Palo Alto Networks (PANW) shares rally and rose 15% as of 2:30 p.m. ET Monday after the company reported higher-than-expected earnings and billings due to strong demand for its cybersecurity services.

Key Points to Remember

- Palo Alto Networks shares jumped after posting higher-than-expected earnings on robust demand.

- The shares had fallen last week on concerns over the timing of its release after the Friday bell.

- Adjusted earnings per share came in at $1.44, higher than 1 $.28 anticipated by analysts.

Palo Alto Networks said its revenue for the fourth fiscal quarter increased 26% year-over-year to $2 billion, from $1.6 billion for the same period in 2022. Net income was $227.7 million or $0.64 per diluted share, compared to $3.3 million a year ago. Adjusted earnings per share came in at $1.44, better than analysts' expectation of $1.28.

The company's fiscal fourth quarter billings increased 18% year-on-year to $3.2 billion. Palo Alto forecast its fiscal first quarter billings to be between $2.05 billion and $2.08 billion, with revenue between $1.82 billion and $1.85 billion, below estimates of $1.93 billion.

Chief Financial Officer Dipak Golechha said the company's operating margins increased by 500 basis points as the company continued to focus on profitability, and Chairman and CEO Nikesh Arora stepped up. is said to be pleased with the reception of the company's artificial intelligence (AI)-based security automation platform, XSIAM.

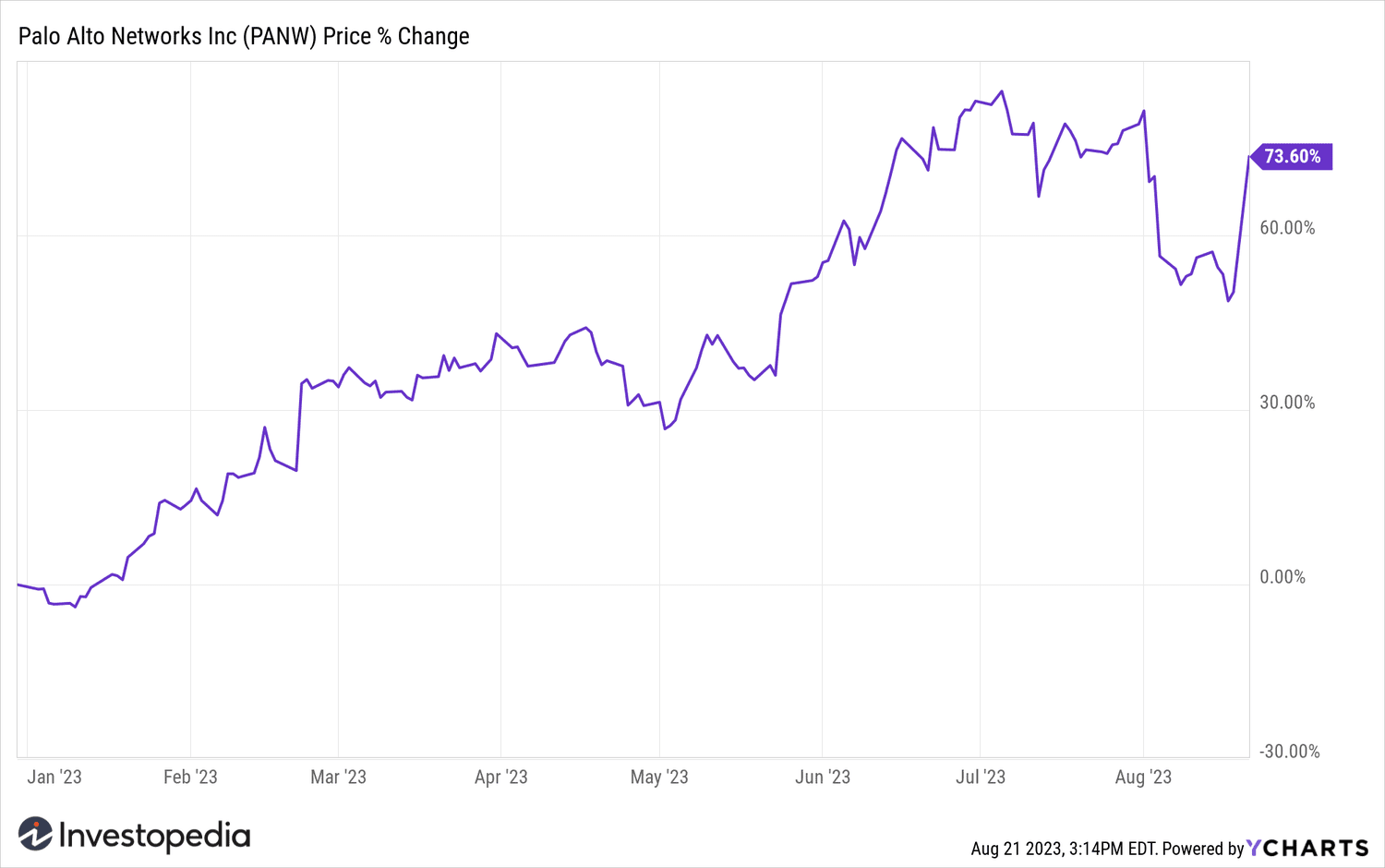

Actions of Palo Alto Networks had fallen nearly 20% on Friday amid concerns over the timing of its earnings release after the bell that day. However, with Monday's gains, stocks are up more than 73% year-to-date.

YCharts

Do you have any topical advice for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com