NIO Inc. (NIO) shares have climbed more than 15% during Wednesday session after Goldman Sachs upgraded the stock to a Buy rating with a target price of $6.40 per share. Analyst Fang Fei city to minimize the risk of liquidity and a more narrow consumption of cash in the wake of the “battery incident”, as well as the 37% improvement of the delivery of the volumes between January and April.

This is the first time that a premium car brand has had a waiting list of buyers, joining the likes of the Toyota Motor Corporation (TM), Tesla, Inc. (TSLA), and select Lexus models, has added Fang in the research note. Last week, NIO has announced a turnover that has fallen from 53.2 per cent to $193.76 million, beating consensus estimates by $18.16 million, while GAAP EPADS came in at$ 0.23, beating consensus estimates by a cent per share.

The china Association of Automobile Manufacturers announced a 11.7% increase in May, car sales at 2.14 million dollars. While this is the second consecutive monthly increase, year-to-date, sales are still down an estimated 23.1% to $ 9.7 million. Sales are forecast to fall 15% to 25% for the year as a whole, depending on how the rest of the pandemic turns out to be.

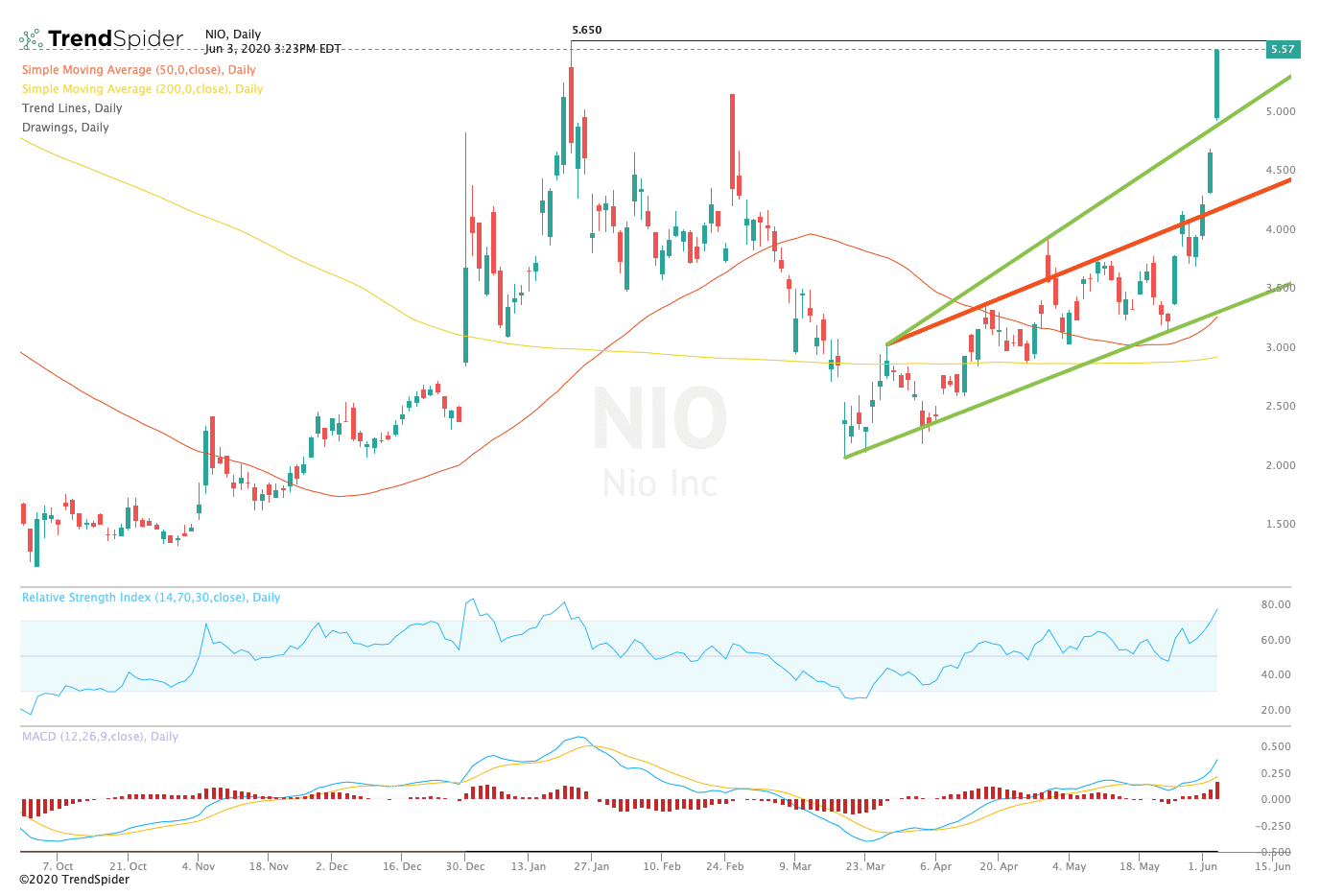

TrendSpider

From a technical point of view, NIO stock extended its gains from the past three sessions. The relative strength index (RSI) moved into overbought territory with a reading of 76.38, but the moving average convergence divergence (MACD) has accelerated its upward trend. These indicators suggest that the stock could see a consolidation before extending its upward movement.

Traders should watch for consolidation below the trend line resistance and above trendline support in the coming sessions. If the stock breaks out, traders could see a move to new highs. If the stock breaks down, operators could see a return to the former price channel or passage, the reaction of the bottom, and the 50-day moving average of $3.31.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com