Newmont Corp. (NEM) said it has received more approvals from regulators and plans to soon complete its $19.2 billion purchase of Australian rival Newcrest Mining Ltd.

Key Takeaways

- Newmont said the Australian and Japanese regulators cleared the way for its $19.2 billion acquisition of Newcrest Mining.

- Newmont said it hoped to complete the transaction in the fourth quarter.

- Newmont has scheduled a shareholder vote to approve the transaction in October.

Newmont said that following a review by Australia's Foreign Investment Review Board (FIRB), the country's treasurer had given the green light to proceed with the acquisition. The company added that last week the Japan Fair Trade Commission (JFTC) also issued a letter of authorization allowing the deal to move forward at any time after the end of the month.

Newmont has already received clearance from officials in several other countries involved in the deal, and noted that it “continues to advance further regulatory approvals.” It hopes to finalize the transaction in the fourth quarter. Newmont has set a shareholder vote on the matter for October 11.

The deal, first announced in May, will create the world's largest gold mining company. Newmont said the combination would generate pre-tax synergies of half a billion dollars and at least $2 billion in cash flow improvements within two years of closing.

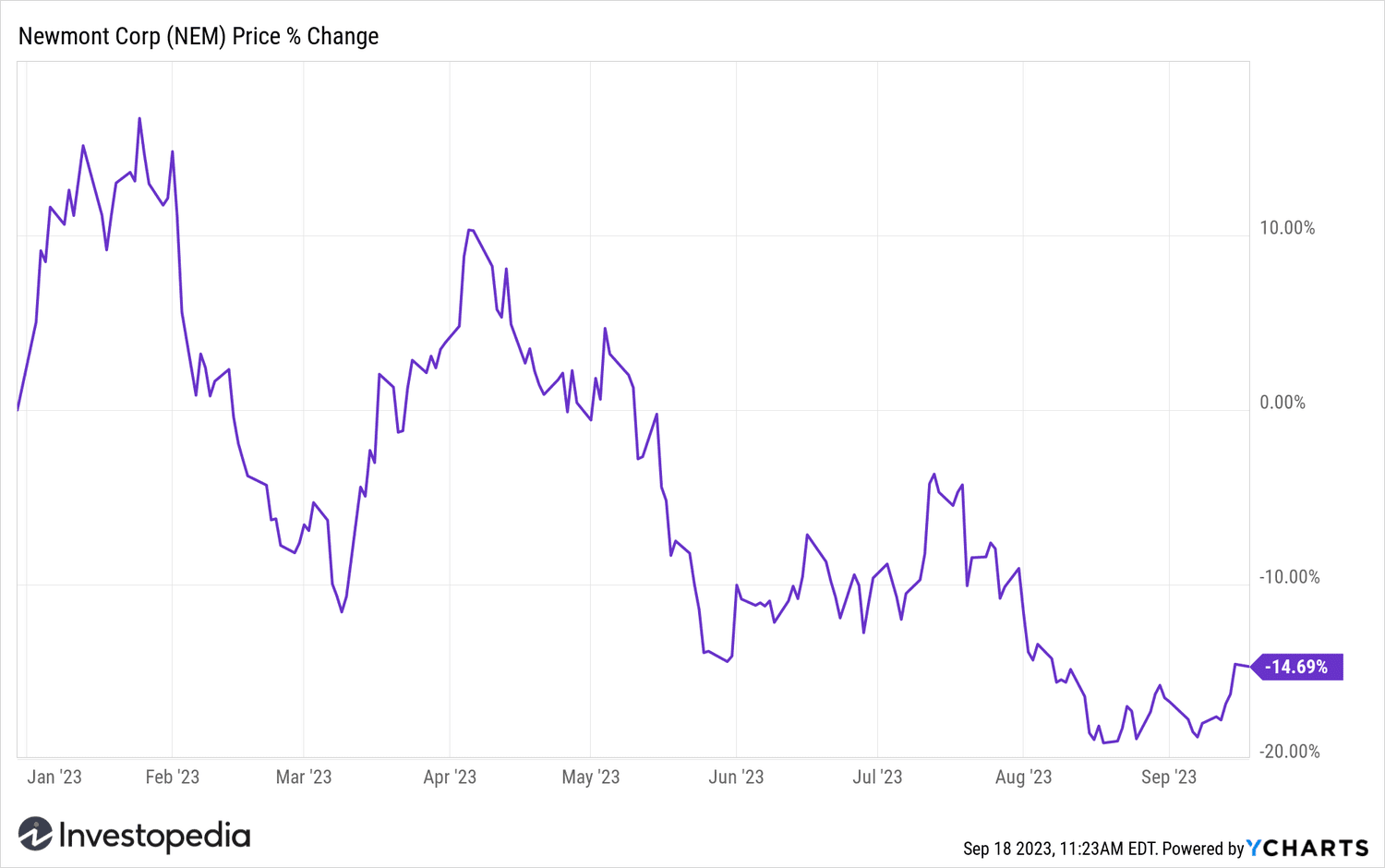

Newmont shares have little changed at the start of the session on Monday. They have lost around 15% since the start of the year.

YCharts

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com