Key Points

- Quarterly Paramount Global's (PARA) results fell short of expectations, and the entertainment company announced it would cut its quarterly dividend.

- Although sales jumped in its direct selling unit to consumers, which includes Paramount & #43; streaming service, spending also increased.

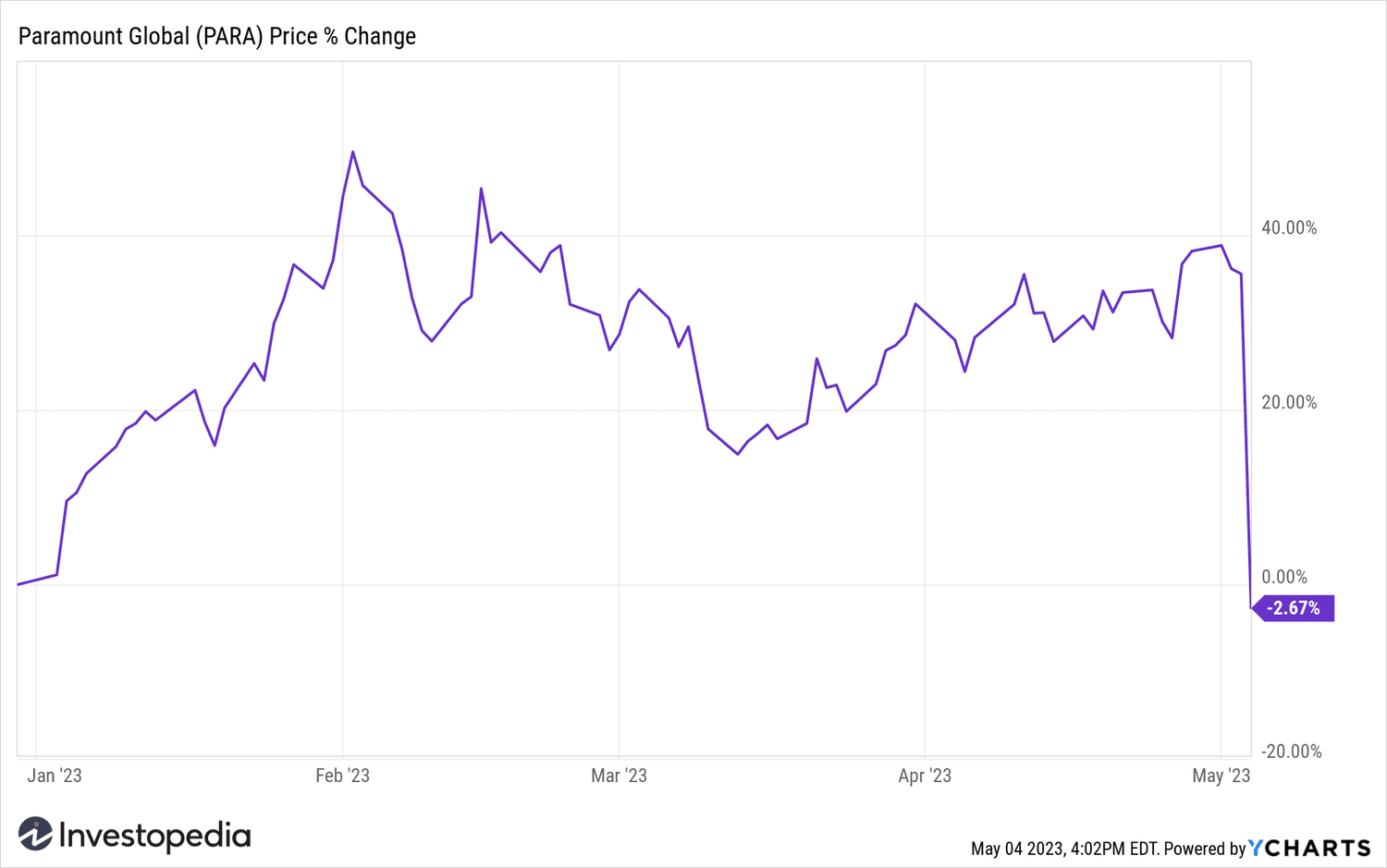

- Paramount Global shares fell 28% on May 24, sending the stock into negative territory for 2023.

Paramount Global (PARA) was the underperforming stocks in the S&P 500 after the media company missed its earnings and revenue estimates and cut its dividend.

The owner of CBS, Nickelodeon, Paramount Pictures and of several other entertainment properties reported earnings per share (EPS) of $0.09, down 85% from a year earlier and about half of what analysts expected. Sales fell 1% to $7.27 billion, $150 million lower than forecast.

Revenue decreased by 8% in its properties traditional television companies and 6% in its motion picture studio division. Sales from the company's direct-to-consumer unit, which includes the Paramount+ streaming service, soared 39%. However, expenses jumped 31%, producing an overall loss of $511 million.

Dividend Cut

Paramount Global has cut its quarterly dividend by $0.24 to $0.05, the first time it has cut the payout since 2009. CEO Bob Bakish said the move “will further enhance our ability to deliver long-term value to our shareholders as we move to continued profitability. The company said it expects the reduction to result in half a billion dollars in annualized savings.

Paramount Global shares have fell 28% on May 4, putting them in negative territory for the year.

Y-Graphs

Source: investopedia.com