Key Points

- PacWest Shares gained nearly 7% in early trading Monday after announcing it would sell a $3.5 billion loan portfolio to Ares Management.

- Ares said the portfolio consists of high-quality, asset-backed, asset-backed loans.

- PacWest has taken steps to shore up its financial position after two major regional bank failures rocked the industry.

Shares of PacWest (PACW) rose nearly 7% in early trading on Monday after investment manager Ares Management Corporation (ARES) agreed to buy a 3 $.54 billion to the troubled regional bank.

Ares said the portfolio consists of “high-quality, senior secured, asset-backed loans” issued by PacWest's lender financing unit. Ares pointed out that the debt includes consumer loans, small business loans, timeshare receivables, auto loans, asset management and fundraising loans, and residential and commercial real estate loans.

PacWest noted that the first portion of the sale was completed last week and generated proceeds of $2.01 billion before transaction costs.

Jeffrey Kramer, partner and portfolio manager at Alternative Credit at Ares, said the transaction will “broaden and enhance” the company's alternative credit lineup. Joel Holsinger, partner and co-head of Alternative Credit, added that Ares' scale and flexible mandates in the private credit market make it “an ideal partner for the banking community as #39;they are optimizing their balance sheets and strengthening their financial situation”. PacWest CEO Paul Taylor said the deal will “enhance our liquidity and capital as we continue to implement our announced strategy to refocus on relationship-based community banking.”

PacWest was among several midsize banks that have come under pressure since the March collapses of Silicon Valley Bank and Signature Bank. He took steps to shore up his financial position, including selling $5.7 billion in loans to real estate investment firm Kennedy Wilson Holdings (KW). Kennedy Wilson received the first installment earlier this month.

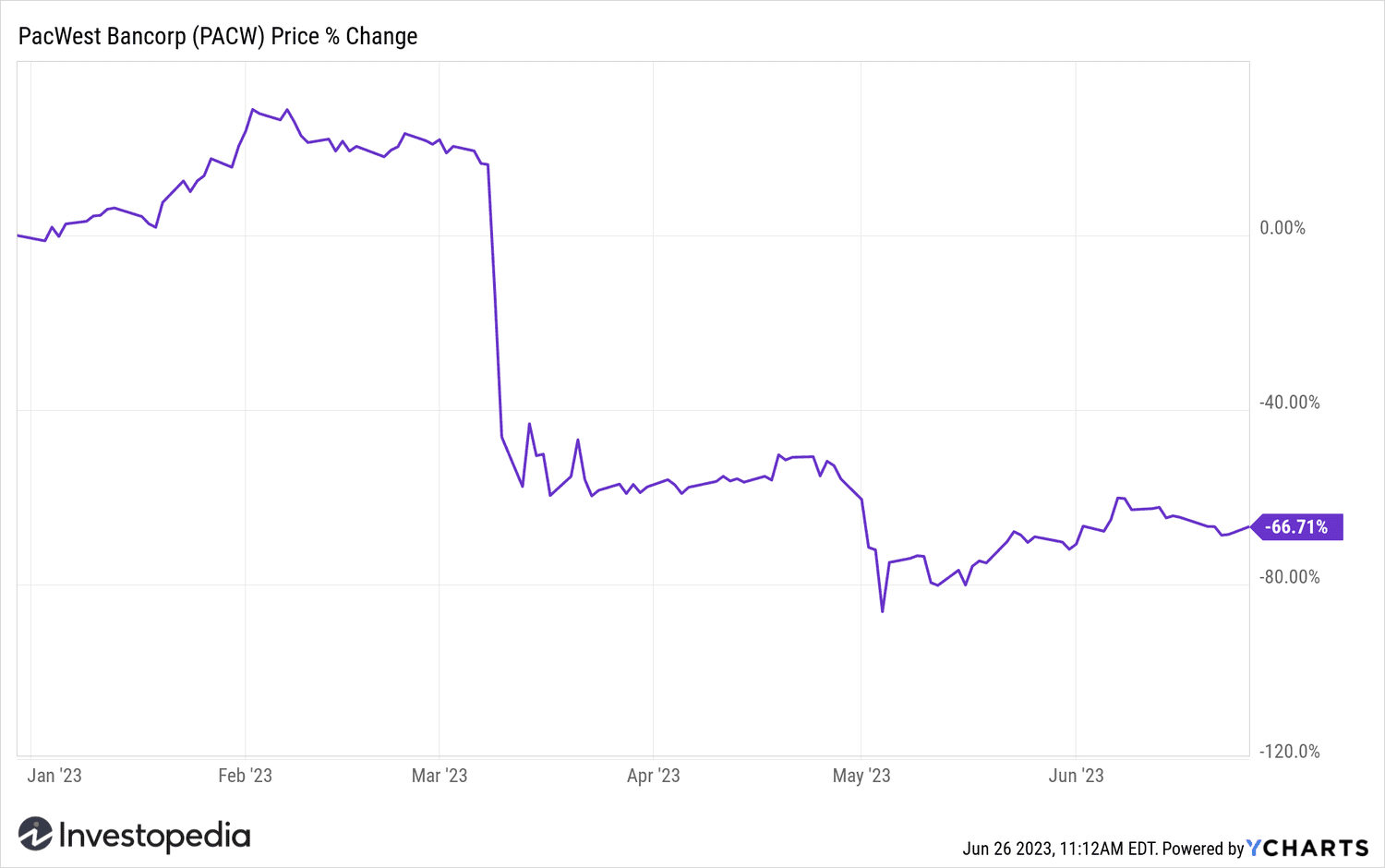

PacWest Bancorp shares have rose after the news, but they have lost more than two-thirds of their value since the March banking turmoil. Shares of Ares Management Corporation also rose.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com