Dow component Nike, Inc. (NKE) has made a V-shaped recovery in January’s bull market high, and it could come out in the next few weeks, the long-term recovery of the upward trend. This price action follows a dramatic escape by a smaller rival Lululemon Athletica Inc. (LULU), highlighting the continued demand for sports apparel and other health-related paraphernalia throughout the pandemic the judgment. (See also: Lululemon Stock is Overbought and Overloved in Advance of the results.)

In mid-May, the company announced that 100% of Nike stores and 95% of the partners belonging to the shops have reopened in China and South Korea, adding to a strong digital demand, and new member acquisition. Only 5% of US stores have been opened in this period, but reopenings are now accelerating, to restore a sense of normalcy, which should translate into even more sales in the end of the second quarter.

The fourth quarter of 2020 revenues, which cover March, April, and May will be released on 25 June, with the run-up in the confessional, the addition of a further catalyst to the upside. The analysts expect Nike to report earnings per share (EPS) of $0.17 on revenues of $7.75 billion, which will result in a significant decline from 2019. A few statistics on the UNITED states of impact have been disclosed during the month of March of income or the update in May, so that the investors will have to rely on ratings and speculation to take the entry decisions.

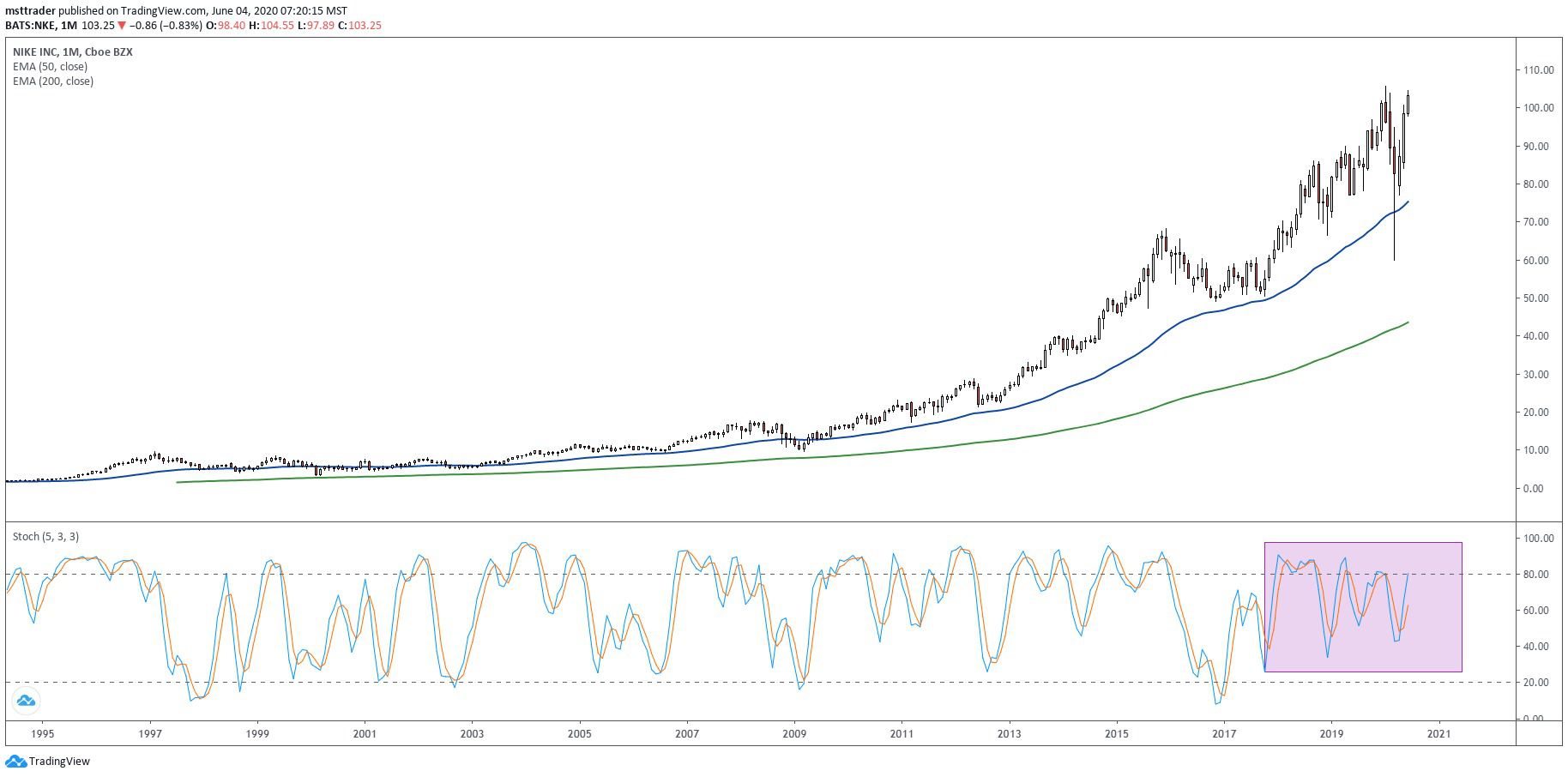

NKE Long-Term Chart (1995 – 2020)

TradingView.com

The stock broke out above of three years of resistance to a split adjusted $2.82 in 1995 and entered into a short-term life of the uptrend that topped out at $9.55 in 1997. That marked the highest for the next seven years, leaving the place to a complex decline recorded a decrease of the trough in the first quarter of 2000, when it reached the bottom of the barrel, to $3.22. The rise and subsequent completed round-trip in the front in 2004, which gives an evasion that failed to gain momentum until 2006.

Steady progress in March 2008 posted a new high at $17.65, giving way to an orderly decline that accelerated during the fourth quarter of the economic collapse. Selling pressure finally eased to a three-year low in 2009, which gives a recovery of the wave that completed a 100% retracement in the state of the high in 2010. The stock broke out immediately, the emergence of Nike in the leadership on the market through the first half of the decade.

The uptrend topped out in the upper $60 for the fourth quarter of 2015 and rolled in a symmetrical triangle that contained price action in 2018 breakout that restored the course of the leadership action. That advance printed a good string of higher highs and higher lows, culminating in January 2020 all-time high of $105.62. He fell down from a small, trim model a month later, and plunged in mid-March, has finally dropped to a two-year low.

The rebound in the second quarter, which follows the same trajectory as the prior decline, reaching within a point of January resistance on Wednesday. This peak could delay the upside progress while the stock of works out of overbought technical readings, may be the generation of a retreat that offers an opportunity to purchase between $90 and$ 95. However, given the strong Dow Jones Industrial Average of the magnitude, it is possible that Nike is the only stock heads higher from here.

NKE Short-Term Outlook

The monthly stochastic oscillator has carved a complex pattern since May 2019, passage-way to sell a cycle which has put in force for the purchase of the waves. The latest increase has almost reached the overbought zone, which has triggered three bearish crosses in the last 20 months. In turn, this suggests that the bulls are in control of the band for now, but the bears could pull off the control at any time. That increases the risk of a substantial way the end of June to the publication of the results.

Similarly, the accumulation of readings have risen to new heights, highlighting impressive second quarter buying power, which should limit the downside pressure in the coming weeks. As a result, the V-shaped pattern now brands the greatest risk to the upside on the development, because the share price has failed to carve out stable floor all the way down to$ 60, which makes it more difficult for several days for slow to find logical support levels.

The Bottom Line

Nike stock has resumed the bull market top and could get out, but the gains may not be in the cards without a long phase of consolidation.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com