PacWest (PACW) shares are down 25% during the day after the troubled regional bank announced deposit outflows of 9.5% for the week ended May 5, rekindling concerns about the health of the bank.

Stocks fell as much as 33% in early trading Thursday, before recouping some losses at 11:15 a.m. Eastern Central Time.

PacWest said last week's deposit outflows were prompted by media reports that the bank was exploring strategic options. The bank now has $15 billion in available cash, compared to $5.2 billion in uninsured deposits, and has been able to fund outflows with those reserves.

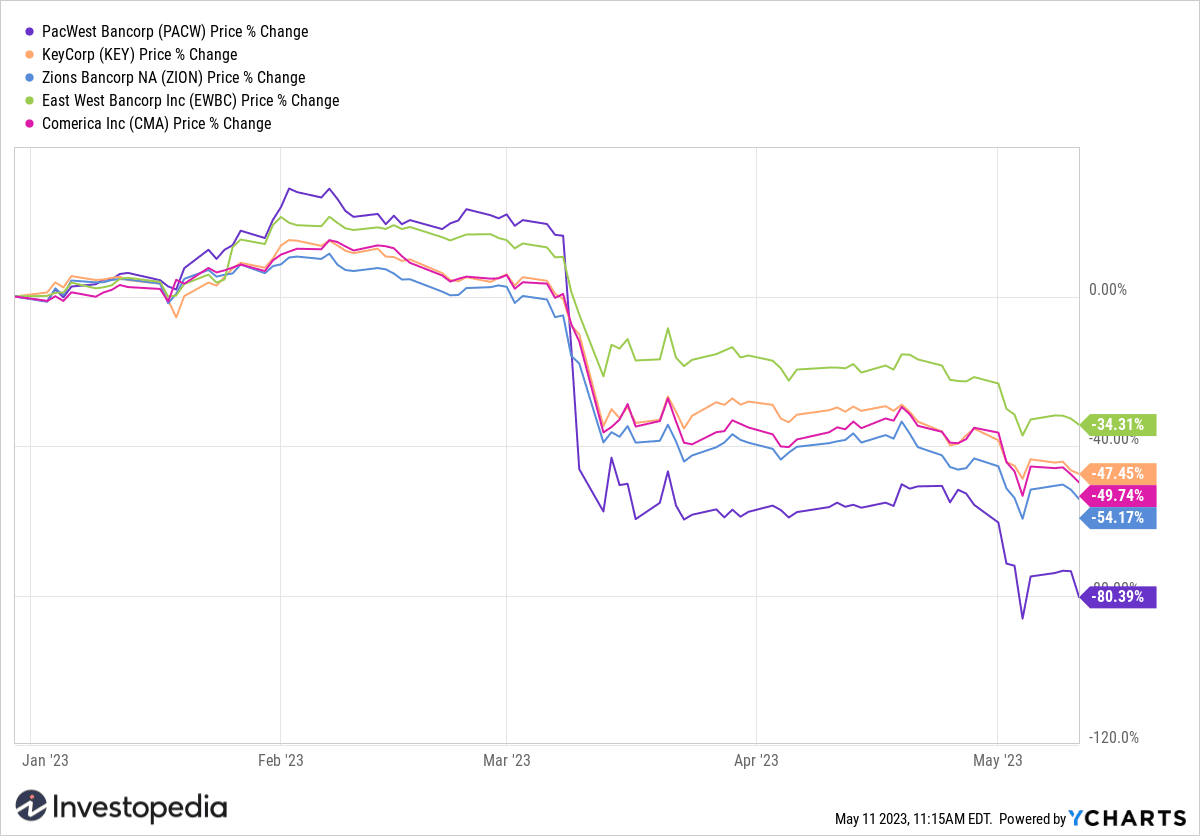

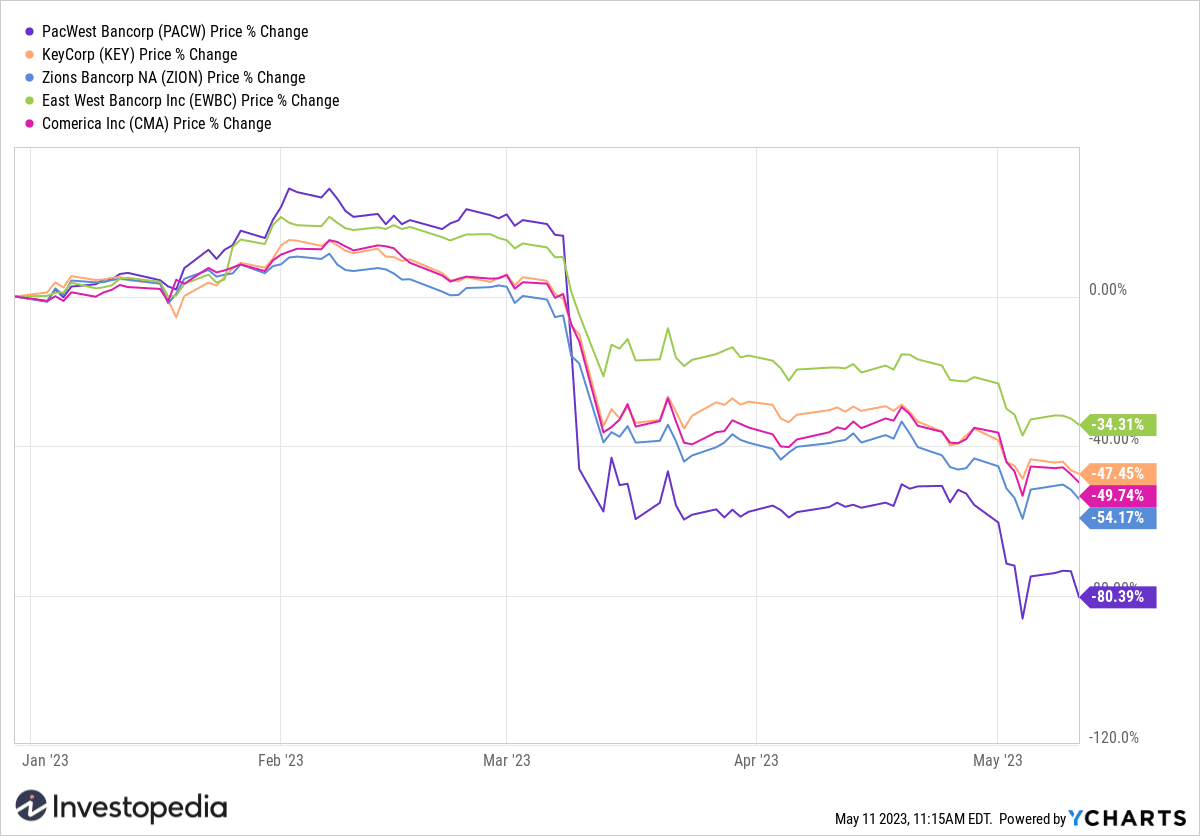

Los Angeles stocks- The based bank fell to record lows last week, days after First Republic Bank became the third high-profile bank failure since March, raising fears that PacWest could be the next victim of the current banking crisis. Its shares are down 80% year-to-date.

The actions of other regional lenders fell this year as the banking crisis unfolded. Those of KeyCorp (KEY), Comerica (CMA) and Zions Bancorp. (ZION) have lost about half their value so far this year.

Western Alliance (WAL), another regional lender in trouble, said its deposits increased by $1.8 billion between March 31 and May 9.

GraphicsY

As of April 24, 73% of PacWest's deposits were insured, up from 48% at the end of 2022, the company said in its latest earnings report. Some of the bank's largest depositors — those whose funds exceeded the FDIC's $250,000 insurance limit — withdrew their funds amid the banking crisis. A larger share of insured deposits could inspire greater investor confidence in the bank's long-term viability.

The turmoil in the banking sector has led to calls for stricter regulation of the banking sector. However, JPMorgan Chase (JPM) CEO Jamie Dimon, whose company acquired troubled First Republic Bank earlier this month, warned against over-regulation and warned that policymakers could learn the wrong lessons from crisis.

"I think it will get worse for banks – more regulations, more rules and more requirements, & # 34; Dimon said in a television interview with Bloomberg. “If you exceed certain rules, requirements, regulations, some of these community banks tell me that they have more compliance people than loan officers.”

Source: investopedia.com