Trending Videos

Takeaways

- Procter & Gamble Co. (P&G) will take on up to $2.5 billion in restructuring costs as well as a writedown related to its Gillette business.

- The consumer products company said the restructuring would take place primarily in some of its corporate markets, including Argentina and Nigeria.

- Procter & Gamble cautioned that while the Gillette unit's business is strong, certain conditions could require a new impairment charge in the future.

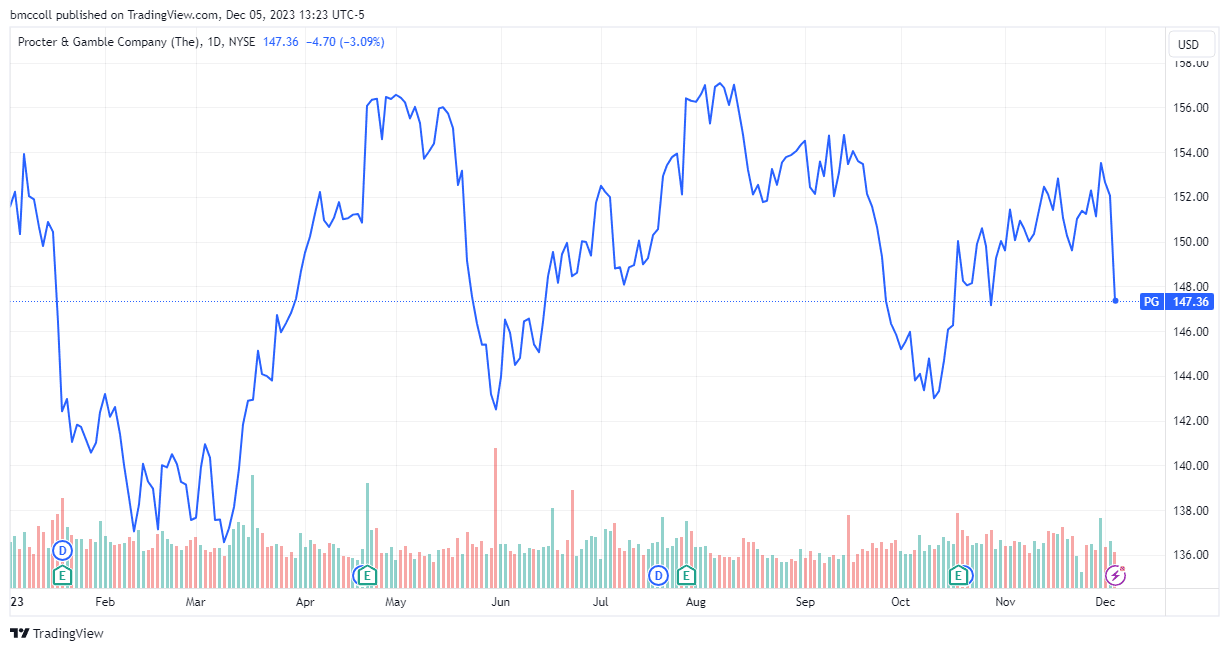

- Shares of P&G were down 3.5% from the previous day late Tuesday. .

Procter & Gamble Co. (PG) shares fell 3.5% Tuesday after the consumer products giant said it would take up to $2.5 billion in charges over the next two years. next financial years linked to a restructuring of certain operations and depreciation costs.

The company said in a regulatory filing Tuesday that the restructuring would take place primarily in certain corporate markets, notably Argentina and Nigeria, “to address challenging macroeconomic and fiscal conditions.”

P&G said these costs would be in the range of $1.0 billion to $1.5 billion after tax and would be recognized in fiscal years 2024 and 2025, with initial costs recognized in the current quarter.

The company added that also during this quarter it will record a non-cash impairment charge of $1.3 billion pre-tax ($1.0 billion after tax) on “intangible assets acquired in the part of the company's 2005 acquisition of The Gillette Company.

P&G explained that the impairment charge was related to “a reduction in the estimated fair value of Gillette's indefinite-lived intangible asset due to a higher discount rate,” as well as the weakening of several currencies against the US dollar and the impact of the restructuring program.

The company has warned under the regulatory filer that while the underlying performance of the Gillette business remains strong, “future adverse changes in the business or macroeconomic environment could trigger an additional impairment charge.”

The news sent shares of Procter & Bet even more in negative territory for 2023.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com