Netflix, Inc. (NFLX) shares rallied above the horizon 2020 high of nearly $400 in April, reaching an all-time high at $459 last week, but it has not yet confirmed a breakout above difficult to 2018 resistance around $425. Time is running out for a bullish outcome, with relative strength and volume indicators starting to flash signs that could trap the end-of-the-party adherents of the trend in a great decline and the decline of the double top scenario.

Stay-at-home and quarantine orders, which contributed to first quarter revenues, with 15.77 million new subscribers blowing in the direction of $ 7.0 million. However, the compression of margins triggered a profit shortfall that could worsen in the second quarter, due to the worldwide judgment of the film and television production. The competition could also take a bite out of the bullish sentiment, with HBO Max adding to the competitive threats of The Walt Disney Company (DIS) and Apple Inc. (AAPL).

Wall Street grew more optimistic about Netflix shares since the April 21 publication of the results, with the upgrades of Wells Fargo, the Pivot of the Research, Jefferies and Citigroup. Investment houses are also pounding the tables, with funds managed by Stanley Duckenmiller, David Tepper, and Keith Meister of the opening or the addition of positions. This support should eventually return to higher prices, but it has had little impact on the accumulation of the measure, which is lagging behind bullish price development by a wide margin.

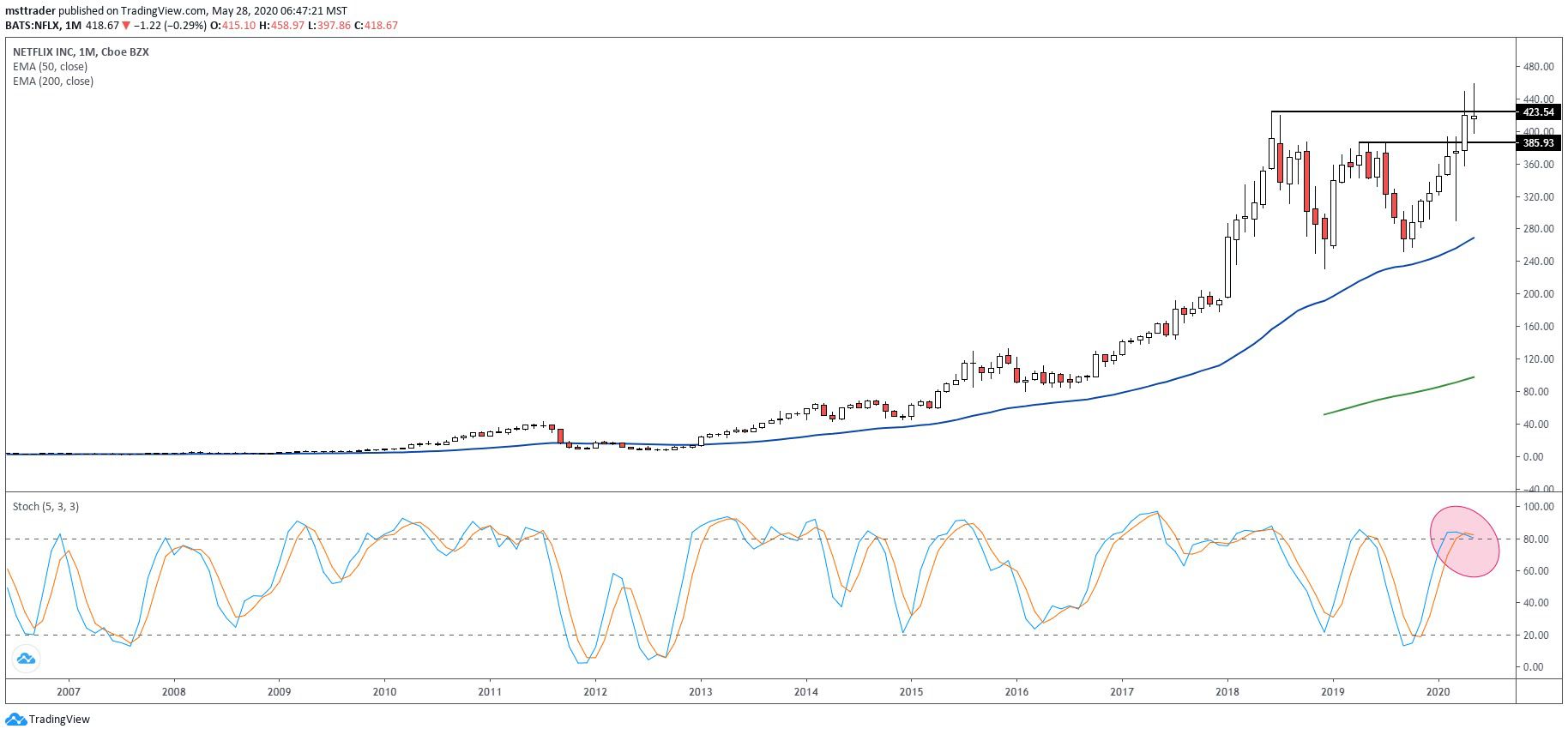

NFLX’s Long-Term Chart (2002 – 2020)

TradingView.com

Netflix came public at a split-adjusted $1.16 / litre in May 2002 and has posted an all-time low of 35 cents in October. It rallied to a new peak in 2003, before stalling at $5.68 in the first quarter of 2004, marking a vertex that has not been challenged for the next four years, ahead of the narrow range-bound action, which included two tests at$ 1.00. A 2009 breakout finally established a strong uptrend, with the first rally of the wave, clocked in at $43.54 in 2011.

The stock tested breakout support in the single digits in 2012 and turned in addition, the seizure of a slight increase, which completed a 100% retracement to the front in 2013. Netflix eased into a rising channel after a 2014 breakout, gaining ground in the 2015 tip $129.29 before rolling in a shallow decline, which has kept the growth of the chain of the higher levels historically low. It is mounted to the resistance after the election of 2016, posting impressive gains as a member of the very desirable FAANG quintet.

The trend advance stalled at $423.21 in June 2018, the establishment of a level of resistance that is still in the game nearly two years later, and is entered in a complex correction that ended in December after the stock has completed the January 2018 gap between $227 and $247. The 2019 bounce reversed at the .786 Fibonacci sell-off of the retracement level in April, which gives a lowest in September, followed by an advance which has reversed the resistance of the range in February 2020.

The stock recovery to another low in March and has completed a round of travel in the 2018 high in April. Immediately breakout reversed after reaching$ 450, while a rebound in May reversed less than 10 points above the April high last week. The stock has criss-crossed the 2018 high on several occasions during this period, indicating that the resistance is always in the control of the band in the long term, despite the short duration of the purchase of tips.

NFLX Short-Term Chart (2018 – 2020)

TradingView.com

The balance volume (OBV), the accumulation-distribution indicator garnished with prices in June 2018 and has entered a phase of distribution, the publication of an 11-month low in December. Later the purchasing power in the impasse, in January 2019, the generation of the resistance who refused to July and February 2020 attempts to escape. OBV and then relaxed in a slight decrease (red line) which is still in place, even if the price is rising to an all-time high, the establishment of a bearish divergence which reduces the chances of limiting the escape.

The monthly stochastic oscillator is passed into the level of overbought at the same time, but the signal line has not yet confirmed a new round of selling. It will only take one or two days down at this point for that to happen, saying it informed the market players to consider a defensive action. Taken together with the OBV of the deficit, the chances of a failure of the evasion are on the increase, perhaps setting the stage for a sell-off that reached the bottom of $300.

The Bottom Line

Netflix shares are listed on a all-time high last week, but the stubborn resistance to the 2018 could trigger a failure of the escape.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com