Takeaways

- Chinese company PDD Holdings' ADR soared as shopping app operator Temu posted a sharp rise in revenue.

- The company said that It was benefiting from its investments in technology and noted that it had made inroads into expanding markets outside of China.

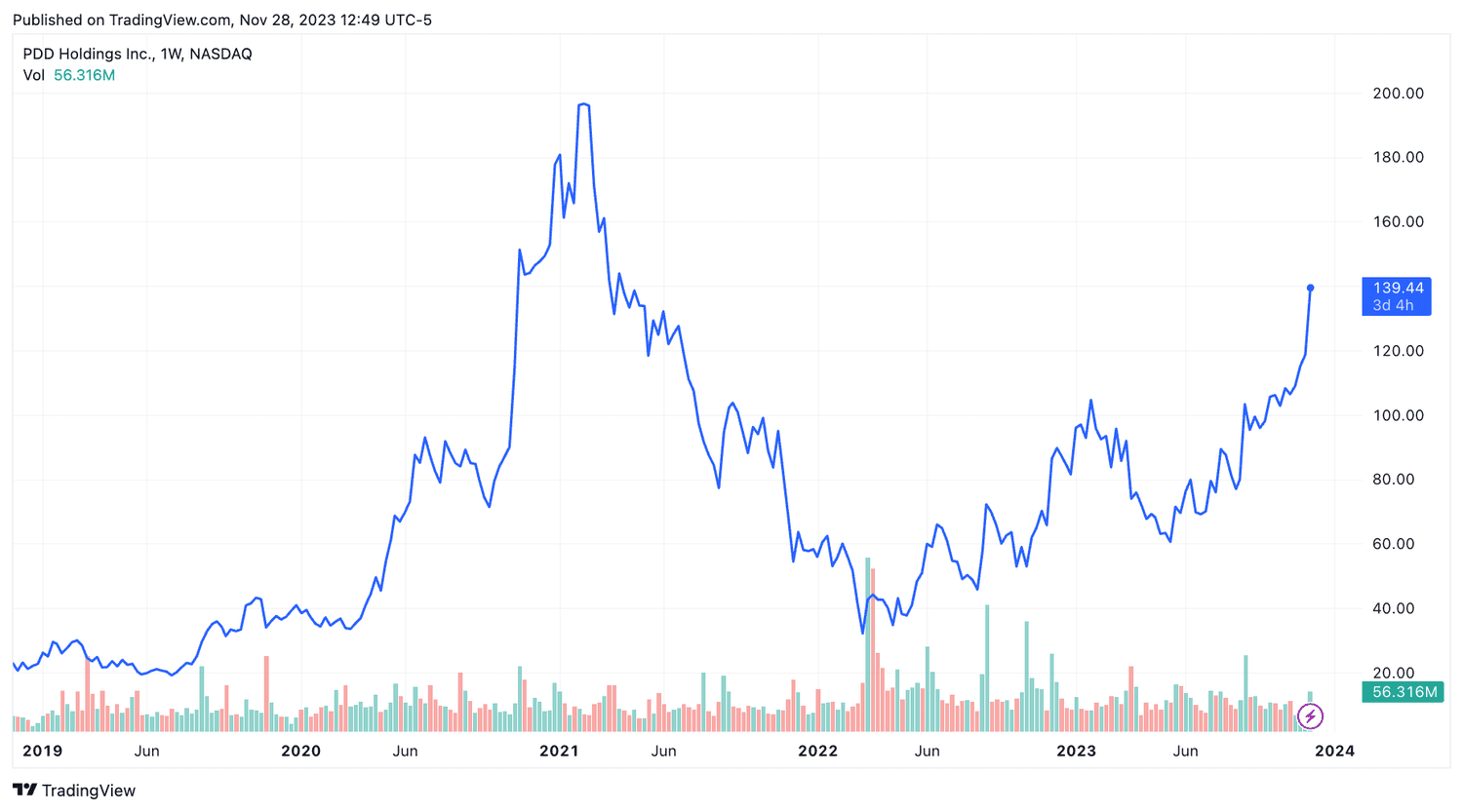

- PDD Holdings' ADRs hit their highest level in more than two years.

Class

PDD Holdings' (PDD) American depositary receipts (ADRs) soared more than 18% in early trading Tuesday after the China-based company. -The commerce group reported a huge increase in revenue, boosted by sales of its shopping app Temu.

PDD recorded a figure of #39;s business in the third quarter of fiscal 2023 was 68.8 million Chinese yuan ($19.4 million), an increase of 94% from the previous year. Net profit increased 37% to 17 million yuan ($2.3 million).

PDD attributed these good results to its technology spending . Co-CEO Lei Chen explained that the company “continued to invest decisively in areas such as agritech, supply chain technology and core R&D capabilities “.

Jun Liu, vice president of finance, added that the financial performance reflects “our investment in technology and deepening the minds of users.” She explained that the company “will continue to invest decisively to support our high-quality development.”

Chen also pointed out that PDD has made “significant progress” in expanding its reach into markets outside of China.

PDD Holdings' ADRs have reached their highest level since April 2021 following the news.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com