Nikola Corporation (NKLA) shares have fallen more than 20% after the electric vehicle company registered to sell up to 23.9 million shares, and from time to time up to 53.39 million shares and 890,000 warrants to shareholders. The private warrants have been issued in the framework of a private placement related to the initial public offering (IPO) of VectoIQ. Investors are betting that the movement could significantly dilute existing shareholders.

In the result of the capital increase, Deutsche Bank analyst Emmanuel Rosner sees an attractive entry point after the technical selling pressure disappears. Rosner believes that Nikola stock is one of the few pure play on zero-emission commercial trucks, where the regulations might lead to high rates of adoption. The analyst maintains an outlet rating and $54.00 per share price of the target.

Deutsche Bank and other analysts are optimistic about Nikola of the fuel cell solutions which consist of electric trucks, hydrogen fuel, and full maintenance and service in a single contract, at prices lower than the property of the traditional trucks. These contracts could be an interesting option for fleet operators and generate solid revenue for Nikola to attractive returns across the life of the vehicles.

TrendSpider

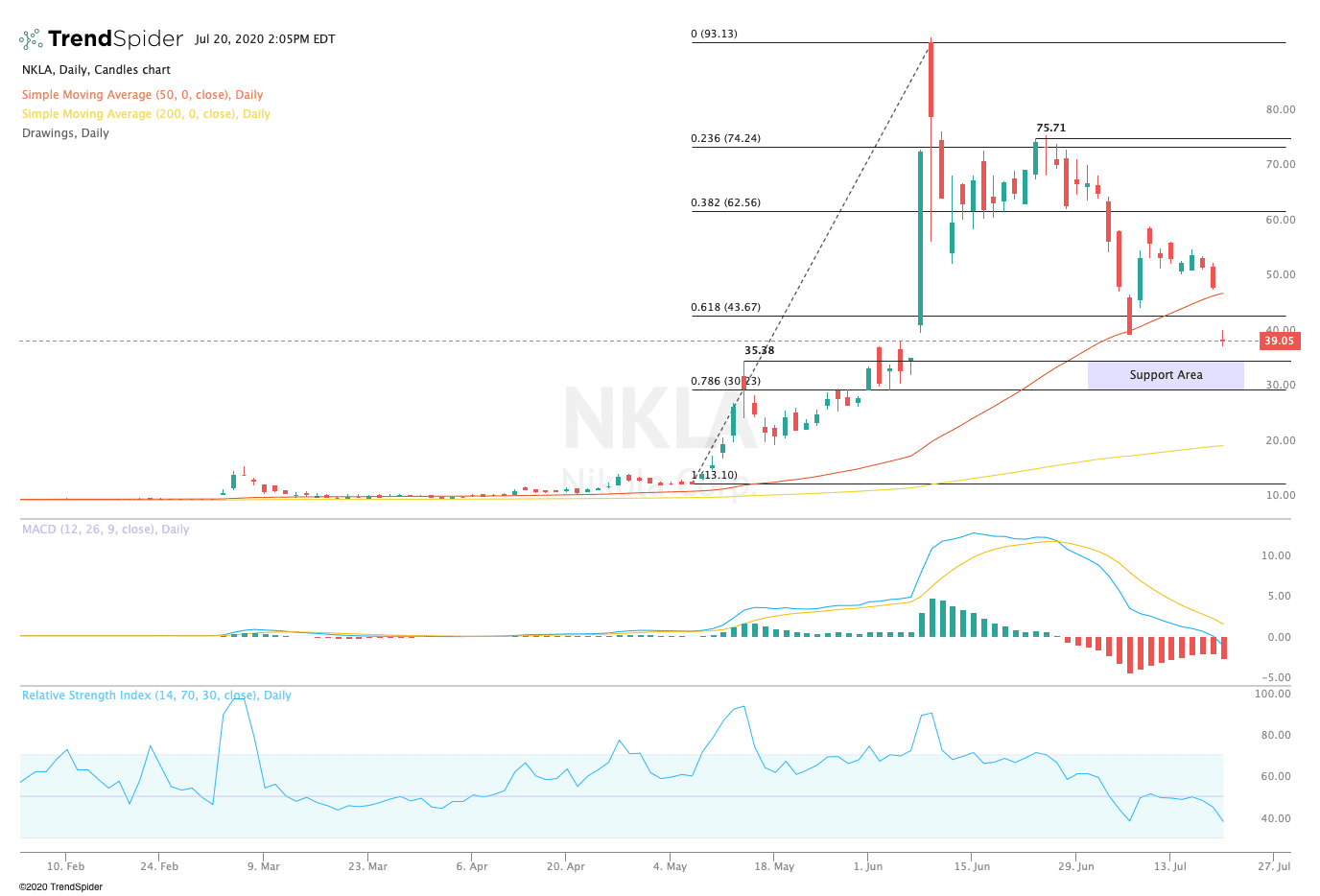

From a technical point of view, the stock has broken down from the 200-day moving average to close a gap dating back to the beginning of the month of June. The relative strength index (RSI) fell to 37.67, but the moving average convergence divergence (MACD) remains in a strong downtrend. These indicators suggest that the stock could see more downside ahead before attempting any consolidation.

Traders should watch for a new release to retest prior highs around $35 in the coming sessions. At this time, the stock might consolidate before potentially bounce higher or break lower. A bounce could lead to a resumption of the trend line resistance near the 50-day moving average of $47.68, while a rupture may lead to a shift towards the 200-day moving average of $20.03.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com