Key Points

- PacWest sold home construction loans to raise cash.

- Kennedy-Wilson Holdings paid a discounted price of $2.4 billion for the PacWest loans.

- PacWest will sell additional loans worth $363 million to Kennedy-Wilson.

Struggling regional bank PacWest Bancorp (PACW) sold 74 home construction loans worth $2.6 billion to real estate investment holding company Kennedy-Wilson Holdings (KW), as may it continue to consolidate its finances.

Kennedy-Wilson agreed to pay $2.4 billion for the wallet.

PacWest has indicated that it will also sell Kennedy-Wilson issued six additional home construction loans with an aggregate principal balance of approximately $363 million.

The bank explained that the transaction is expected to close in multiple tranches during the second quarter and early in the third quarter.

Many regional banks like PacWest were overexposed to real estate debt. First Republic Bank, which was taken over by regulators before being sold to JPMorgan Chase, had 60% of its $173 billion in loans in single-family real estate, 13% in multi-family and 6% in unspecified commercial real estate loans, according to a JPMorgan investor presentation.

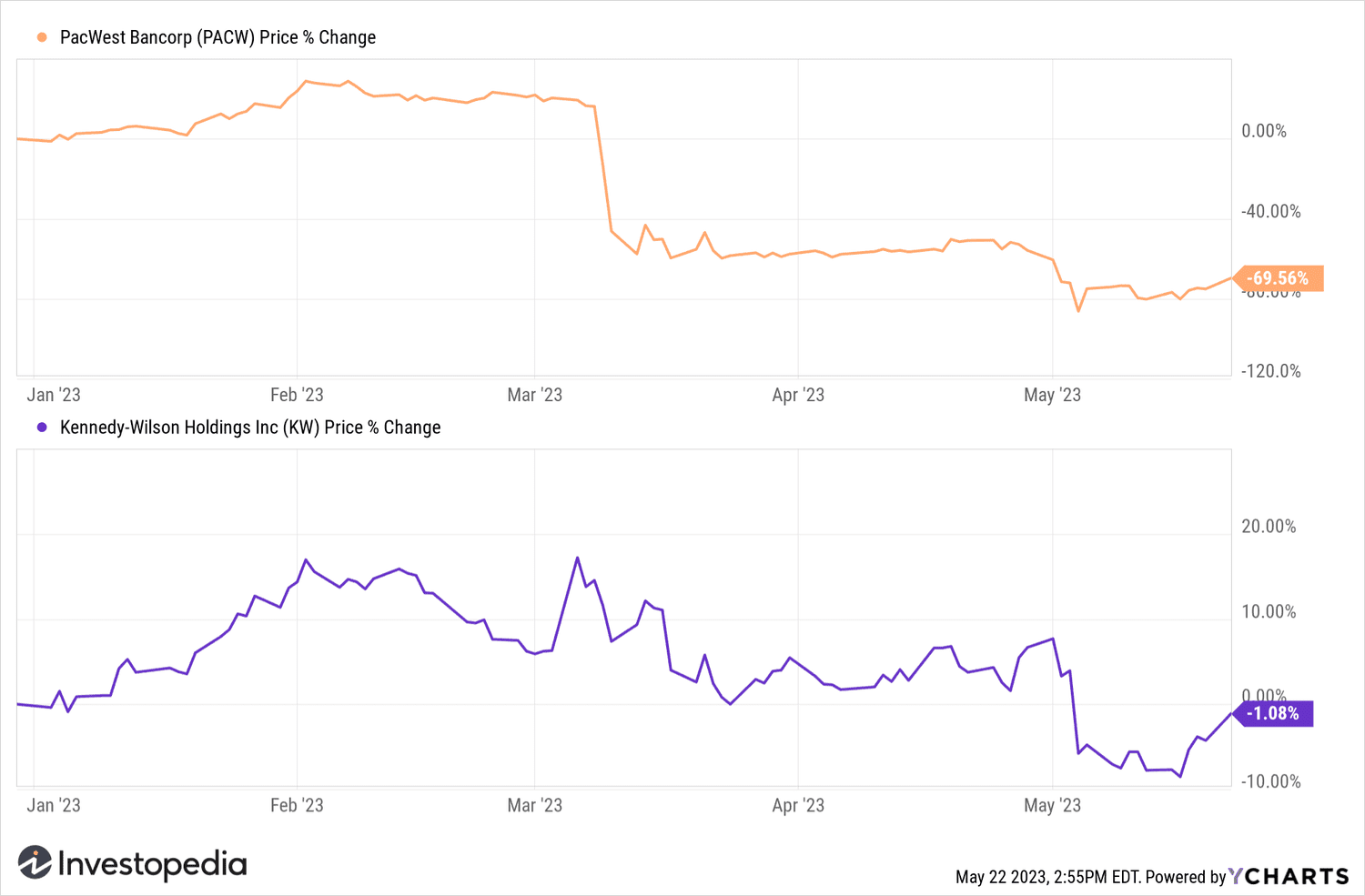

PacWest is part of several banks regions that were negatively impacted by the collapse of Silicon Valley Bank, Signature Bank and First Republic Bank earlier this year. Two weeks ago, PacWest said it was exploring “strategic options,” including in talks with several potential partners and investors, and cut its dividend to improve cash flow.

PacWest shares soar nearly 20% following Monday's news. Kennedy-Wilson shares also rose 3%.

Y-Graphs

Source: investopedia.com