Australian Securities Regulator sues PayPal (PYPL) for a term contract that it says is unfair to small businesses.

KEY THINGS TO REMEMBER

- The Australian Securities Regulator has sued PayPal over a term clause it says is unfair to small businesses.

- As per contract PayPal Australia standard, the business account holder has 60 days to notify PayPal of the discrepancies, after which the charges will be accepted as correct.

- ASIC alleges that this term was unfair because it allows PayPal to retain wrongly charged fees.

In PayPal Australia's standard contract, there is a clause that gives business account holders 60 days to notify any errors or discrepancies in charges, after which users must accept the charges as correct.

The Australian Securities and Investments Commission (ASIC) has claimed that this clause is unfair because it allows PayPal to withhold fees it wrongly charged if the disputed amount is not reported in the accounts. 60 days. ASIC considers the responsibility to report the error an unfair burden on small business account holders, of which there were approximately 608,275 as of June 30.

In documents filed with In the Federal Court of Australia, ASIC argued that allowing PayPal to withhold erroneously credited charges created an imbalance in the rights and obligations of PayPal and its business customers. ASIC seeks an injunction to declare the clause of the contract void.

"We worked in full cooperation with ASIC and takes this matter very seriously. It would not be appropriate to comment in detail on the proceedings in court, however, we are carefully reviewing the claims,” he said. a PayPal Australia spokesperson told Reuters.

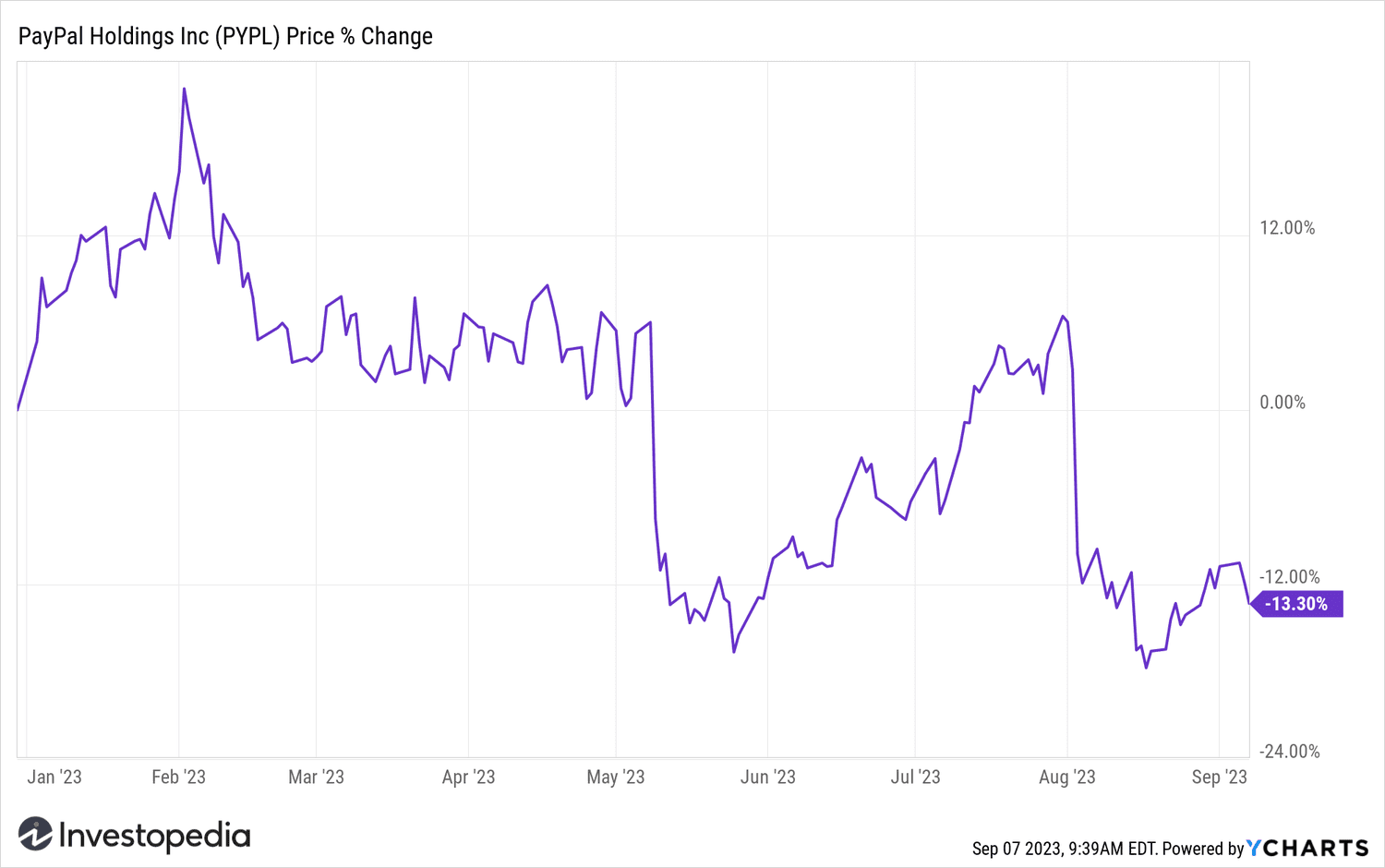

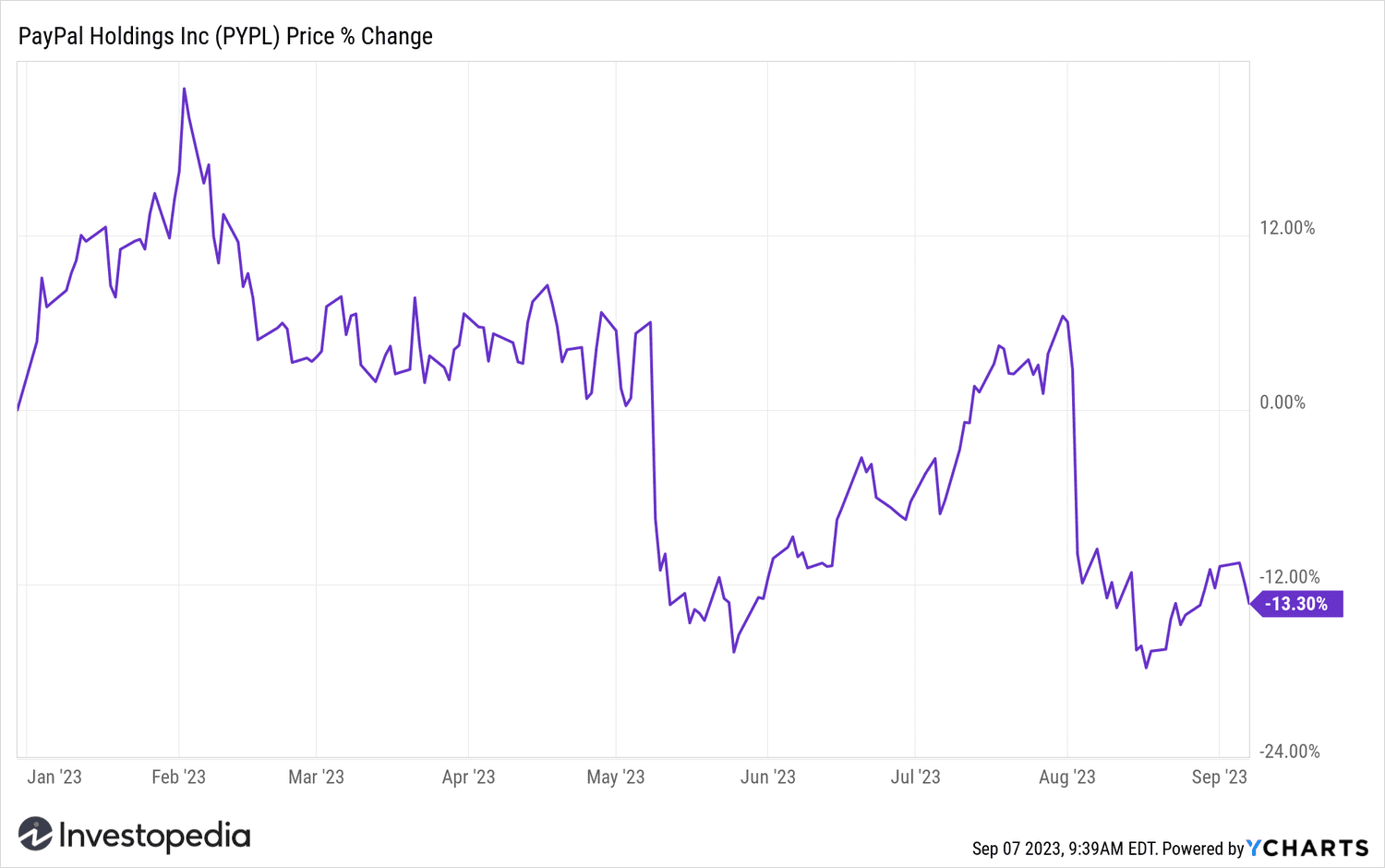

PayPal shares fell up more than 2% in early trading Thursday following the news. With Thursday morning's drop, PayPal shares are down about 18% year-to-date.

YCharts

39;news for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com