Takeaways

- PepsiCo beat quarterly earnings and sales estimates and raised its earnings outlook as it benefited from higher prices.

- Average prices rose 11% and the company expects modest increases of price by next year.

- PepsiCo shares rose in early trading Tuesday following the news.

Price increases helped PepsiCo (PEP) report better-than-expected quarterly results, and the soda and snack maker boosted its forecast.

PepsiCo announced its profit by Shares for the third quarter of fiscal 2023 (EPS) of $2.25, with revenue up 6.7% to $23.5 billion. Both were above expectations.

Average prices rose 11% over the period. Organic sales increased by 8.8%, driven by a 13% increase in Europe. However, while revenues rose, global ready meal volumes fell 1.5% and North American beverage volumes fell 6% as rising prices weighed on demand. The company said a “modest” level of further price increases would come next year.

PepsiCo now plans a full year Constant currency EPS growth of 13%, up from its previous estimate of 12%. This is the third consecutive quarter that the company has raised its outlook.

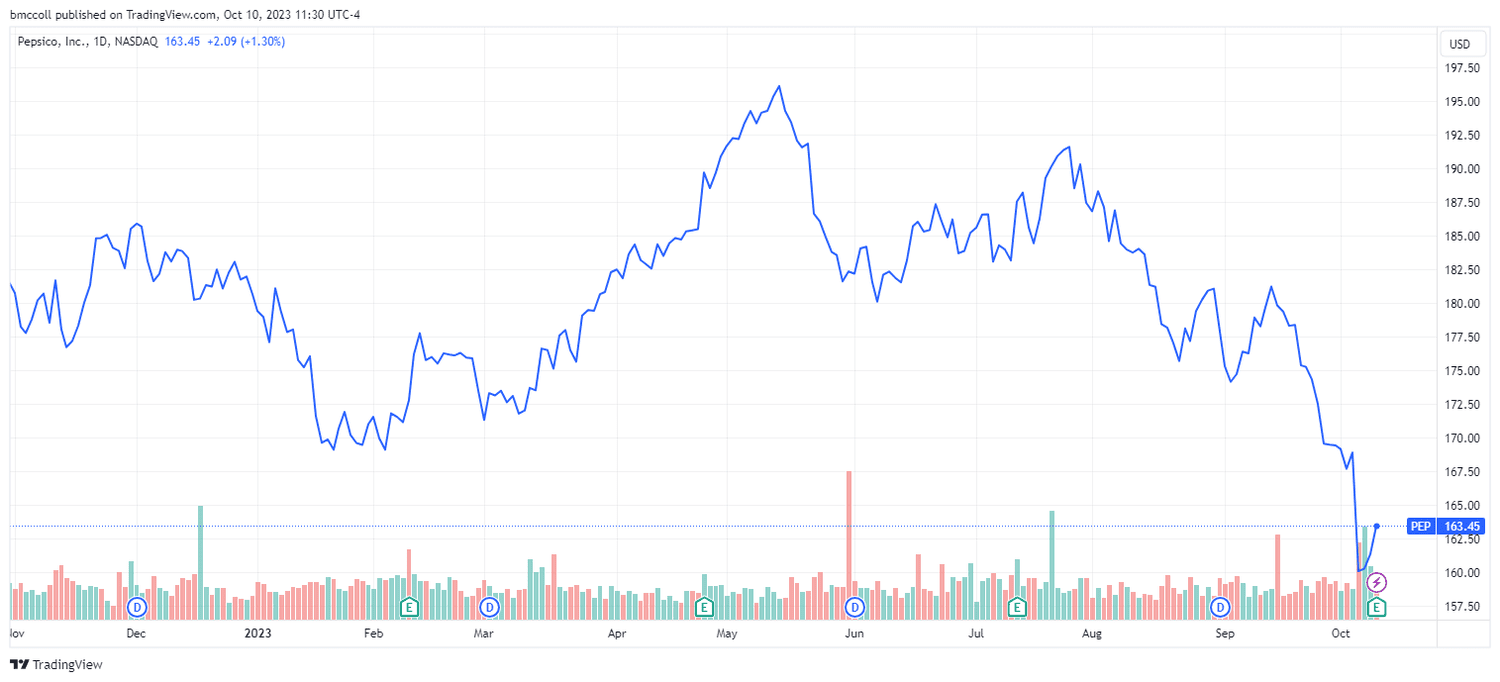

PepsiCo shares topped 1 % up as of 11:30 a.m. ET Tuesday following the announcement, rising for the third straight session after hitting a 16-month low last week.

TradingView. Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

TradingView. Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com