PayPal Holdings, Inc. (PYPL) reports earnings Wednesday after the closing bell, with Wall Street analysts expect the digital giant to post earnings per share (EPS) of $0.75 in the first quarter of 2020 revenue of $4.72 billion. The company beat fourth quarter 2019 estimates in January, but has lowered its first-quarter profit and revenue guidance due to a series of acquisitions. The consensus outlook has continued to decrease over the last three months due to the sars coronavirus pandemic.

The company is well positioned to survive during the crisis, with the multi-year of the collapse of the cash operations increased by quarantines and stay-at-home orders. However, the sales volumes respond strongly to economic cycles, the growth during periods of expansion and contraction during periods of contraction. With 30 million Americans unemployed, PayPal profit outlook has taken a significant blow that is likely to continue in the next one or two quarters, at least.

The stock has done well over the past seven weeks, a sculpture in the form of V-model who has made a return in February all-time high of $124.25. However, this level is just three points above the 2019 high and still have the marks of resistance, because the first quarter decline to the failure of the escape. In addition, the buildup has not managed to recover at the same rate as prices, with both elements increasing the probability of a reversal to the downside after earnings.

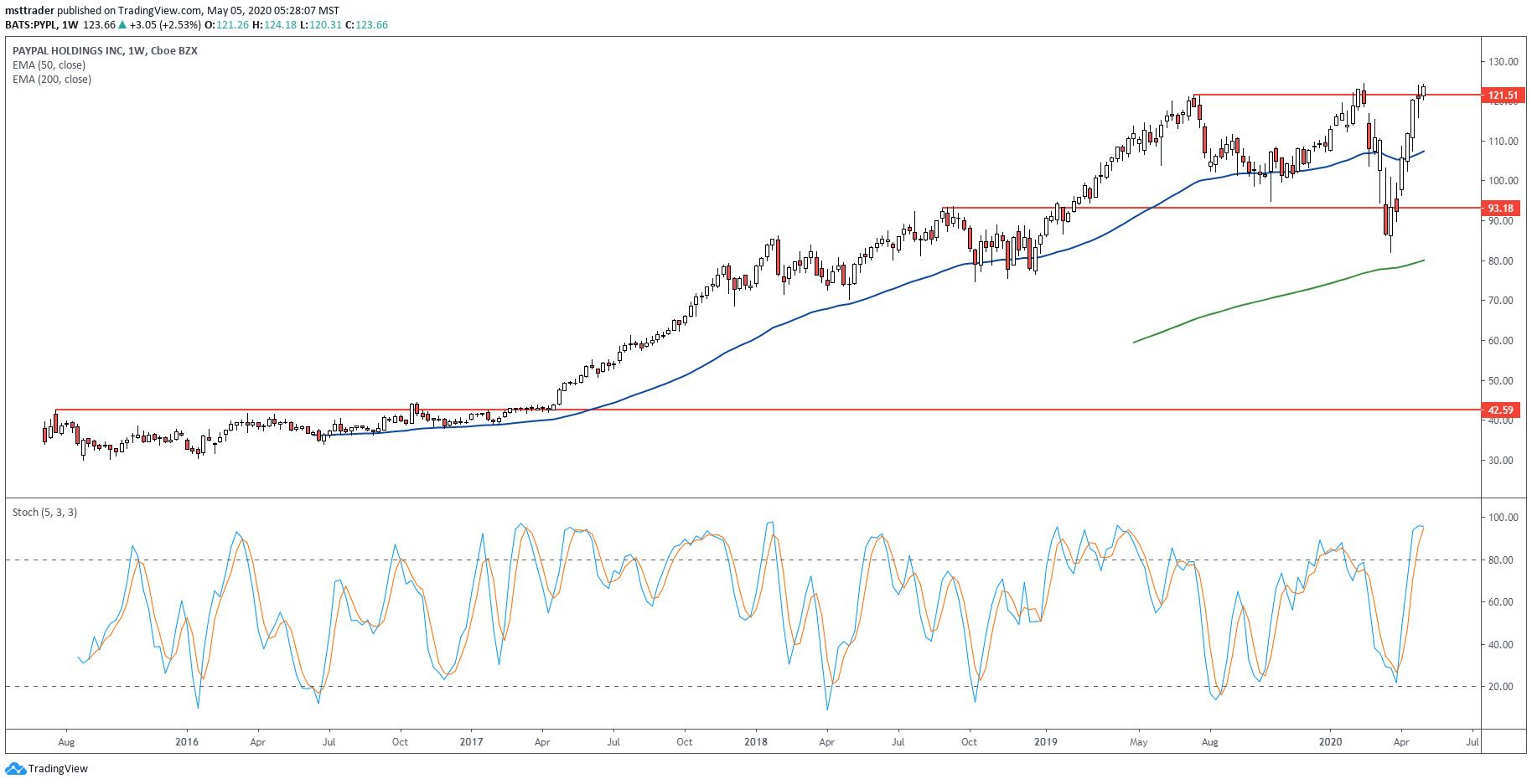

PYPL Long-Term Chart (2015 – 2020)

TradingView.com

The creation of the public company, in July 2015, through a spin-off from parent eBay Inc. (EBAY), the opening in the middle of$30 and enter in a bullish trend in mind a few days later, to $42.55. The resistance level marked for nearly two years, leaving in its place a rapid descent at an all-time low at$ 30.00, followed by narrow range bound price action. In October 2016 the breakout attempt has failed, while a second effort in May of 2017 cleared the barrier, the establishment of a strong upward trend.

The subsequent advance stalled in the middle of$80 in the first quarter of 2018, but the bulls maintained a small rally of the trajectory, adding a few points in September. The stock held up well during the fourth quarter swoon this year, finding support at the 50-week exponential moving average (EMA), before 2019 increase that has reached a new record high in February. This rally wave ended at $121.48 in July, the establishment of a barrier that is still guiding the price action.

A constant decline in October ended the first quarter of derivation level, which gives a round based model, followed by a rebound back to the up state. The stock rallied to a new peak on Feb. 14 but turned tail just four sessions later, triggering a failure of an escape that pierced October of support. Selling pressure eased to a 14-month low near $80, holding above the low recorded in the fourth quarter of 2018, before turning higher in April.

PYPL Short-Term Chart (2018 – 2020)

TradingView.com

The balance volume (OBV), the accumulation-distribution indicator garnished with prices in July 2019 and has begun a small distribution phase, which was completed at the beginning of 2020. The Accumulation of February has reached the resistance with the price, before a recovery, which strengthened the resistance to the red lines. OBV has bounced strongly off the month of March 52-week low, but has not reached the resistance line, raising doubts about the purchasing power in advance of the publication of the results.

The evolution of prices since the month of May in 2019, also raises a red flag, with horizontal resistance and the descending trendline support. Healthy uptrends tend to unfold through higher highs and higher lows, but the rally in May, has failed to carve out a higher low. This phenomenon aspect raises the probability that a rally to new highs will fade quickly, the impression of higher in a prospect of a reduction of the expansion of the training, which is also known as a megaphone pattern. As a result, it is logical to look to OBV for a change to the red line before to invest the capital after the news.

The Bottom Line

PayPal stock has rallied back to 2019 and 2020 resistance, but other prices may be needed to support a breakout.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com