Nikola Corporation (NKLA) shares have fallen more than 11% during trading on Tuesday after RBC Capital initiated coverage of the stock with a Sector Perform rating and a price target of $46 per share. Analyst Joseph Spak expects zero issue of trust of the application of the culture as government regulations, incentives, and the sustainability of the company the objectives of a kick, but he called the company more of a business plan in the present moment.

Earlier this month, Nikola founder Trevor Milton tweeted that the company has sold packages for the deposit on his next Badger van. The automaker has started taking deposits on its electric or hydrogen fuel cell pick-up, June 29, 2020, with plans to provide the truck on Dec. 4, by 2020. The stock has also been bolstered by Tesla, Inc.’s (TSLA) soaring valuation over the past few sessions.

At the end of June, analysts from JPMorgan, warned that Nikola actions have been fully assessed in the short term at their then-current levels, by creating the possibility of a short-term pullback. Analyst Paul Coster wrote that Nikola’s business model could be interesting, but the risks were high for the pre-sales of the company. The analyst maintained a Neutral rating and $45 price target at the time.

TrendSpider

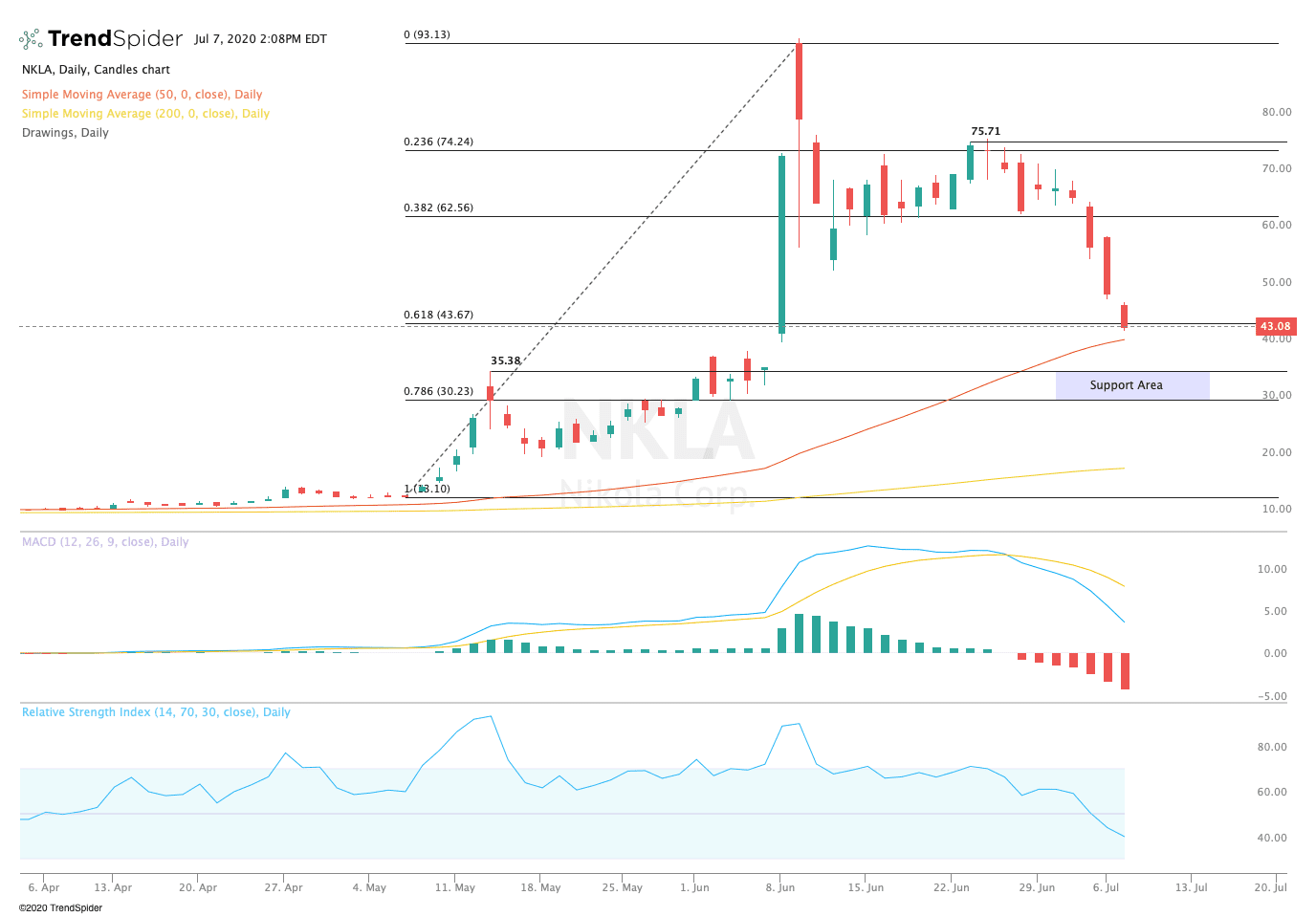

From a technical point of view, the stock moved sharply lower towards its 50-day moving average at $40.85 in the course of the session on Tuesday. The relative strength index (RSI) had fallen to 39.77, but the moving average convergence divergence (MACD) remains in a strong uptrend to the downside. These indicators suggest that the stock could see a little more downside before a period of consolidation.

Traders should watch for consolidation near the 50-day moving average at $40.85 in the coming sessions. If the stock rebounds from these levels, traders could see a tendency to the reaction of the vertices of $75.71. If the stock breaks down from these levels, traders could see a move towards the front of the reaction highs of near $35.00. The downward movement of the MACD indicator suggests, operators need to assume that the continuation of the decline to come.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com