Key takeaways

- Novartis ADRs jumped after the pharmaceutical company raised its outlook, announced a stock buyback and detailed spinoff plans.

- The company raised its outlook for sales and profit of group operations in 2023.

- Novartis will repurchase up to $15 billion in shares over the next two years.

Novartis (NVS) American Depositary Receipts (ADRs) rose more than 4% in trading on Tuesday after the drugmaker strengthened its guidance, announced a new share buyback program and outlined plans to the spin-off of its Sandoz generic drugs unit.

Novartis now expects full-year group sales to grow by a high single-digit percentage, up from its earlier projection of a mid-single-digit gain , and that the group's core operating income will grow by a low double-digit percentage compared to its previous estimate of high single-digit percentage growth. Sales growth was boosted by “strong first-half momentum” and drug performance, including heart failure drug Entresto and prostate cancer treatment Pluvicto.

CFO Harry Kirsch has indicated that Novartis planned to list Sandoz shares in Switzerland and ADRs in the United States in early October. The company called an extraordinary general meeting of shareholders to vote on the proposal on September 15.

The company also said it will initiate a stock buyback of up to $15 billion, which is expected to be completed by the end of 2025.

In the second quarter, Novartis posted earnings per share (EPS) of 1. $83 and $13.62 billion in revenue, both better than analysts' forecasts.

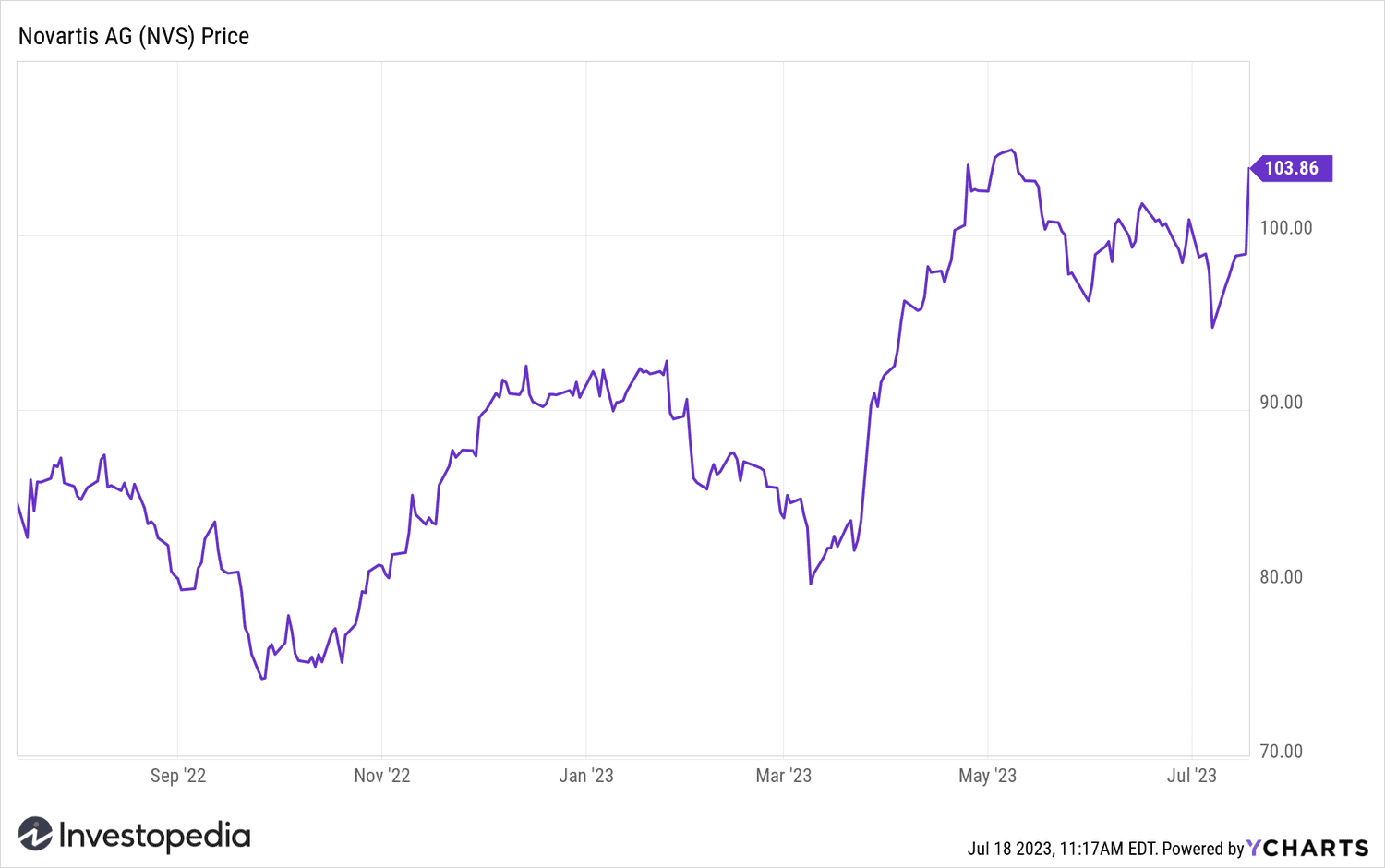

With Tuesday ahead, the Novartis' ADRs have gained more than a third of their value since their September 2022 lows. />

YCharts

Do you have any news tip for Investopedia reporters ? Please email us at tips@investopedia.com

Source: investopedia.com