Key Points

- Natural Gas pipeline company ONEOK has purchased Magellan Midstream Partners, L.P. for $18.8 billion.

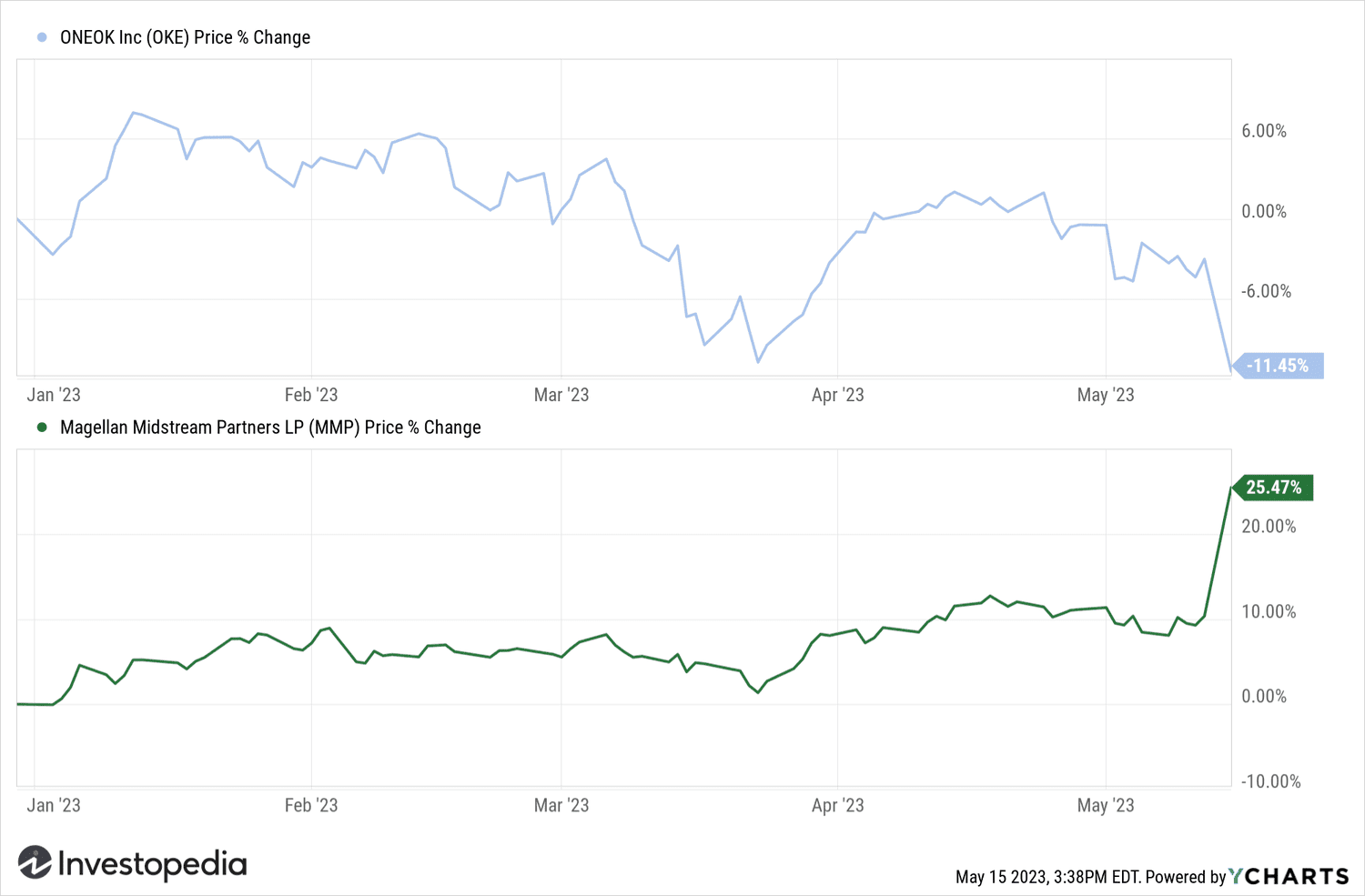

- The deal values Magellan's stock at $67.50, a premium of 21.8% from Friday's closing price.

- ONEOK said the deal will help it expand its reach in petroleum and refined products.

Gas pipeline operator ONEOK (OKE) said it would expand into the transportation of petroleum and refined products with the purchase of Magellan Midstream Partners, L.P. (MMP) for $18.8 billion. dollars.

ONEOK said that the The agreement gives Magellan investors $25 and 0.667 shares of ONEOK for each Magellan share held. That equates to $67.50 each, 21.8% above Magellan's closing price on Friday.

ONEOK CEO Pierce Norton II, said the acquisition will broaden the company's product platform and boost its core businesses, “as well as strengthen our ability to participate in the ongoing energy transformation with an increased presence in the corridors.” of sustainable fuel and hydrogen”.

When purchasing Magellan, ONEOK to obtain the longest network of refined petroleum products pipelines in the United States, with access to almost half of the country's refining capacity.

Magellan CEO Aaron Milford, added the deal gives Magellan investors the benefit of an “upfront cash component” with ONEOK's dividend. The transaction is expected to close in the third quarter of this year.

The news caused the ONEOK shares rose 9% on Monday, while shares of Magellan Midstream Partners climbed 13%.

Y-Graphs

Source: investopedia.com