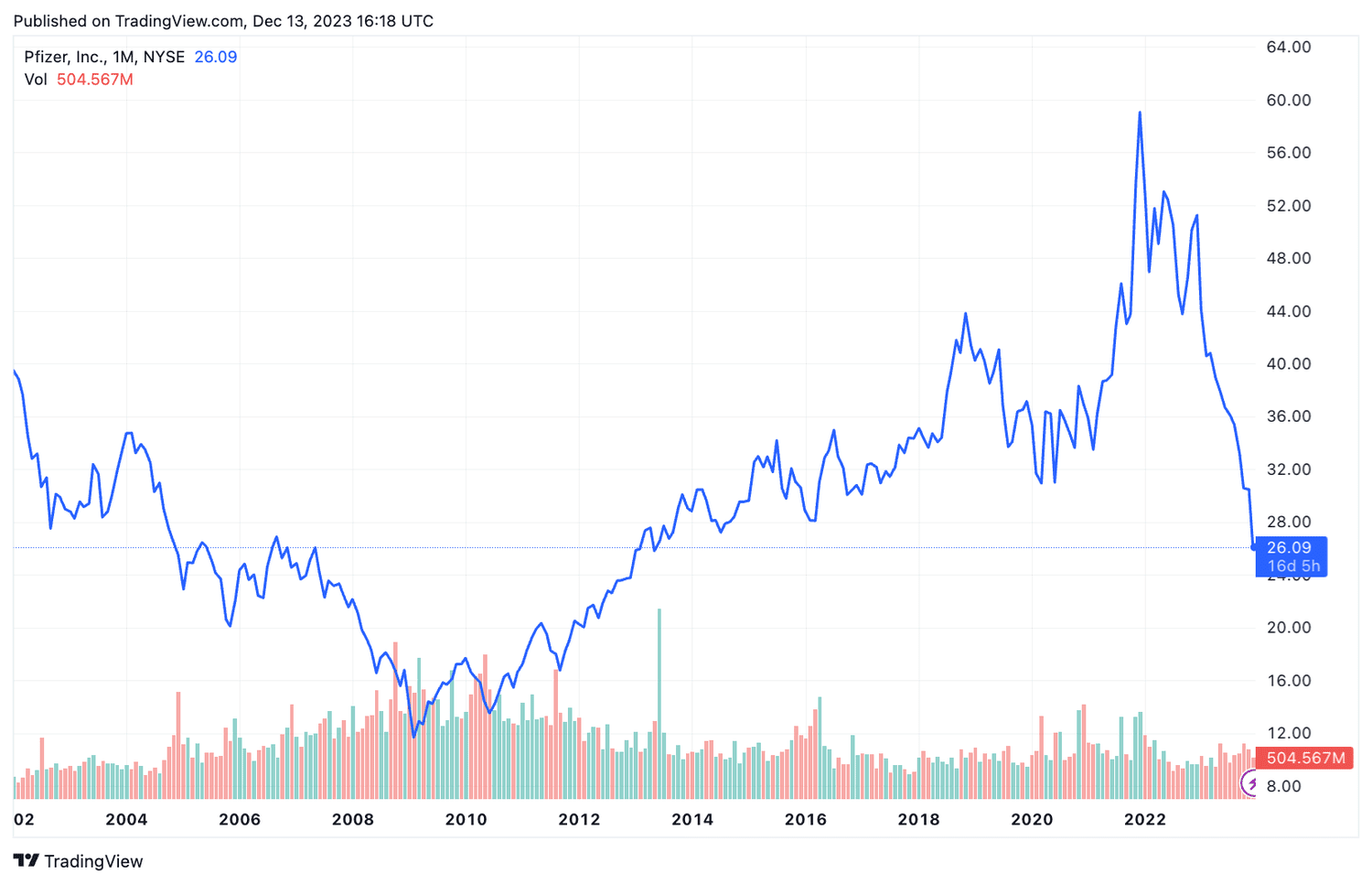

- Pfizer shares fell to their lowest level since 2013.

Shares of Pfizer (PFE) fell more than 8% in early trading Wednesday to their lowest level in more than 10 years after warning that revenue could decline next year and issuing lower-than-expected forecasts. forecast as demand for its COVID-19 vaccines and treatments wanes.

The drugmaker said it expects 2024 revenue to be in the range of $58.5 billion to $61.5 billion, up slightly from this year's forecast of 58 at $61 billion. It expects earnings of $2.05 to $2.25 per share. Both lacked estimates.

Pfizer said its COVID-19 vaccine and Paxlovid virus treatment will generate $8 billion in sales next year, up from the roughly $12.5 billion it expects to make from those products. This year.

Chief Financial Officer David Denton told analysts the company does not expect COVID-19 vaccination rates in 2024 to be significantly different from those in 2023, and CEO Albert Bourla added that Pfizer wants to create a “good floor » in order to avoid overestimating demand, as he did. This year.

The pharmaceutical company indicated that& #39;it projected $3.1 billion in sales in 2024 thanks to its $43 billion acquisition of cancer drug maker Seagen in February. That deal was approved by U.S. regulators this week and Pfizer expects it to close tomorrow.

Pfizer shares fell by 8.2% around 11:15 a.m. ET and have lost nearly half their value this year.

TradingView

Do you have a news tip for news journalists? Investopedia? Please email us at tips@investopedia.com

Source: investopedia.com