Key takeaways

- Revenue at Genuine Parts missed results as its U.S. auto parts group underperformed, sending its shares tumbling.

- Same-store sales in third quarter changed little from last year.

- The company has shrunk. its full-year earnings per share guidance.

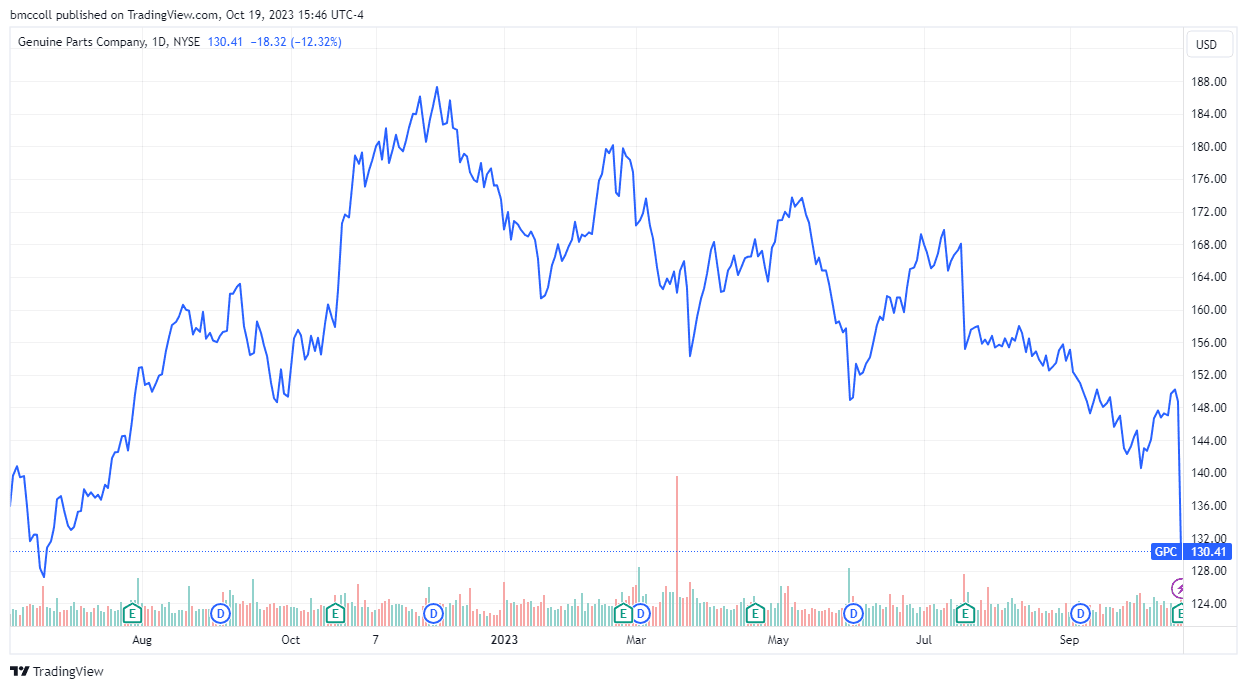

Genuine Parts (GPC) was the worst-performing stock in the S&P 500 on Thursday, as shares fell more than 12% after the automotive and industrial parts dealer missed revenue estimates as its U.S. parts unit Autos underperformed and same-store sales were little changed from last year.

Genuine Parts reported that its third-quarter fiscal 2023 revenue was up 2.6% year-over-year to $5.82 billion, compared to analysts' forecasts of $5.82 billion. 91 billion dollars. Earnings per share (EPS) came in at $2.49, better than expected.

Same-store sales increased 0.5% from the same period in 2022. Revenue in the company's auto parts group increased 3.9% to $3.63 billion, while revenue from its industrial parts group rose 0.6% to $2.20 billion.

Will Stengel, chief operating officer, said that while the industrial and international automotive businesses performed well, “results from our U.S. automotive business were below our expectations and were negatively impacted by one day fewer sales”.

Genuine Parts has reiterated its commitment full-year guidance except EPS, which it cut to $9.20 to $9.30 from $9.15 to $9.30 previously.

Coin stocks 39;s origin plunged to their lowest level since June 2022 following the news.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com