PayPal Holdings, Inc. (PYPL) stock is trading at an all-time high above $190 in Thursday’s pre-market session after the electronic payment company beat second quarter of 2020 estimates by healthy margins and raised third-quarter and fiscal year guidance. The company recorded earnings per share of $1.07, while the turnover grew by an impressive 22% to $ 5.26 billion, with positive results sustained by the acceleration of the transition from paper to digital payment transactions, as a result of the COVID-19 pandemic.

Key Takeaways

- PayPal beat aggressive second-quarter profit and revenue estimates.

- The stock broke out to a all-time high after the news.

- High-volume purchasing provides even higher prices in the next few weeks.

The processor has reported a 29% rise in Total Payment Volume (TPV) to $222 billion dollars while the addition of 21.3 million new active accounts, marking the highest user growth in the company’s history. Additional gains are likely in the coming quarters, with the world of the transition to contactless payment, not to spread the virus. As a result, PayPal shareholders are likely to be rewarded with even greater upside in the coming quarters.

It is not surprising, Wall Street rates the stock as a “Strong buy”, on the basis of 28 “Buy,” and 6 “Hold” recommendations. No analysts are recommending that shareholders sell their positions at this time. Price targets currently range from a low of $132 high Street $234, while the stock is going to open the session of Thursday, about $5 below the median $198 target. This positioning bodes well for a-wave upward, the comment and the price increase.

A digital transaction is a homogenous system involving one or more participants, where the transactions are carried out without the need for the money. Digital transactions involve a constant evolution of the way we do things in which the financial technology (fintech) companies collaborate with the various sectors of the economy in order to meet the increasingly sophisticated demands of the growing population of tech-savvy users.

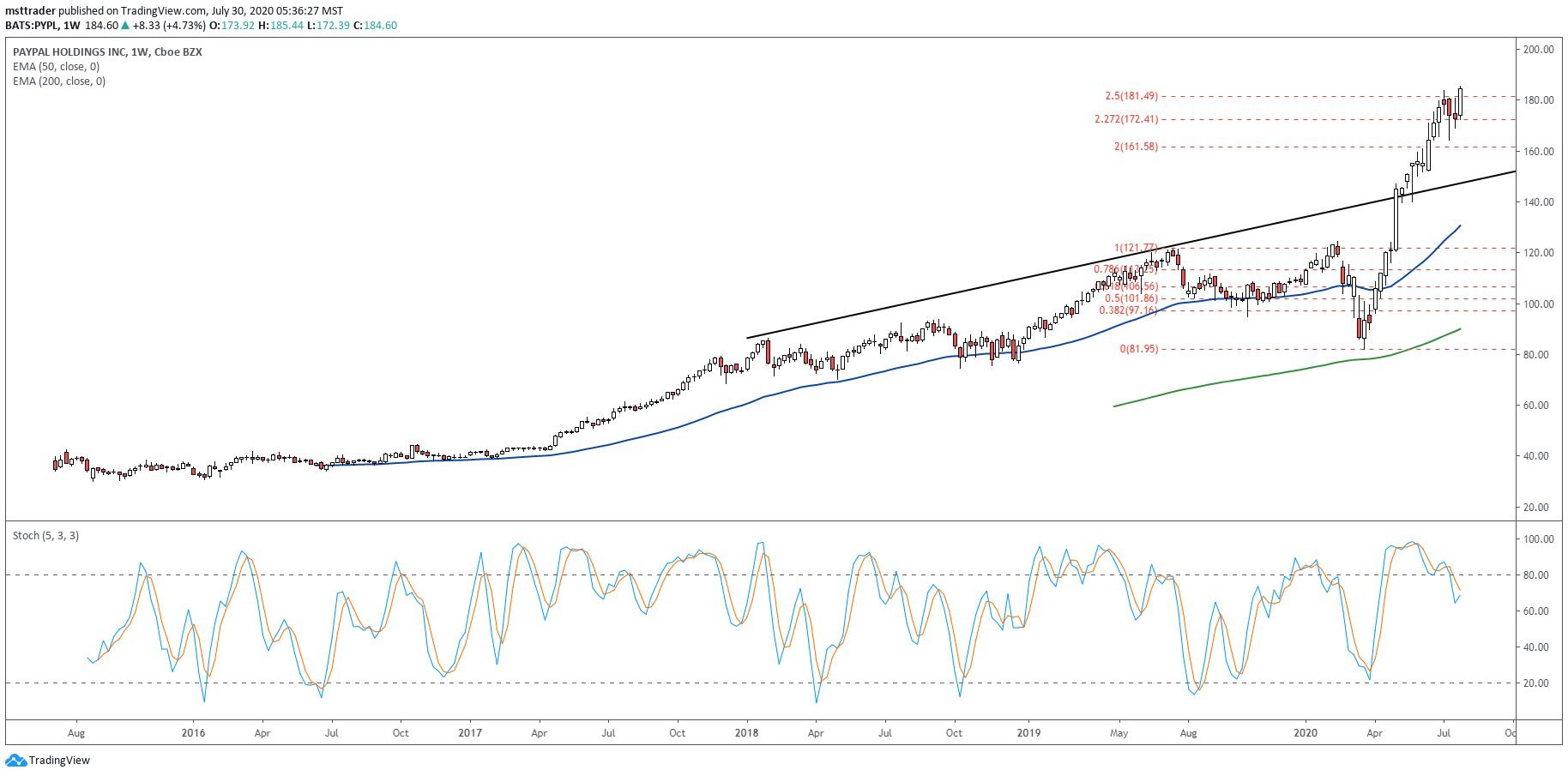

PayPal Long-Term Chart (2015 – 2020)

TradingView.com

PayPal came public in July 2015 eBay Inc. (EBAY), spin-off, the opening in the upper part of the $30 and trading up to the low $40 a few weeks later. Who has scored the highest for the next 15 months, before a decline that has posted an all-time low at $30. The stock tested this level successfully in January 2016, completing a double bottom reversal has launched a new upward trend. Strong price action mounted to the front of the top in April 2017 breakout, which attracted strong interest from buyers.

The rally stretched into the middle of$80 in January 2018 and blocked off, performance is slightly higher in the summer months, followed by a slight decrease at the end of the year. The range support in the low $70s contained in the drop, before to renew the interest of buyers who have reached new heights in the first quarter of 2019. The advantage of the impasse once again after topping $120 in July, while a February 2020 breakout attempt has failed, leaving the place to a vertical decline that found support in the low $80.

Paypal Short-Term Chart (2018 – 2020)

TradingView.com

The second quarter rebound reaches the state of the high in May and exploded, adding more than 60 points before the last night of the confessional. The increase topped in the low $180s earlier this month, and eased into a small platform that could support the price increase. The first upside target is the psychological $200 level, marking a barrier that could take a long time to overcome. The large unfilled gap between $129 and $139 could also come into play if large landmarks turn in sharp decline, potentially offering a low risk buying opportunity.

The balance volume (OBV), the accumulation-distribution indicator equaled bullish price action since 2018, trim in July 2019 and February 2020. It broke out of quality, with prices in May and side entry pattern more than two weeks before the start of July peak. OBV should be out once more after the opening bell, the support to the upside, but all bets are off if it fails to post a new record of the session.

A breakaway gap is a term used in technical analysis that identifies a strong movement of the price through support or resistance. The price is detached from the support or resistance through a gap, as opposed to an intraday breakout. Breakaway gaps are often seen at the beginning of a trend, when the price moves outside of a range or a trend reversal.

The Bottom Line

PayPal stock broke out to a all-time high after a blowout quarter, supported by COVID-19 of the tail wind.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com