Points to remember

- Nio ADRs plunged as electric vehicle maker's loss widened and revenue tumbled.

- Automaker's shipments fell from same period in 2022 .

- Nio' The outlook for deliveries in the current quarter has exceeded that of analysts. forecast.

Nio (NIO) US certificates of deposit (ADR) fell 6% in early trading on Tuesday after the Chinese electric vehicle (EV) maker reported worse-than-expected results due to lower shipments.

Nio reported a loss of $0.45 per share in the second quarter of fiscal 2023, more than double its 2022 loss. Revenue fell 14.8% to $1.21 billion. Both lacked estimates.

The company delivered 23,520 electric vehicles over the period, compared to 25,059 a year ago. He said that due to this decline, along with lower average selling prices, vehicle sales revenue fell 24.9% to $991 million.

However, Nio said it expects to deliver between 55,000 and 57,000 vehicles in the current quarter, a jump of 74-80% from 2022 and well above analysts' forecasts. It projects revenue of between $2.61 billion and $2.70 billion, a 45-50% gain over last year.

Founder and CEO William Li noted that with the company transitioning to its new NT2.0 production platform, expanding its power grid and increasing its sales capabilities, “we expect solid growth in vehicle deliveries in the second half of 2023.”

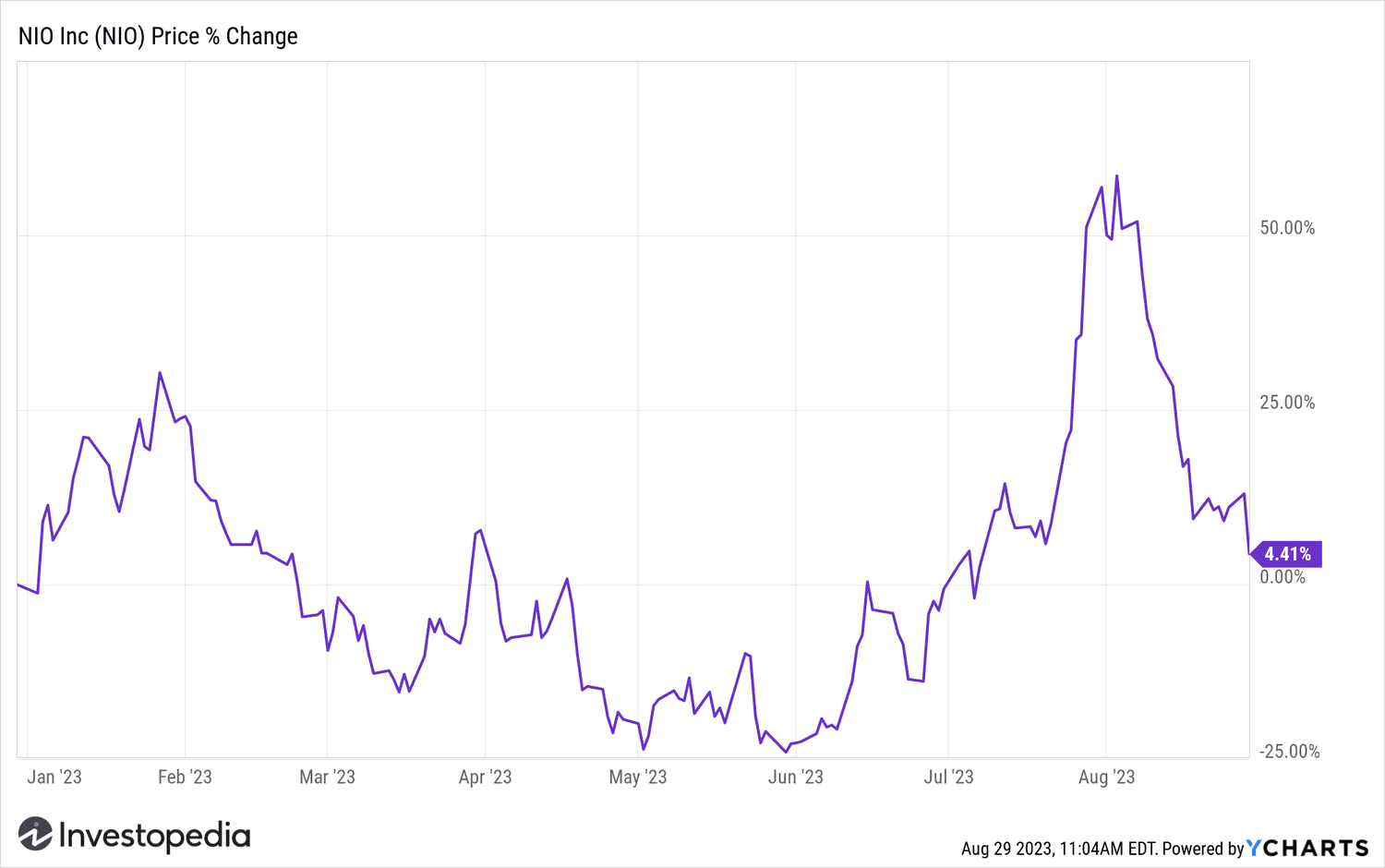

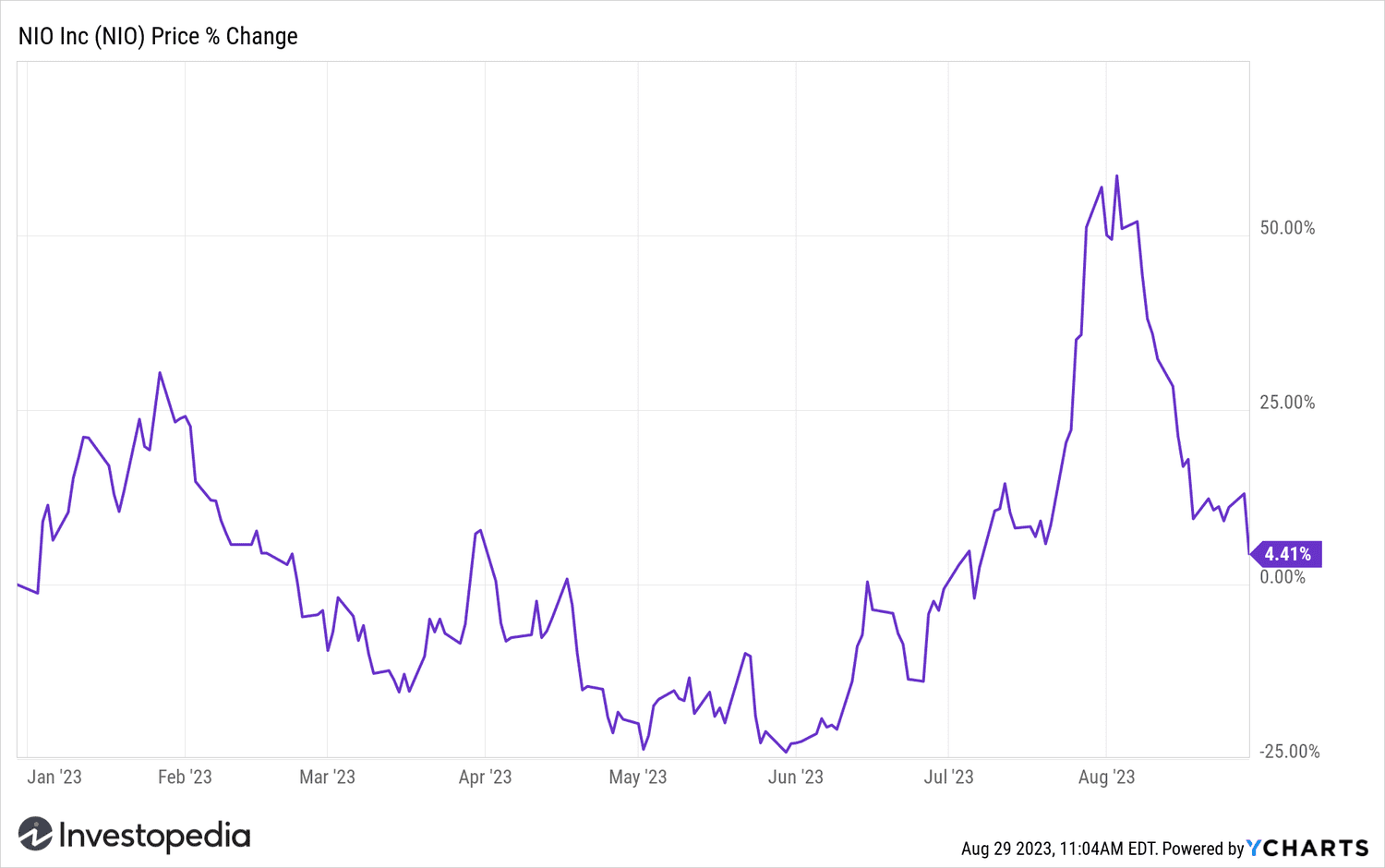

Nio ADRs have been steadily declining since hitting a 10-month high in early August, but still up for the year.

YCharts

news for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com