Trending Videos

Takeaways

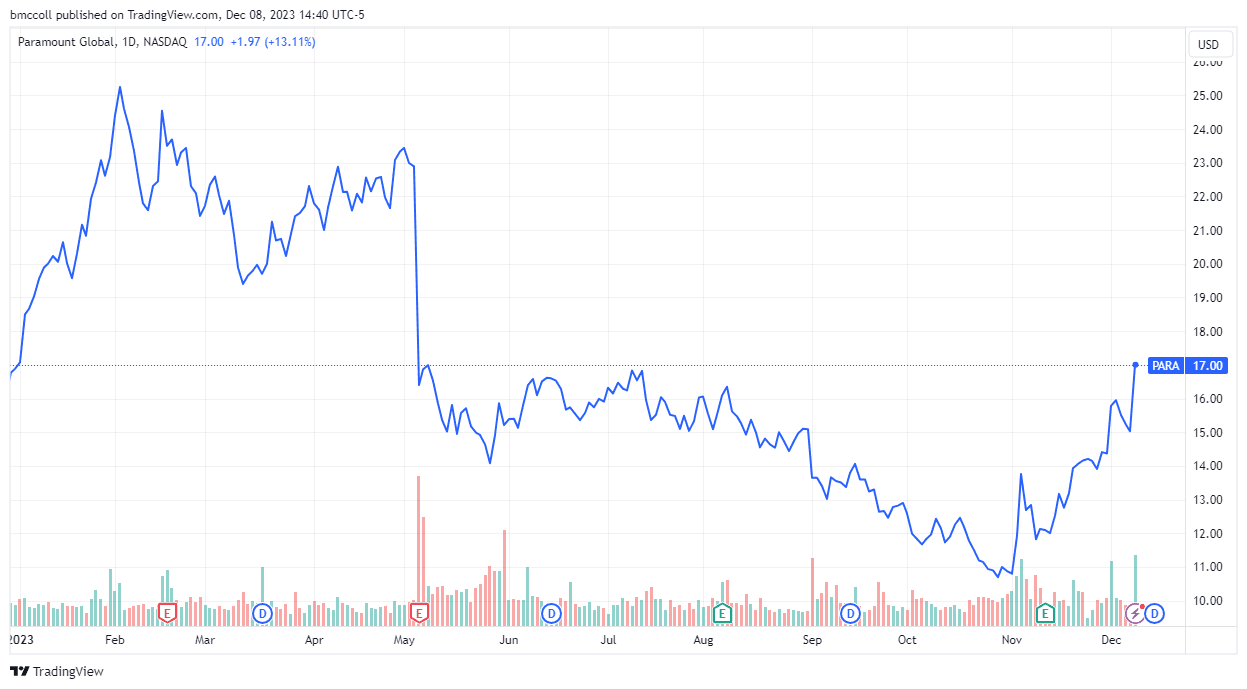

- Shares of Paramount Global have soared following rumors that the entertainment giant could be sold.

- Reports suggest David Ellison of Skydance Media and RedBird Capital Partners are considering a purchase Paramount.

- It is. They believed that any deal to acquire Paramount would require taking control of National Amusements, which owns a majority stake in the company.

Paramount Global (PARA) was the The best-performing stock in the S&P 500 as reports circulated that the entertainment giant could be sold.

Reports from Deadline and Puck suggest that the film's producer David Ellison, CEO of Skydance Media, and private equity firm RedBird Capital Partners are considering acquiring the company.

Deadline explained that any effort to buy Paramount would likely require taking control of movie theater operator National Amusements, which owns 77% of Paramount's Class A voting stock.

Shari Redstone, who is president of National Amusements and non-executive chairman of Paramount, would be open to selling Paramount if the price is right.

Puck said that There was no formal process or dealbook done, but non-disclosure agreements were signed, and a small group is believed to be working on the numbers. 39;a possible agreement.

Stories sent to actions Paramount Global at its highest level since May and in positive territory for the year. The stock was up 13% at the end of trading Friday.

TradingView.

TradingView.

Source: investopedia.com