Trending Videos

Takeaways

- Illumina Inc. has decided to end its controversial purchase of GRAIL and will divest from the cancer diagnostic test maker.

- The deal clashed with the opposition from regulators in the United States and Europe when the DNA sequencing company closed its doors on the GRAIL transaction before receiving approval.

- Activist investor Carl Icahn also blasted the decision and launched a proxy fight at Illumina that helped him secure a board seat.

The purchasing saga controversial DNA sequencing company Illumina Inc. (ILMN) from cancer diagnostic test maker GRAIL appears to be over.

The company announced Sunday that it divested from GRAIL following significant opposition from regulators and activist investor Carl Icahn.

Illumina separated from GRAIL in 2016 and then repurchased it in September 2020. It closed the transaction, then valued at $8 billion, in August 2021 before obtaining the 39;s regulatory approval. U.S. and European officials opposed the move, saying the combination would hurt innovation and raise prices.

As the legal battles raged, Icahn lambasted the decision to move forward before obtaining approval and launched a proxy fight, ultimately winning a seat on the board of directors. #39;administration and ousting President John Thompson.

Friday, a court The federal appeals court ordered the Federal Trade Commission (FTC) to conduct another review of the merger, but noted that the FTC had substantial evidence to block the deal.

The company said in a statement that It would not pursue further appeals and would divest GRAIL through a third-party sale or equity transaction. CEO Jacob Thaysen said Illumina would accelerate the process and that he and the management team “continue to focus on our core business and supporting our customers.”

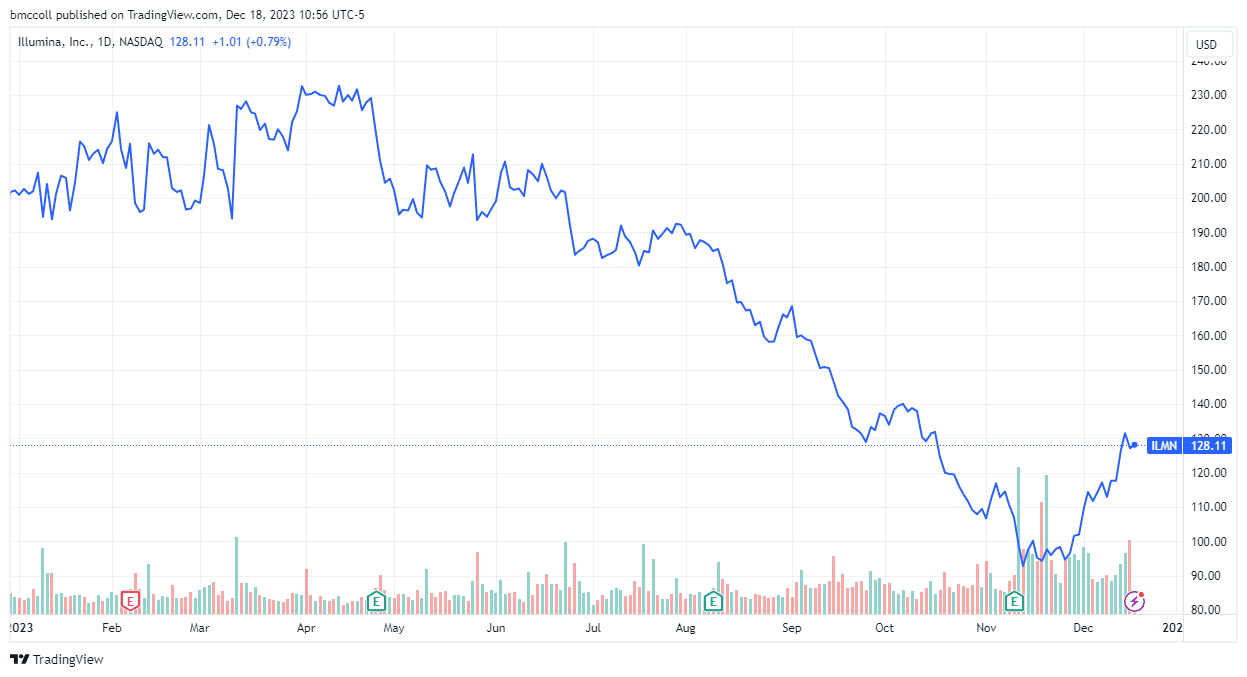

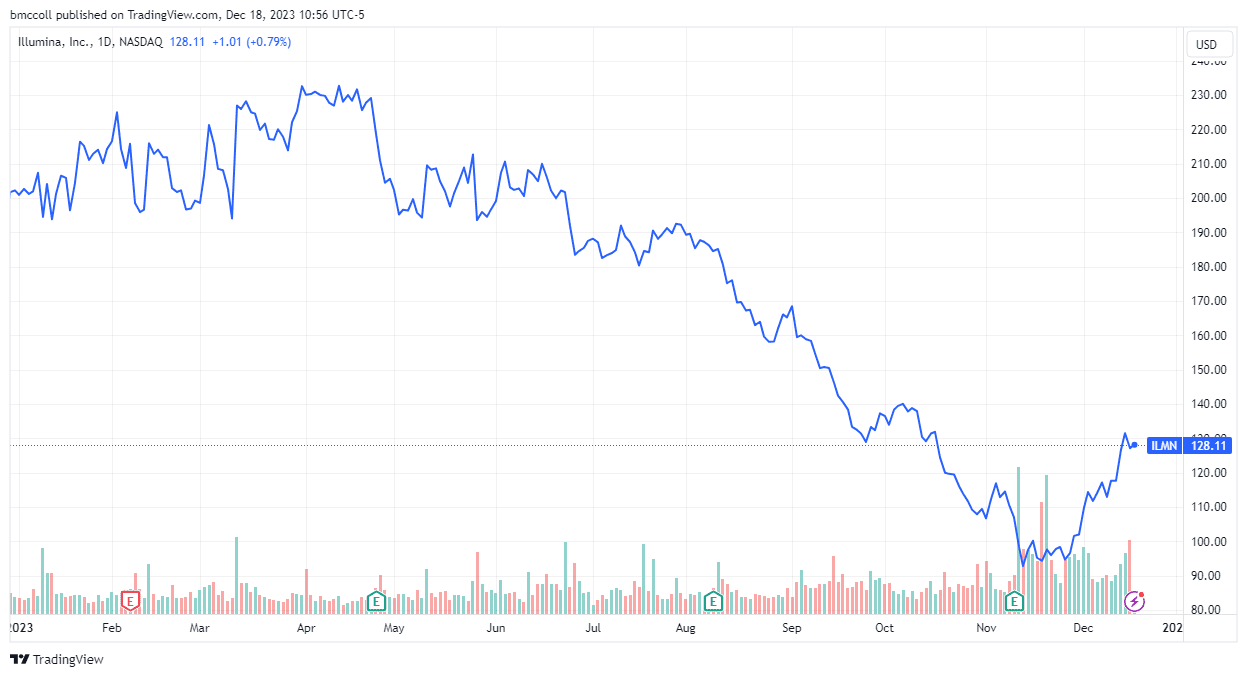

The actions of Illumina rose more than 2% around midday Monday, but they have lost more than a third of their value so far this year.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com