Key Takeaways

- Analysts estimate EPS of $0.02 vs $0.62 in Q4 2019

- More sales in China will remain in good health as the North American sales plunge year on year.

- COVID-19 having regard to causing the sharp decline in company-wide sales.

Nike Inc. (NKE), the world’s leading athletic apparel company, is one of many retailers and consumer goods companies hurt by the COVID-19 pandemic. The company said in mid-May that all of its stores of the company and most of its partners ‘ outlets reopened in Greater China, and that it was gradually re-opening of stores in North America. Investors are focusing intensely on how these trends affect Nike when it reports results for the 4th quarter of the FISCAL year 2020 on 25 June. Nike, including the horizon 2020 fiscal year ended May 31, could be an indicator of the effects of the pandemic, many U.S. companies report earnings in the next 2 months. The news from Nike will be most of the time dark. Analysts expect a 96.5% plunge in earnings per share (EPS) and 31% of revenue decrease for the quarter. EPS and revenue are also expected to fall for the year.

Two key metrics that investors will focus on are the sales growth in Greater China, one of the main foreign markets for Nike, and also in North America, its biggest market. The results can be mixed. Nike sales in Greater China are expected to fall only slightly year on year (yoy), as sales of digital products, partially offset by the abnormal decrease of the business volume in the retail trade during the quarter. North america revenue is expected to significantly degrade. The mixed results reflect the timing of the scenario in which the virus is spreading from China, before spreading to other parts of the world.

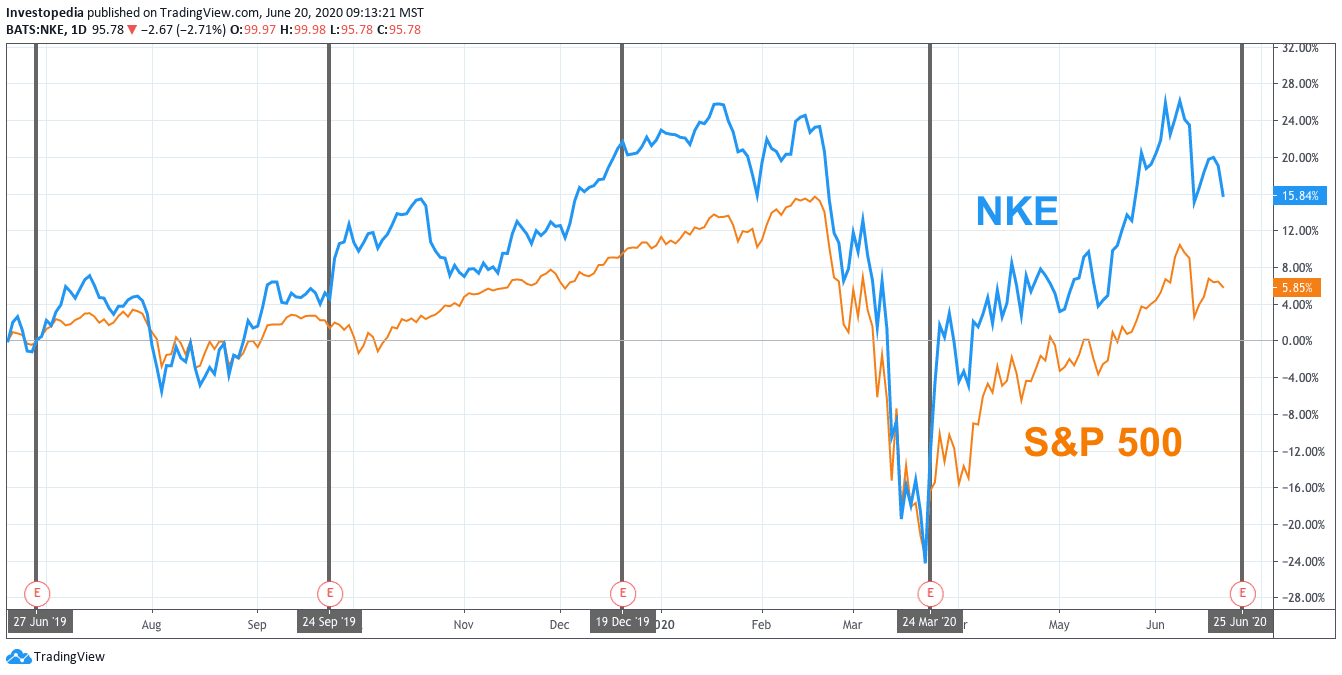

Nike shares reflect optimism about the company as well as its success in building online sales in China and elsewhere in the middle of the pandemic. After an initial fall earlier this year, Nike shares have rebounded and increased at an hair of their all-time high this month. They have outperformed the market over the last 12 months, with a total return of 15.8% compared to the S&P 500 index total return of 5.9%

Source: TradingView.

Nike reported strong results through Q3 of FISCAL 2020. The company, for example, posted EPS growth of 14.5% and a revenue growth of 5.1% for Q3, which ended on February 29, 2020. The company, at the time, has pointed to the negative impact of COVID-19 on its activities in Greater China. But the company said that the growth in sales of digital products and the strong growth in the overall business in other regions of the world, including North America, helped offset the impact. Nike shares jumped the day after the report and were superior to the overall market since.

Before the outbreak of the virus, Nike has been the experience of some of its fastest growth in recent years. The company has registered an EPS growth of 33.8% for the 2nd quarter of FISCAL 2020, its fastest pace in at least 12 quarters. Turnover increased by 10.3%. Nike shares continued their upward trend until mid-January.

The expectations for Q4 and Nike of the whole of the YEAR 2020 clearly reflects the negative impacts of COVID-19. As shown, two EPS and revenues are expected to plunge. These results will also be dragging down the whole of the year, with analysts estimating EPS to decrease by 10% for the entire FISCAL year 2020, the revenue drops by 2.6%.

The estimate for the Q4 2020 (AF)

Q4 2019 (AF)

Q4 2018 (AF)

The Earnings Per Share

Of $0.02

$0.62

$0.69

Sales (B)

$7.0

$10.2

$9.8

The Greater China Sales Revenue (B)

$1.7

$1.7

$1.5

Sales In North America (B)

$2.5

$4.2

$3.9

Source: Visible Alpha

The weakness of the Nike’s financial is expected to be driven by sales in North America, the region that generates the majority of revenues of the company. Sales in north America accounted for about 41% of Nike’s total revenue in FISCAL 2019. Sales in the region increased 4.4% in Q3 and 5.3% in the Q2 of FISCAL year 2020. But sales in North America are expected to slide from 38.8% in the 4th quarter, clearly reflecting the impact of COVID-19 on the region and the subsequent store closures.

Nike Greater China sales may give an overview of how North America could bounce back economically once it begins to open retail stores and business on a wide basis. This may depend at what point the UNITED states and Canada are as successful as China in reducing the spread of the virus and the control of future epidemics. Nike Greater China sales, which accounted for about 16% of Nike’s total revenue during the YEAR 2019, has fallen 5.2% in the 3rd quarter of FISCAL 2020, which was completed at the end of February, during which the pandemic began to spread rapidly on the continent. Sales increased by 19.6% in the previous quarter, Q2 of FISCAL year 2020. Despite the ravages of the pandemic, Nike is expected to maintain a high level of the Greater China sales in Q4 2020 in the middle of the biggest economic downturn in China for decades: the sales are expected to fall only 1.7% year-on-year.

Source: investopedia.com