Takeaways

- SLB& North American revenues fell for a second consecutive quarter and overall sales exceeded forecasts.

- International revenues increased 6% from the second quarter and 12% year-over-year .

- li>

- CEO Olivier Le Peuch said the oil and gas industry is looking more internationally and offshore, which benefits the #39;company.

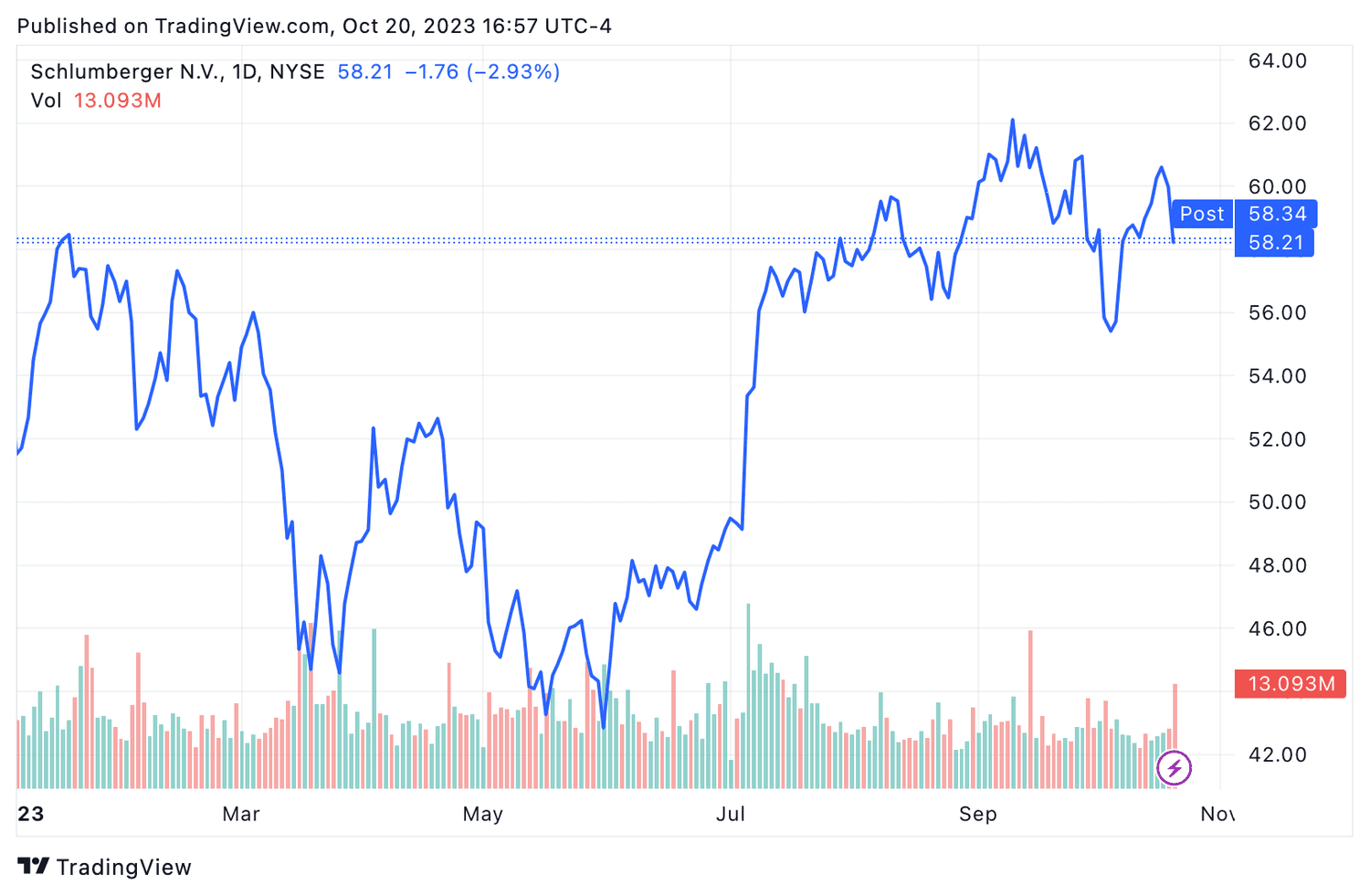

Shares of SLB (SLB) fell nearly 3% on Friday after reporting slowing demand in North America and as concerns grew over the potential negative impact of fighting in the Middle East on oil supplies. Shares of industry competitors also fell.

The largest oilfield services provider said revenue from its North American operations in the third quarter of fiscal 2023 was down 6% sequentially to $1.64 billion, the second consecutive quarter of decline. sales in the region. This is an increase of 6% over one year. International sales were $6.61 billion, a 5% gain from the second quarter and a 12% increase from 2022.

SLB posted earnings per share (EPS) of $0.78, slightly better than forecasts, but overall revenue of $8.31 billion was below forecasts.

CEO Olivier Le Peuch said that “market fundamentals remain very attractive for our business.” He added that the oil and gas industry “continues to benefit from a multi-year growth cycle that has shifted to international and offshore markets,” which he said was advantageous for SLB.

SLB also indicated that more Earlier this month, it finalized its previously announced deal with Aker Solutions and Subsea7 to create a new company named OneSubsea, which will focus on subsea production and reserves.

SLB shares lost ground on Friday, but up 13% year to date.

TradingView

Do you have a tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com