- Nikola short sellers may be forced to buy because of the costs and losses

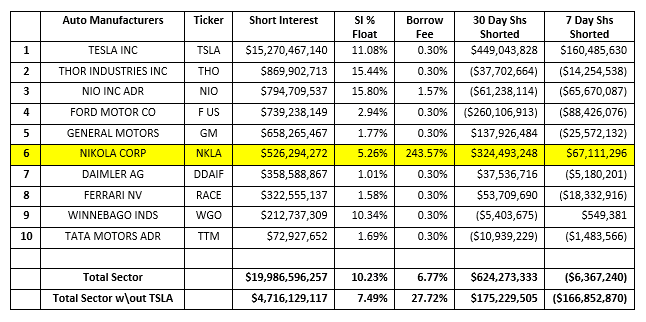

- The company is the sixth largest short in the automotive industry

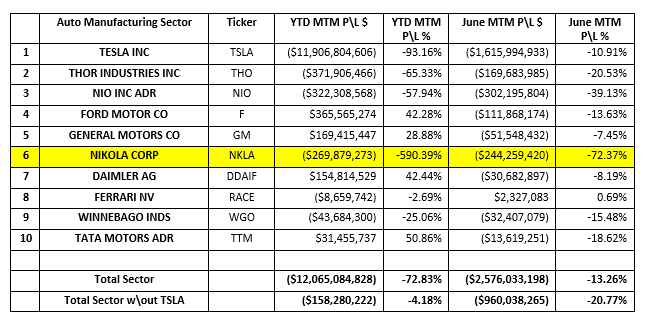

- June mark-to-market losses for the auto shorts to $ 2.58 billion, largely due to Tesla

Electric truck maker Nikola Company may have developed a fan among the retail investors have pushed up the market capitalization, but with zero revenues expected this year, it has also attracted the attention of short sellers. The Phoenix, Arizona-based company, which was recently made public, is already the sixth biggest short in the auto industry with $ 526 million of short interest.

Stock borrow rates of Nikola are slender because of the intensification of the short-selling demand and restricted ready supply. Stock borrow costs on existing short positions is 243.57% annualized fees and rates exceeding 600% in yesterday’s trading. Short sellers have also suffered mark-to-market losses of $ 244 million in June, and the stock continues its ascent. This combination makes Nikola a “target of choice for a short squeeze,” said Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners in a new note.

Source: S3 Partners.

“NKLA to the lack of supply has two main factors, the lack of institutional long-the shareholders and of the large amount of our shareholders,” said Dusaniwsky. “The lack of stock borrow to the offer has strangled a chance for short sellers to build their position and create negative stock price pressure in the stock. And finally, we are witnessing the actions borrow, remember to hit the street, forcing some shorts to buy to cover and close their positions as there is no stock to borrow offers to replace those recalled stock borrows.”

Mark-to-market losses of this month for the short sellers targeting the Auto Manufacturing Sector is $ 2.58 billion, and most of this is attributable to electric vehicle makers. To the exclusion of the shorts betting against Tesla, whose stock has been soaring lately, in spite of its chief executive officer to call him overrated, this figure drops to $ 960 million. The other major sources of loss Nikola and Chinese manufacturer of NIO.

Source: S3 Partners.

Source: investopedia.com