Key takeaways

- Revenue and PDD Holdings revenues take off on e-commerce demand.

- Sales at parent company of e-commerce sites Pinduoduo and Temu soared 66%.

- The company said it enjoyed a positive development. change in consumer sentiment.

Chinese multinational trading group PDD Holdings (PDD)'s American certificates of deposit (ADR) surged on rising sales of its Pinduoduo and Temu e-commerce sites.

PDD announced earnings per share price (EPS) for the second quarter of fiscal 2023 of $1.44, with revenue up 66% to $7.21 billion. Both were well above expectations.

Sales of Online Marketing and 39;others rose 50% to $5.23 billion, while transaction services sales soared 131% to $1.98 billion.

Co-CEO Jiazhen Zhao said the company “We have seen a positive change in consumer confidence, leading to an increase in demand in various product areas.

Sales also benefited from the use of promotions during the Chinese shopping festival 618 from the end of May to mid-June. Vice President of Finance Jun Liu added that PDD “seized the opportunities of favorable consumer trends and invested firmly and responsibly.”

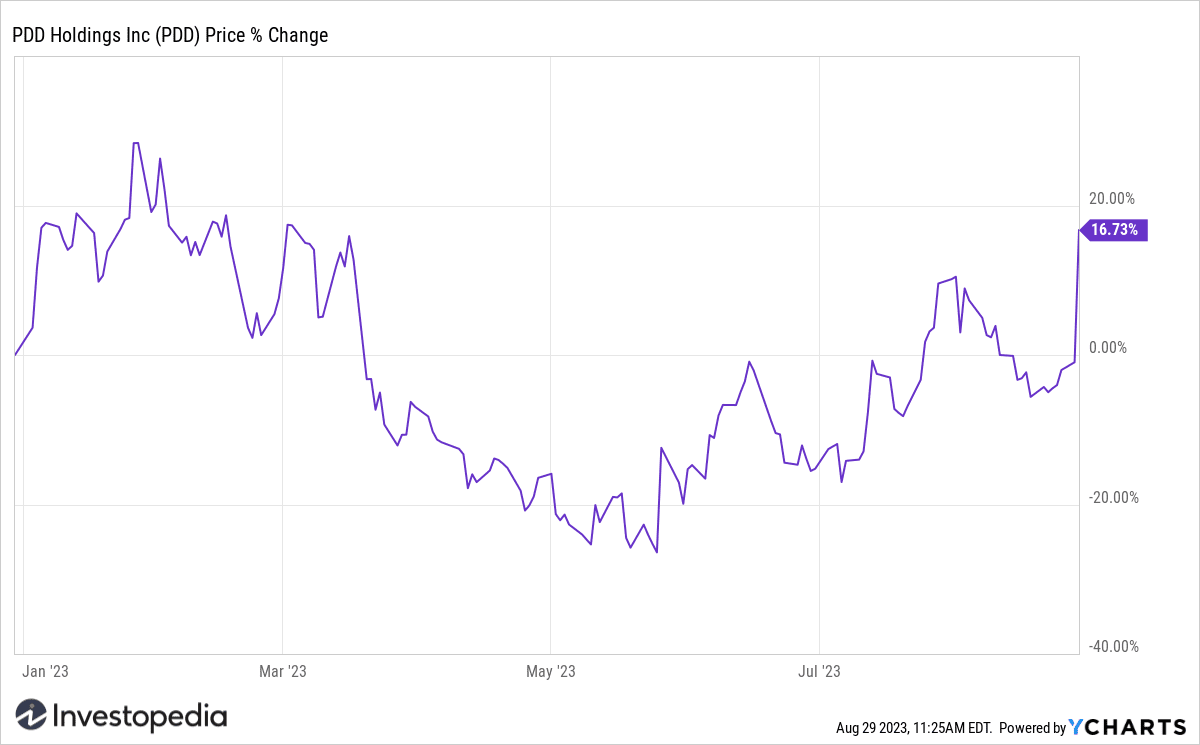

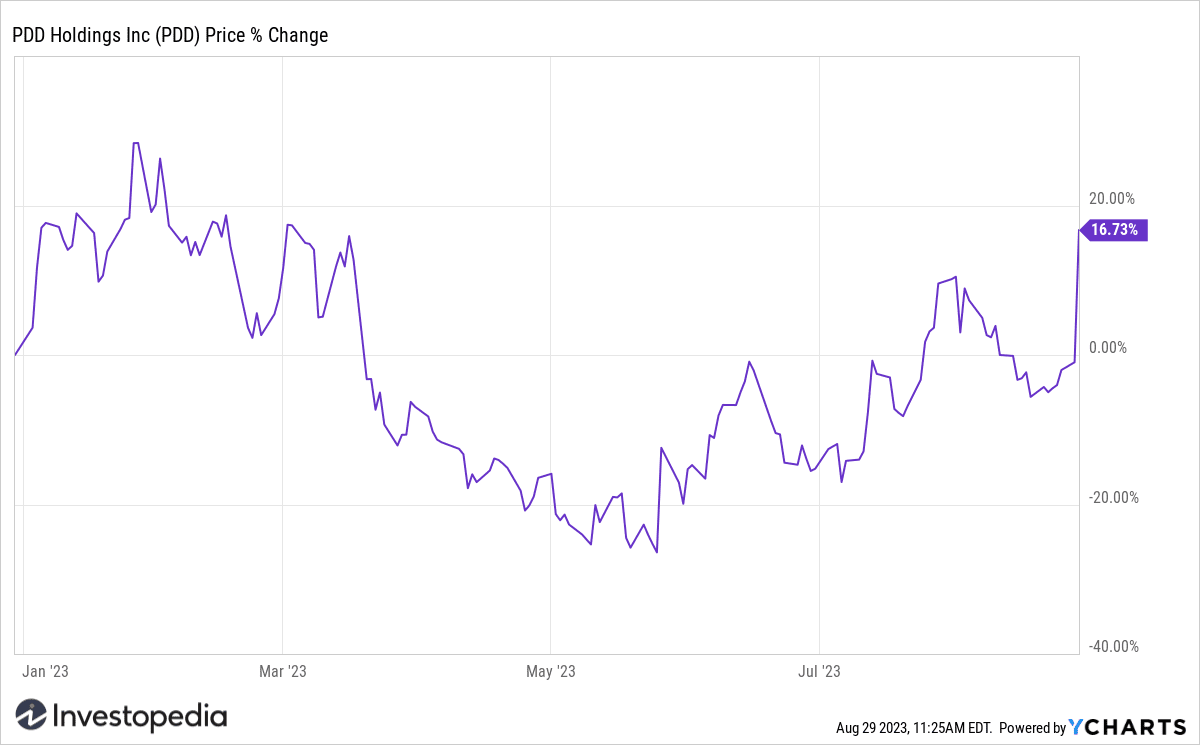

PDD Holdings ADRs have jumped 16% in early trading on Tuesday, reaching their highest level since February.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com