Key Takeaways

- Analysts estimate EPS of $1.80 vs $0.60 in Q2 2019.

- Total paying subscribers expected to rise sharply year-on-year.

- Revenue is seen rising in the middle of the audience during COVID-19 pandemic.

Shares of Netflix Inc. (NFLX) have increased by more than 55 per cent until 2020, a stark contrast to a broader market, which fell in the middle of the COVID-19 pandemic. An important factor in the success of Netflix in the last few months, it is that the house-view of consumers on a global scale have sharply increased their viewing of streaming TV and movie content on Netflix. Many consumers should stay at home, even in the midst of the governments plans to re-open parts of the UNITED states and the global economy.

Investors will look closely at whether Netflix’s gains are sustainable in the long term when it publishes its results for the 2nd quarter of the FISCAL year 2020, July 16, after the market close. Analysts expect solid gains in Netflix earnings per share (EPS) and subscribers for the quarter and for the YEAR 2020. Netflix revenue growth should also be strong, but it will be slower than in recent quarters.

A key measure of investors will look at is total paid streaming for Netflix subscribers during the 2nd quarter. In order to support the growth of EPS and revenue, Netflix must continue to add to its subscriber base, particularly in international markets, where it sees the fastest growth. In the 2nd quarter, analysts expect Netflix’s total paid subscriber growth at the highest for five quarters.

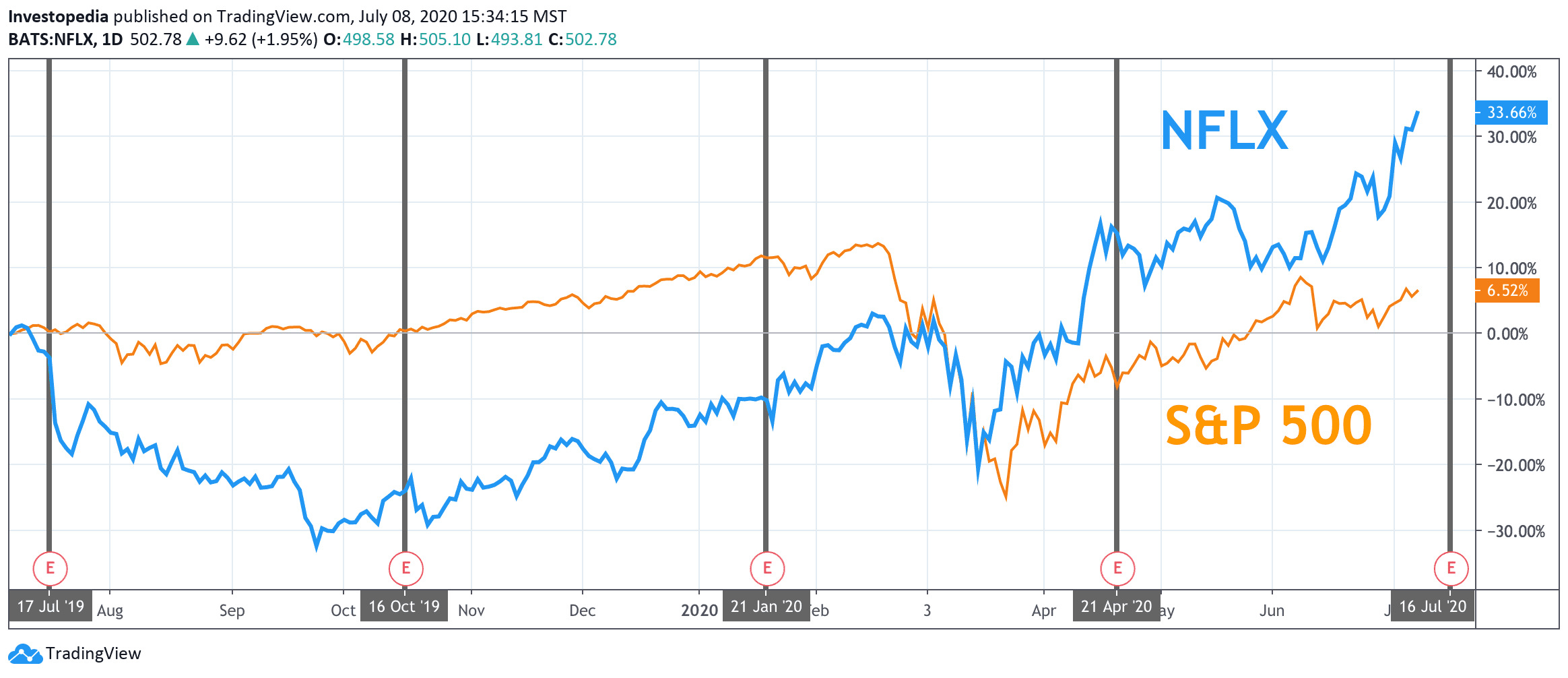

This kind of performance has focused Netflix’s stock. In the last 12 months, it has far outpaced the broader market, posting a total return of nearly 33.7% compared to the S&P 500 index total return of 6.5%.

Source: TradingView.

Netflix’s revenue has increased significantly in recent years, has more than doubled from the 2nd quarter of the YEAR 2017 during the 1st quarter of FISCAL year 2020. Yet, revenue growth has slowed year-on-year (yoy) between the 2nd quarter of FISCAL year 2018, and the 2nd quarter of FISCAL year 2019. Analyst predict T2 to 2020, the revenue growth will be even slower, up 23.3% to $ 6.1 billion. While Netflix is expected to increase revenue by 22.9% for the full YEAR 2020, a slower rate of growth in six years.

Netflix is the earnings per share have seen a lot more volatility in recent years. Q2 of FISCAL year 2019 has been an outlier in recent quarters, the adjusted earnings per share declined by 29.4% year-on-year that users in the UNITED states has declined for the first time in almost a decade. Now, analysts expect EPS for the Q2 of 2020, the triple of the previous year, with a consensus estimate of$ 1.80. Is also of the highest quarterly EPS in at least three years.

Netflix Key Measures

Estimate of the Q2 2020 (AF)

Real for the 2nd quarter of 2019 (FY)

Real for the 2nd quarter of 2018 (AF)

Earnings Per Share ($)

1.80

0.60

0.85

Revenue ($B)

$ 6.1 million

$4.9

$3.9

Total Paying Subscribers (M)

190.6

151.6

124.4

Source: Visible Alpha and Netflix Investor Relations

As mentioned, the paid subscriptions are a key indicator of Netflix to the health. The increase of the subscription to the global scale, the UNITED states and abroad, is the key to increased profits. This is because the ability of the company to increase prices has been limited due to the growth of new streaming rivals. (Netflix has more subscribers that participate in its original DVD to the program, but it is a small part of its activities.)

The growth of the company has paid subscriptions has been strong, but slowing, T2 time periods. Netflix has increased paid streaming subscriptions 25.6% year-on-year to 124.4 million in Q2 of FISCAL year 2018, and 21.9% year-on-year to 51.6 million in Q2 of FISCAL year 2019. The Consensus estimates for Q2 of FISCAL year 2020 subscribers to 190.6 million, a 25.7%. In Q1 2020, Netflix has reported a 22.8% gain 182.9 million paid streaming subscribers. Netflix is the deceleration of revenue growth—such as the number of subscribers is accelerating —and may reflect the pressure on prices due to increased competition, which will remain a major challenge for Netflix.

Source: investopedia.com